Amundi MSCI All Country World UCITS ETF USD Acc: NAV Analysis And Performance

Table of Contents

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc NAV

What is NAV and why is it important?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. It's calculated by taking the total market value of all the securities held in the ETF's portfolio, subtracting any liabilities, and dividing by the number of outstanding shares. For ETF investors, the NAV reflects the true value of their investment on a daily basis, fluctuating with the price movements of the underlying assets. Understanding the NAV is vital because it provides a benchmark against which to assess the ETF's market price. Discrepancies between the NAV and market price can present opportunities for arbitrage. The Amundi MSCI All Country World UCITS ETF USD Acc's NAV is calculated daily by Amundi, using the closing prices of its constituent assets. It's essential to check the ETF's NAV regularly, particularly before buying or selling, to ensure you're getting a fair price.

Analyzing NAV Trends for the Amundi MSCI All Country World UCITS ETF USD Acc

Analyzing NAV trends helps investors understand the long-term growth and volatility of the ETF. Methods for analyzing NAV trends include:

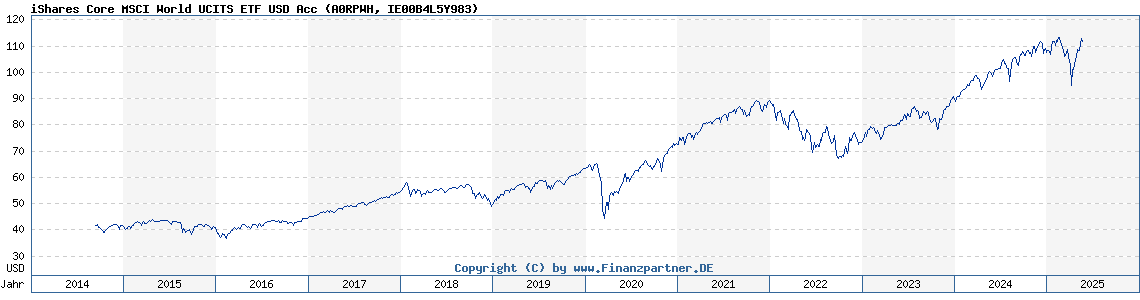

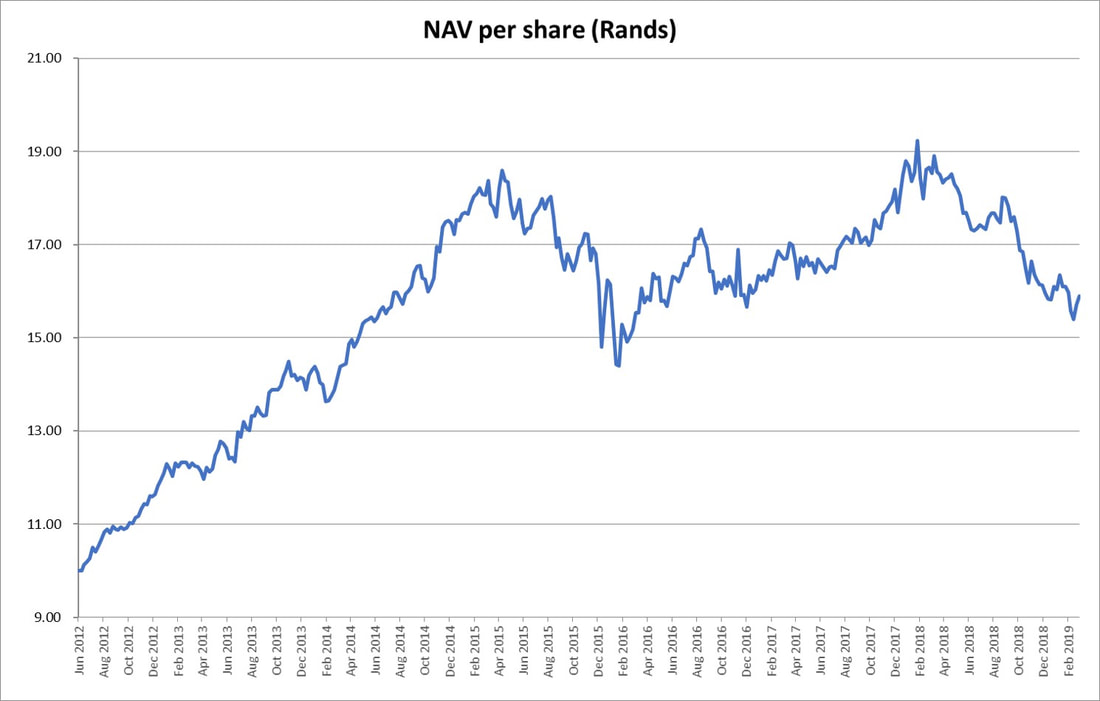

- Charting: Visual representation of NAV data over time allows for identification of upward and downward trends.

- Benchmark Comparison: Comparing the Amundi MSCI All Country World UCITS ETF USD Acc's NAV to relevant benchmarks like the MSCI ACWI index provides insights into its relative performance.

(Note: A graph showcasing historical NAV data would be included here if data were available. This would require access to a financial data provider like Bloomberg or Refinitiv.)

