Why Did Canadian Tire Buy Hudson's Bay? Understanding The Merger

Table of Contents

Diversification and Expansion of Canadian Tire's Retail Footprint

Canadian Tire's acquisition of Hudson's Bay represents a bold strategic move towards significant diversification and expansion. The merger isn't just about adding another retail brand to their portfolio; it's about accessing new markets and enhancing their overall retail footprint across Canada.

Reaching New Customer Demographics

Hudson's Bay caters to a more upscale customer demographic than Canadian Tire's traditional base. This acquisition provides Canadian Tire with:

- Increased market share: Penetrating a segment they previously had limited access to.

- Access to higher-spending consumers: Expanding their revenue streams beyond their existing customer base.

- Expansion beyond the typical Canadian Tire shopper: Broadening their brand appeal and attracting a wider range of consumers.

This strategic move significantly diversifies Canadian Tire's offerings, reducing reliance on their core automotive and home improvement sectors and opening doors to a new level of consumer spending.

Real Estate Value and Strategic Location

Hudson's Bay owns prime real estate in major Canadian cities, a key asset that significantly contributed to the merger's appeal. This real estate possesses immense value for Canadian Tire in several ways:

- Potential for redevelopment: Existing Hudson's Bay locations could be renovated or repurposed to better suit Canadian Tire's needs or leased to other tenants.

- Increased rental income: Canadian Tire can generate significant income by leasing out underutilized space within Hudson's Bay properties.

- Strategic placement for Canadian Tire stores or other ventures: Prime locations can facilitate the expansion of Canadian Tire's own retail footprint or the introduction of new brands and services.

The strategic location of these properties ensures optimal visibility and accessibility, enhancing the overall value proposition for Canadian Tire. The potential for repurposing or subleasing unused space within Hudson's Bay locations adds another layer of financial benefit to this aspect of the merger.

Synergies and Operational Efficiencies

Beyond the expansion of their retail footprint, the merger promises several operational synergies and efficiency improvements for Canadian Tire.

Supply Chain Optimization

Integrating the supply chains of Canadian Tire and Hudson's Bay offers opportunities for significant cost savings:

- Reduced transportation costs: Consolidating logistics and distribution networks can lead to economies of scale.

- Streamlined inventory management: Combining inventory systems can improve efficiency and reduce waste.

- Economies of scale: Larger purchasing volumes will result in better pricing from suppliers.

These improvements can translate into significant cost reductions and enhanced profitability for the combined entity.

Marketing and Brand Synergies

The merger also presents opportunities for leveraging marketing and brand synergies:

- Joint marketing campaigns: Targeted campaigns can reach a broader audience, maximizing advertising impact.

- Combined loyalty points programs: A unified loyalty program can enhance customer engagement and retention.

- Enhanced customer reach: Combining customer databases will allow for more personalized marketing and targeted promotions.

However, integrating two distinct brands will require careful consideration of potential branding challenges and the development of a cohesive integration strategy.

Financial Implications and Investor Perspective

The Canadian Tire and Hudson's Bay merger has significant financial implications, both in the short term and long term.

Short-Term and Long-Term Financial Goals

The acquisition is expected to deliver several financial benefits to Canadian Tire:

- Increased revenue streams: Accessing a new customer segment and expanding product offerings will boost revenue.

- Improved profitability: Operational synergies and cost savings will improve the overall profit margin.

- Return on investment: The long-term financial success of the merger will depend on the effective integration of both businesses.

The stock market's reaction to the merger and overall investor sentiment will be a crucial indicator of the success of this strategic move.

Debt and Financing Strategy

The financing strategy employed by Canadian Tire to fund the acquisition, including its debt levels and impact on future expansion plans, will be closely monitored by investors and financial analysts. Changes in credit ratings will reflect market confidence in the merger’s financial stability.

