Apple Stock Suffers Setback Amidst $900 Million Tariff Projection

Table of Contents

The $900 Million Tariff Projection: A Deep Dive

The projected $900 million tariff burden represents a substantial threat to Apple's financial performance. Understanding the breakdown of this impact is crucial for assessing the overall risk.

Breakdown of the Tariff Impact

The projected tariffs affect a range of Apple products, significantly impacting its profit margins. Estimates suggest the following approximate tariff costs per product line:

- iPhones: $300 million (this is an estimate and can vary based on model and component sourcing).

- iPads: $150 million (this is an estimate and can vary based on model and component sourcing).

- Macs: $100 million (this is an estimate and can vary based on model and component sourcing).

- Apple Watches & AirPods: $50 million (this is an estimate and can vary based on model and component sourcing).

- Other Products: $300 million (this is an estimate accounting for other products subject to tariffs).

These figures are based on analyst reports from reputable firms like Morgan Stanley and Goldman Sachs, considering the current tariff rates and Apple's reported manufacturing locations. The impact on profit margins is substantial, potentially reducing Apple's overall earnings by a significant percentage depending on their ability to pass on the increased costs.

Geopolitical Factors and Trade Tensions

The escalating trade war between the US and China is the primary driver behind these tariffs. This ongoing conflict creates significant uncertainty for multinational corporations like Apple, heavily reliant on Chinese manufacturing and supply chains. The broader economic context includes implications for global trade flows and investor confidence. Various scenarios are possible, each impacting the Apple stock price differently:

- Escalation: Further tariff increases could severely impact Apple's profitability, leading to a more significant decline in the Apple stock price.

- De-escalation: A resolution to the trade conflict could lead to a rebound in Apple stock, restoring investor confidence.

- Stalemate: A prolonged trade war could create prolonged volatility in the Apple stock market, making it difficult to predict future performance.

Data from the US Census Bureau shows a significant trade volume between the US and China, making Apple particularly vulnerable to these trade tensions. Understanding this context is vital for assessing the risks associated with Apple stock investment.

Investor Reaction and Market Sentiment

The $900 million tariff projection immediately triggered a negative reaction in the stock market.

Stock Price Volatility and Trading Activity

The announcement led to significant volatility in the Apple stock price, with an immediate dip followed by fluctuating trading activity. [Insert chart/graph showing Apple stock price fluctuations around the announcement date]. Trading volume increased considerably as investors reacted to the news, with a notable increase in sell-offs initially.

Analyst Predictions and Future Outlook

Leading financial analysts have offered varied predictions regarding the long-term prospects of Apple stock. Some suggest a potential long-term negative impact, while others believe Apple can mitigate the effects through diversification or price adjustments. Many analysts are advising caution, suggesting investors carefully consider the risks before making any significant investment decisions. Alternative investment strategies should be explored to manage exposure to the Apple stock market's volatility during this time.

Apple's Response and Mitigation Strategies

Apple has yet to offer a comprehensive solution to counter the projected losses from these tariffs.

Apple's Official Statements and Actions

Apple’s official statements regarding the tariffs have been limited, focusing on navigating the situation and maintaining a positive outlook. [Insert any relevant quotes from Apple executives or press releases here]. The effectiveness of their strategies will depend on their ability to absorb the increased costs or pass them on to consumers without significantly affecting sales.

Potential Long-Term Implications for Apple's Supply Chain

The tariffs could force Apple to reconsider its reliance on Chinese manufacturing. Shifting production to other countries like Vietnam or India is a possibility, though this presents considerable challenges:

- Increased Costs: Establishing new manufacturing facilities and supply chains in other countries involves substantial upfront investment and logistical complexities.

- Skill Gaps: Finding skilled labor in alternative locations may be difficult.

- Political Risks: Each new location presents unique political and economic risks.

These factors could significantly impact Apple's long-term profitability and its relationships with existing Chinese suppliers.

