Why Stretched Stock Market Valuations Shouldn't Deter Investors: A BofA Viewpoint

Table of Contents

The Limitations of Traditional Valuation Metrics in a Low-Interest-Rate Environment

Traditional valuation metrics, such as the Price-to-Earnings (P/E) ratio, are often used to gauge the relative expensiveness of stocks. However, these metrics can be misleading in a low-interest-rate environment. The prolonged period of quantitative easing and exceptionally low bond yields has significantly impacted stock valuations. Lower interest rates reduce the attractiveness of fixed-income investments, causing capital to flow into equities, thus driving up prices and potentially inflating P/E ratios.

- Traditional valuation metrics may overstate the risk: A high P/E ratio doesn't automatically equate to high risk when the cost of capital is low.

- Low interest rates justify higher valuations: The discounted cash flow model, a core tool in valuation, shows that lower discount rates (reflecting low interest rates) lead to higher present values for future earnings, supporting higher valuations.

- Comparing current valuations to historical context, considering interest rate differences: Simply comparing current P/E ratios to historical averages without accounting for the significantly lower interest rate environment provides an incomplete and potentially misleading picture. Analyzing valuations relative to the prevailing interest rate environment provides a more accurate assessment.

Strong Corporate Earnings and Profitability: A Counterbalance to High Valuations

Despite concerns about stretched stock market valuations, corporate earnings and profitability remain robust across many sectors. This strong performance acts as a counterbalance to high valuations, suggesting underlying strength in the economy. For example, the technology sector has consistently delivered impressive earnings growth, fueled by increased demand for software and cloud services. Similarly, the healthcare sector continues to exhibit strong profitability driven by an aging population and advancements in medical technology.

- Data illustrating strong earnings growth in key sectors: Recent financial reports reveal significant year-over-year increases in earnings for many companies across various sectors, exceeding expectations.

- Analysis of factors contributing to corporate profitability: Efficient cost management, innovative business models, and increased productivity are driving corporate profitability despite macroeconomic headwinds.

- Comparison to previous periods of high valuations: A review of prior periods with high valuations demonstrates that strong corporate earnings often preceded sustained market growth.

Long-Term Growth Potential and Technological Innovation as Drivers

The potential for long-term growth remains significant, driven by ongoing technological innovation. Disruptive technologies like artificial intelligence, machine learning, and biotechnology are reshaping industries and creating new opportunities for substantial returns. These advancements promise to drive future corporate earnings and underpin the justification for current valuations.

- Examples of disruptive technologies and their market impact: The widespread adoption of cloud computing, the proliferation of mobile devices, and the emergence of AI-powered solutions demonstrate the transformative potential of technology.

- Analysis of the potential for continued innovation: A robust pipeline of technological breakthroughs suggests that the pace of innovation is likely to accelerate, creating even more opportunities for growth in the coming years.

- Discussion of the long-term growth prospects for specific sectors: Sectors heavily invested in research and development, such as technology and healthcare, stand to benefit disproportionately from technological advancements.

BofA's Strategic Investment Recommendations for Navigating Stretched Valuations

BofA's analysis suggests a strategic approach to investing in this environment. While acknowledging the apparent high valuations, we believe that a long-term perspective, coupled with careful portfolio diversification and risk mitigation strategies, remains crucial. This might involve focusing on high-growth sectors with strong long-term fundamentals and considering a diversified approach across asset classes.

- Specific investment recommendations: BofA recommends a focused approach, targeting companies with demonstrably strong earnings growth and innovative business models.

- Strategies for diversification: A diversified portfolio across sectors, asset classes, and geographies can help mitigate risks associated with potentially elevated market valuations.

- Risk management considerations: A robust risk management strategy includes understanding the risks inherent in a high-valuation environment and implementing measures to protect against potential market downturns.

Don't Let Stretched Stock Market Valuations Deter Your Investment Strategy

In conclusion, while stretched stock market valuations are a valid concern, several factors suggest they shouldn't deter long-term investors. Low interest rates, strong corporate earnings, and the potential for continued growth fueled by technological innovation all contribute to a more nuanced picture than a simple focus on P/E ratios might suggest. BofA's analysis indicates that a well-diversified portfolio, a long-term investment horizon, and a carefully considered investment strategy remain key to navigating the complexities of the current market. To discuss how to best navigate stretched stock market valuations and build a robust investment portfolio tailored to your specific needs, consult with a BofA financial advisor today.