Key periods of growth and decline should be analyzed, attempting to correlate them with relevant market events, such as economic recessions, geopolitical crises, or shifts in investor sentiment. Real-time NAV data can be accessed through the ETF provider's website, financial news websites, or dedicated financial data platforms.

Performance Analysis of the Amundi MSCI All Country World UCITS ETF USD Acc

Historical Performance Metrics

Evaluating the historical performance of the Amundi MSCI All Country World UCITS ETF USD Acc involves analyzing key performance indicators (KPIs). These include:

- Total Return: The overall return, including capital appreciation and dividend income, over a specified period.

- Annualized Return: The average annual return over a longer period, smoothing out short-term volatility.

- Sharpe Ratio: Measures risk-adjusted return, showing the excess return relative to the risk taken.

- Volatility: Measures the fluctuation of the ETF's price, reflecting its risk level.

(Note: Tables and charts displaying historical performance data, compared to relevant benchmarks like the MSCI ACWI, would be included here. This requires access to a financial data provider.)

The impact of different market conditions—bull markets, bear markets, and periods of high volatility—on the ETF's performance should be carefully assessed.

Risk and Reward Assessment

Investing in global equities inherently carries risks. These risks include:

- Market risk: Fluctuations in the overall stock market.

- Geopolitical risk: Political instability and events impacting global markets.

- Currency risk: Fluctuations in exchange rates.

The Amundi MSCI All Country World UCITS ETF USD Acc has a moderate-to-high risk profile, consistent with a globally diversified equity portfolio. The relationship between risk and return is positive; higher potential returns come with higher risk. The ETF's expense ratio directly impacts returns, reducing the overall investment gain.

Comparison with Similar ETFs

Comparing the Amundi MSCI All Country World UCITS ETF USD Acc with similar globally diversified ETFs is crucial. This comparison should include:

- Performance: Total return, annualized return, and Sharpe ratio.

- Expense ratio: The annual cost of managing the ETF.

- Holdings: The composition of the ETF's underlying assets.

(Note: A comparison table would be included here to facilitate understanding. This requires data from multiple ETF providers.)

Factors Influencing the Amundi MSCI All Country World UCITS ETF USD Acc Performance

Market Factors

Macroeconomic factors significantly influence the ETF's performance:

- Interest rates: Changes in interest rates affect corporate earnings and investor sentiment.

- Inflation: High inflation erodes purchasing power and can impact market valuations.

- Economic growth: Global economic growth directly impacts company profits and stock prices.

- Geopolitical events: Events like wars, political instability, and trade disputes can dramatically influence market sentiment and the ETF's performance.

- Currency fluctuations: Changes in exchange rates affect the value of foreign investments.

- Sector performance: Different sectors (e.g., technology, healthcare, energy) perform differently over time, impacting the overall ETF return.

ETF Specific Factors

Factors specific to the ETF itself also influence its performance:

- Investment Strategy: The ETF tracks the MSCI All Country World Index, aiming to replicate its performance. Any deviations from this strategy can influence results.

- Expense Ratio: A lower expense ratio leads to higher net returns for investors.

- Composition Changes: Changes in the ETF's underlying holdings, due to rebalancing or index reconstitution, can impact performance.

Conclusion

Analyzing the NAV and performance of the Amundi MSCI All Country World UCITS ETF USD Acc requires a thorough understanding of its underlying assets, market dynamics, and its risk profile. Regularly monitoring the NAV and comparing its performance to relevant benchmarks is essential for investors. Remember that past performance is not indicative of future results. Before investing in the Amundi MSCI All Country World UCITS ETF USD Acc or any other investment, conduct your own thorough research and consider your individual financial goals and risk tolerance. Seeking professional financial advice is highly recommended. For more detailed information, refer to the ETF's official fact sheet and prospectus available on the Amundi website.

Featured Posts

-

Escape To The Country Budgeting And Financing Your Rural Move

May 25, 2025

Escape To The Country Budgeting And Financing Your Rural Move

May 25, 2025 -

Getting Tickets To The Bbc Radio 1 Big Weekend Everything You Need To Know

May 25, 2025

Getting Tickets To The Bbc Radio 1 Big Weekend Everything You Need To Know

May 25, 2025 -

Police Helicopter Pursuit Unbelievable Refueling Stop At 90mph

May 25, 2025

Police Helicopter Pursuit Unbelievable Refueling Stop At 90mph

May 25, 2025 -

Tisice Prepustenych Kriza Zasiahla Najvaecsie Nemecke Spolocnosti

May 25, 2025

Tisice Prepustenych Kriza Zasiahla Najvaecsie Nemecke Spolocnosti

May 25, 2025 -

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Talent

May 25, 2025

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Talent

May 25, 2025

Latest Posts

-

How Net Asset Value Nav Affects Your Amundi Dow Jones Industrial Average Ucits Etf Investment

May 25, 2025

How Net Asset Value Nav Affects Your Amundi Dow Jones Industrial Average Ucits Etf Investment

May 25, 2025 -

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav And Performance

May 25, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav And Performance

May 25, 2025 -

Waiting For The Call A Reflection

May 25, 2025

Waiting For The Call A Reflection

May 25, 2025 -

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025 -

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025