Analyzing Wedbush's Bullish Apple Prediction Following Price Target Adjustment

Table of Contents

H2: Wedbush's Original Apple Price Target and the Rationale Behind the Adjustment

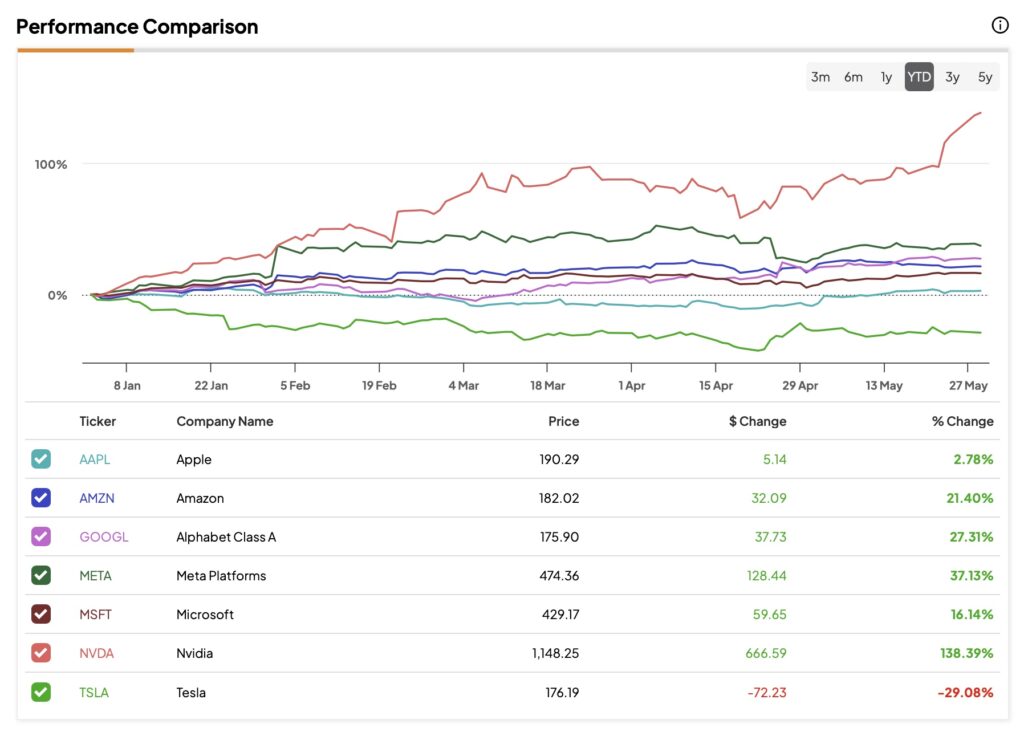

Wedbush's previous price target for Apple isn't explicitly stated in all reports, but the upward revision is the focus. The rationale behind the initial target likely considered prevailing market conditions, Apple's historical performance, and projected growth estimates. However, the recent upward adjustment of the Wedbush Apple price target is significantly more noteworthy. Several key factors contributed to this positive change:

- Strong iPhone sales, particularly the iPhone 14 series: The iPhone 14's launch proved highly successful, exceeding initial sales expectations and demonstrating continued consumer demand for Apple's flagship product. This strong performance directly impacts Apple's revenue and profitability.

- Growing Services revenue: Apple's services segment, encompassing iCloud, Apple Music, Apple TV+, and other subscription services, has shown consistent growth. This recurring revenue stream provides increased stability and predictability to Apple's financial performance, contributing to the upward revision of the Wedbush Apple price target.

- Positive market sentiment towards Apple: Overall positive investor sentiment towards Apple played a role. Apple's reputation for innovation and strong brand loyalty contributes to this positive market outlook.

- Expansion into new markets and product categories: Apple’s continued expansion into new markets and its diversification into products like the Apple Watch and AirPods contribute to overall revenue growth and justify a higher Wedbush Apple price target.