Conclusion

Canadian Tire's acquisition of Hudson's Bay is a complex strategic maneuver driven by a multifaceted rationale. The key motivations are diversification into new customer demographics, leveraging the immense value of Hudson's Bay's prime real estate, achieving operational synergies and cost efficiencies through supply chain optimization and marketing integration, and ultimately, enhancing long-term financial prospects. This merger is poised to reshape the Canadian retail landscape, presenting both opportunities and challenges for the combined entity. The success of this integration will be closely watched, shaping the future trajectory of both brands and the overall competitive landscape.

What are your thoughts on the Canadian Tire and Hudson's Bay merger? Share your insights in the comments below!

Featured Posts

-

The Rise Of Wildfire Betting A Reflection Of Societal Attitudes Towards Risk

May 28, 2025

The Rise Of Wildfire Betting A Reflection Of Societal Attitudes Towards Risk

May 28, 2025 -

8 Oleh Oleh Kuliner Unik Khas Bali Lebih Dari Pie Susu

May 28, 2025

8 Oleh Oleh Kuliner Unik Khas Bali Lebih Dari Pie Susu

May 28, 2025 -

Ramalan Cuaca Jawa Tengah 24 April Hujan Diperkirakan Sore Hari

May 28, 2025

Ramalan Cuaca Jawa Tengah 24 April Hujan Diperkirakan Sore Hari

May 28, 2025 -

Ligue 1 Talent Arsenal And Newcastle To Compete For Signing

May 28, 2025

Ligue 1 Talent Arsenal And Newcastle To Compete For Signing

May 28, 2025 -

Harvard Faces Trumps Funding Threat Redirection To Vocational Training

May 28, 2025

Harvard Faces Trumps Funding Threat Redirection To Vocational Training

May 28, 2025

Latest Posts

-

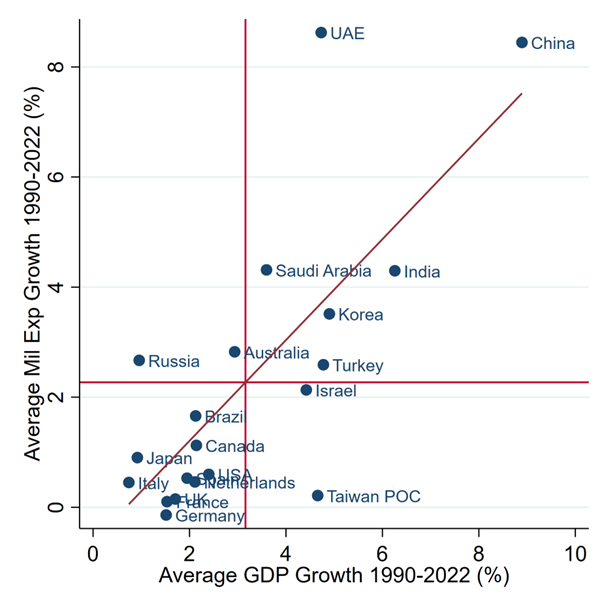

64 Billion Economic Impact Predicted From Carneys Military Spending Cibc Analysis

May 30, 2025

64 Billion Economic Impact Predicted From Carneys Military Spending Cibc Analysis

May 30, 2025 -

Trumps Trade War 8 Key Impacts On The Canadian Economy

May 30, 2025

Trumps Trade War 8 Key Impacts On The Canadian Economy

May 30, 2025 -

Economic Uncertainty Grows Amidst Rising Inflation And Unemployment

May 30, 2025

Economic Uncertainty Grows Amidst Rising Inflation And Unemployment

May 30, 2025 -

Carneys Military Spending Plan A 64 Billion Economic Injection Cibc Report

May 30, 2025

Carneys Military Spending Plan A 64 Billion Economic Injection Cibc Report

May 30, 2025 -

Plummeting Home Sales Signal Housing Market Crisis

May 30, 2025

Plummeting Home Sales Signal Housing Market Crisis

May 30, 2025