Featured Posts

-

Riot Fest 2025 Full Lineup Announcement Green Day Weezer And More

May 02, 2025

Riot Fest 2025 Full Lineup Announcement Green Day Weezer And More

May 02, 2025 -

Amy Irvings Mother Priscilla Pointer Passes Away At Age 100

May 02, 2025

Amy Irvings Mother Priscilla Pointer Passes Away At Age 100

May 02, 2025 -

Analysis Justice Departments School Desegregation Order And Its Consequences

May 02, 2025

Analysis Justice Departments School Desegregation Order And Its Consequences

May 02, 2025 -

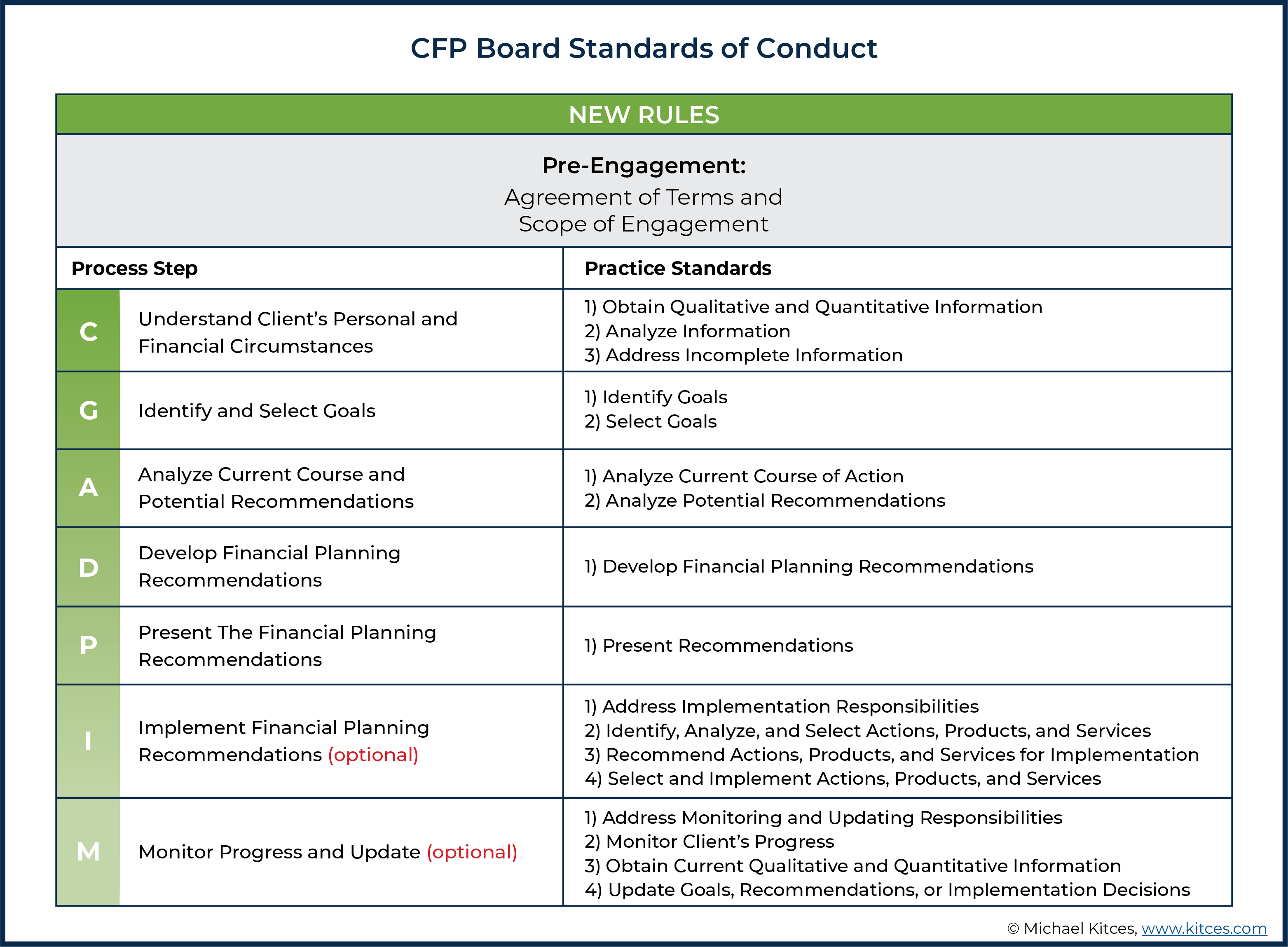

Cfp Board Ceos Retirement Impact On Financial Planners And The Industry

May 02, 2025

Cfp Board Ceos Retirement Impact On Financial Planners And The Industry

May 02, 2025 -

Canada Facing Ultra Low Growth Expert Analysis And Outlook

May 02, 2025

Canada Facing Ultra Low Growth Expert Analysis And Outlook

May 02, 2025

Latest Posts

-

Rupert Lowe And Uk Reform Analyzing The Effectiveness Of His X Platform Communication

May 02, 2025

Rupert Lowe And Uk Reform Analyzing The Effectiveness Of His X Platform Communication

May 02, 2025 -

Bullying Allegations Against Reform Uks Rupert Lowe Police Involved

May 02, 2025

Bullying Allegations Against Reform Uks Rupert Lowe Police Involved

May 02, 2025 -

Norfolk Mp Takes On Nhs Trust In Landmark Gender Identity Supreme Court Case

May 02, 2025

Norfolk Mp Takes On Nhs Trust In Landmark Gender Identity Supreme Court Case

May 02, 2025 -

Supreme Court Hearing Norfolk Mp Challenges Nhs Hospital Over Gender

May 02, 2025

Supreme Court Hearing Norfolk Mp Challenges Nhs Hospital Over Gender

May 02, 2025 -

Rupert Lowes Great Yarmouth Commitment After Political Rift

May 02, 2025

Rupert Lowes Great Yarmouth Commitment After Political Rift

May 02, 2025