- Specific Data Points: While the exact data points used by Wedbush aren't always publicly available, their analysis likely included sales figures, user growth in services, and projections based on market research and future product launches.

H2: Key Factors Contributing to Wedbush's Bullish Outlook on Apple

Wedbush's bullish outlook on Apple is supported by several long-term growth prospects:

- Innovation in hardware and software: Apple's consistent track record of innovative product development fuels continued market dominance and drives future growth. New technologies and features keep consumers engaged and create demand for upgrades.

- Expansion of the Apple ecosystem: The increasing interconnectedness of Apple devices (iPhone, iPad, Mac, Apple Watch, AirPods) creates a strong and loyal customer base, driving sales of complementary products and services. This ecosystem effect is a major contributor to the positive Wedbush Apple price target outlook.

- Growth in the Services segment: The Services sector is a crucial driver of Apple's future growth, offering predictable and recurring revenue streams less susceptible to cyclical market fluctuations.

- Opportunities in emerging markets: Expanding into and penetrating emerging markets represents significant growth potential for Apple, further supporting the bullish Wedbush Apple price target prediction.

- Competitive Advantages: Apple's strong brand recognition, premium pricing strategy, and vertically integrated business model give it a significant competitive edge in the tech market.

H3: Analyzing the Risks Associated with the Wedbush Apple Price Target

Despite the bullish outlook, several risks could impact the Wedbush Apple price target:

- Supply chain disruptions: Global supply chain instability could affect Apple's production and delivery timelines, impacting revenue and potentially lowering the stock price.

- Increased competition: Intense competition from other tech giants, particularly in the smartphone and services markets, could erode Apple's market share.

- Economic slowdown or recession: A global economic downturn could reduce consumer spending on discretionary items like Apple products, negatively impacting sales and the Wedbush Apple price target.

- Changes in consumer spending habits: Shifts in consumer preferences or economic hardship could lead to decreased demand for Apple products.

H2: Implications for Investors: Should You Buy, Hold, or Sell Apple Stock?

Wedbush's analysis suggests a positive outlook for Apple stock. However, individual investment decisions depend on risk tolerance and investment goals.

- Arguments for buying: Strong growth potential, robust ecosystem, and continued innovation make Apple an attractive investment.

- Arguments against buying: Potential risks like economic downturns and increased competition must be considered.

- Investment Sentiment: The overall investor sentiment towards Apple is generally positive following the price target adjustment, but caution is warranted.

- Advice: Investors with a higher risk tolerance may consider buying, while more risk-averse investors may prefer to hold or adopt a more conservative strategy. Diversification is always recommended.

- Alternative Strategies: Investors might consider dollar-cost averaging or other strategies to mitigate risk.

Conclusion: Wedbush's upward revision of its Apple price target reflects a bullish outlook driven by strong iPhone sales, a rapidly growing Services sector, and Apple's continued innovation. While risks like supply chain disruptions and economic downturns remain, the overall positive sentiment suggests significant potential for Apple's stock. Understanding the nuances of the Wedbush Apple price target prediction is crucial for informed investment decisions. Stay informed about the latest developments regarding the Wedbush Apple price target and continue your research before making any investment decisions. Further analysis of Apple's financial performance and market trends will aid in making well-informed choices regarding Apple stock.

Featured Posts

-

Apple Price Target Lowered But Is Wedbush Right To Remain Bullish

May 24, 2025

Apple Price Target Lowered But Is Wedbush Right To Remain Bullish

May 24, 2025 -

Krasivaya Data 89 Svadeb Na Kharkovschine

May 24, 2025

Krasivaya Data 89 Svadeb Na Kharkovschine

May 24, 2025 -

Yurskiy 90 Let So Dnya Rozhdeniya Intellektuala I Ostroslova

May 24, 2025

Yurskiy 90 Let So Dnya Rozhdeniya Intellektuala I Ostroslova

May 24, 2025 -

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025 -

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Latest Posts

-

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025