Conclusion

The $900 million tariff projection presents a significant challenge to Apple's financial outlook and has undeniably impacted Apple stock. The ongoing trade war between the US and China creates uncertainty, affecting not only Apple but also the broader tech industry and global trade. The impact on Apple's profit margins is substantial, and its reliance on Chinese manufacturing remains a critical vulnerability.

Call to Action: Stay informed about developments in the ongoing trade war and its impact on Apple stock. Conduct thorough research into Apple's financial reports and analyst predictions to make informed investment decisions. Carefully monitor the Apple stock price and related news for updates, and consider diversifying your portfolio to mitigate risks associated with Apple stock investment. Understanding the complexities of Apple stock and the global trade climate is crucial for navigating this challenging market.

Featured Posts

-

Sses 3 Billion Spending Cut Impact Of Economic Slowdown

May 25, 2025

Sses 3 Billion Spending Cut Impact Of Economic Slowdown

May 25, 2025 -

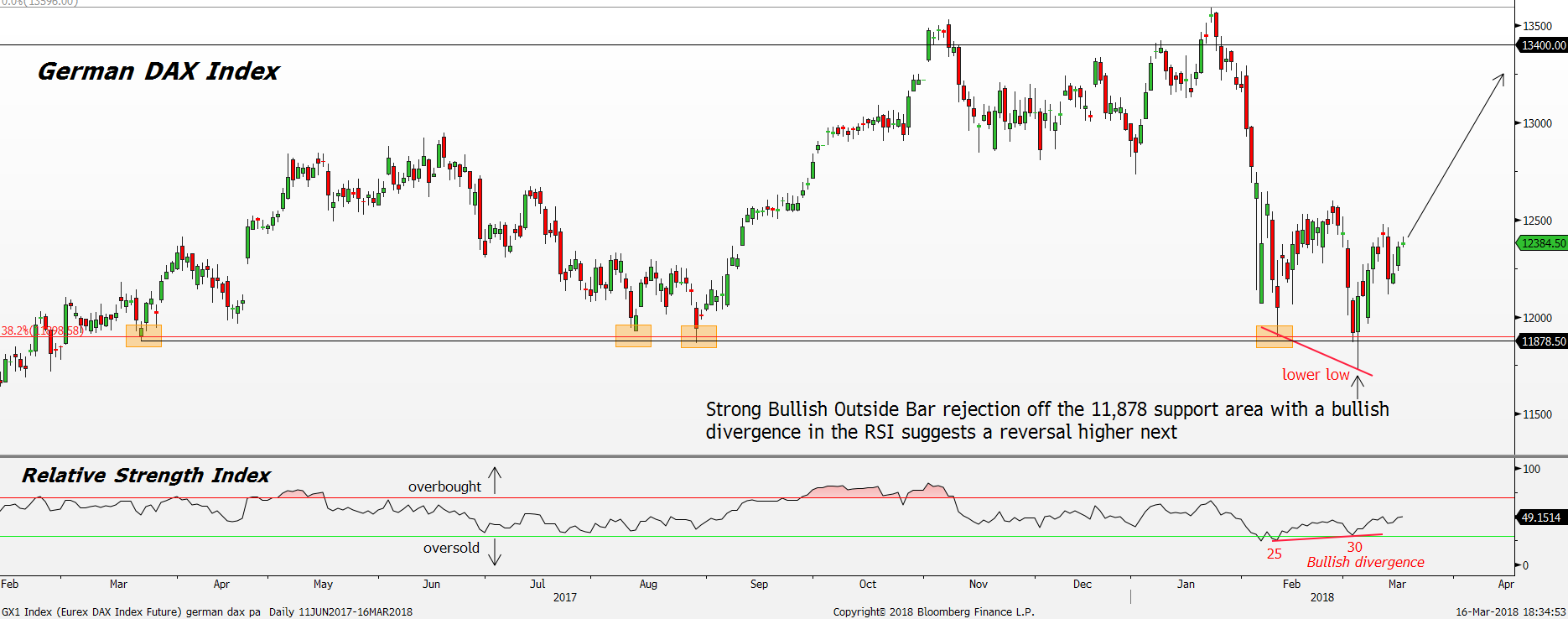

Dax Surge Will A Wall Street Rebound Dampen German Market Gains

May 25, 2025

Dax Surge Will A Wall Street Rebound Dampen German Market Gains

May 25, 2025 -

A Realistic Escape To The Country Challenges And Rewards

May 25, 2025

A Realistic Escape To The Country Challenges And Rewards

May 25, 2025 -

Na Uitstel Trump Aex Fondsen Klimmen Stevig Omhoog

May 25, 2025

Na Uitstel Trump Aex Fondsen Klimmen Stevig Omhoog

May 25, 2025 -

Macrons Party Proposes Hijab Ban For Under 15s In Public Spaces

May 25, 2025

Macrons Party Proposes Hijab Ban For Under 15s In Public Spaces

May 25, 2025

Latest Posts

-

A Review Of Expenditures Presidential Seals Luxury Goods And High Profile Gatherings

May 25, 2025

A Review Of Expenditures Presidential Seals Luxury Goods And High Profile Gatherings

May 25, 2025 -

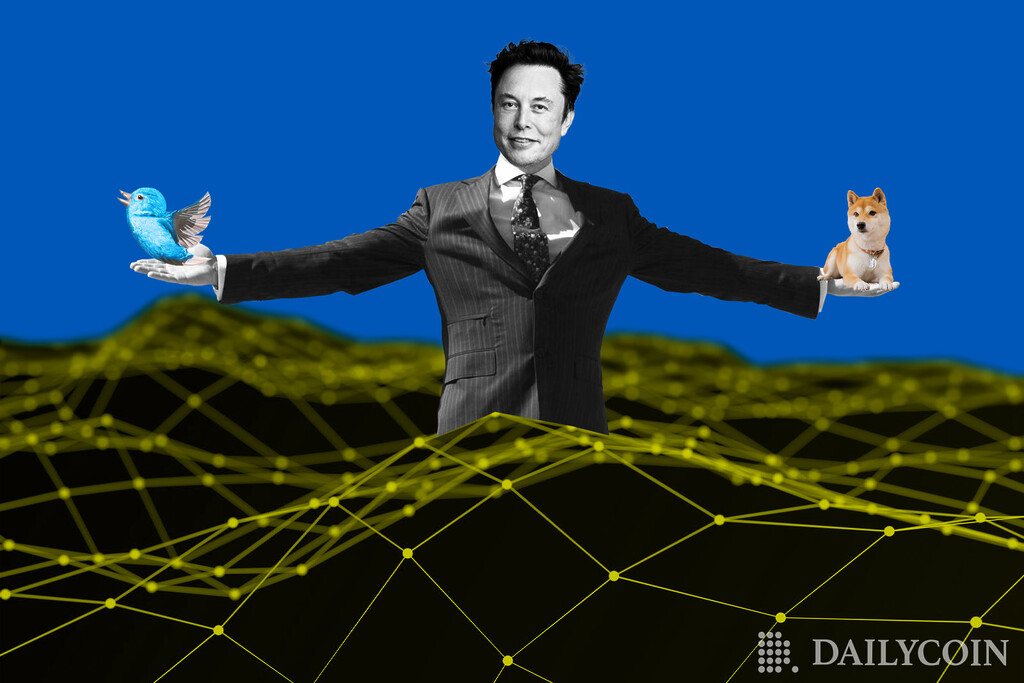

The Elon Musk Dogecoin Relationship An Analysis

May 25, 2025

The Elon Musk Dogecoin Relationship An Analysis

May 25, 2025 -

Dogecoin Price And Elon Musks Actions Correlation Or Causation

May 25, 2025

Dogecoin Price And Elon Musks Actions Correlation Or Causation

May 25, 2025 -

Is Elon Musk Abandoning Dogecoin A Deeper Dive

May 25, 2025

Is Elon Musk Abandoning Dogecoin A Deeper Dive

May 25, 2025 -

Presidential Seals Expensive Gifts And The Issue Of Transparency

May 25, 2025

Presidential Seals Expensive Gifts And The Issue Of Transparency

May 25, 2025