CFP Board CEO To Retire In Early 2026: What This Means For Financial Planning

Table of Contents

Impact on CFP Certification and Standards

The CFP certification is a hallmark of professionalism and expertise in financial planning. Maintaining its integrity is paramount. The CFP Board CEO retirement necessitates a smooth transition to ensure the continued high standards associated with this prestigious designation.

Maintaining the Integrity of the CFP Certification

A successful transition requires careful consideration of several key areas:

- Potential challenges in maintaining exam rigor: The incoming CEO will need to ensure the CFP exam continues to accurately assess the knowledge and skills required of competent financial planners. This includes regularly updating the exam content to reflect evolving industry practices.

- Upholding ethical standards: The CFP Board's commitment to ethical conduct must remain unwavering. The new leadership will need to actively enforce the code of ethics and address any potential breaches swiftly and transparently.

- Addressing potential disruptions to the certification process: Minimizing any disruption to the certification process itself is critical. This includes ensuring a seamless transition in administrative processes and maintaining clear communication with CFP professionals.

The incoming CEO's role is pivotal in ensuring the continued prestige and global recognition of the CFP designation. Their leadership will be instrumental in navigating potential challenges and upholding the rigorous standards that have made the CFP mark so highly valued.

Future of CFP Board Examinations and Curriculum

Under new leadership, the CFP exam and curriculum may undergo revisions. This presents both challenges and opportunities.

- Potential updates to reflect evolving financial landscapes: The curriculum needs to adapt to emerging trends such as sustainable investing, fintech integration, and the increasing complexity of global markets.

- Adapting to technological advancements in financial planning: The use of financial planning software, robo-advisors, and other technological tools is rapidly changing the industry. The curriculum needs to reflect this technological evolution.

- Incorporating new financial planning trends: New areas of expertise, such as behavioral finance and financial wellness planning, may need to be integrated into the curriculum to ensure CFP professionals possess the necessary skills.

We might see increased focus on specialized areas. For instance, a greater emphasis on sustainable investing or a deeper dive into behavioral finance principles could be incorporated to equip CFP professionals for the evolving demands of the industry.

Leadership Transition and Board Governance

The process of selecting a new CEO and ensuring a smooth transition is crucial for the future of the CFP Board.

The Search for a New CEO

The CFP Board's search for a new CEO will likely involve a rigorous process focused on identifying a candidate with the following qualities:

- Extensive experience in financial planning: A deep understanding of the industry, its challenges, and its future direction is essential.

- Proven leadership skills: The ability to lead and manage a large organization, navigate complex issues, and effectively communicate with diverse stakeholders is vital.

- Strong understanding of the regulatory environment: Navigating the complexities of financial regulations and maintaining compliance is crucial for the CFP Board's continued success.

The leadership style of the incoming CEO will significantly impact the CFP Board's direction. A collaborative approach might foster innovation and engagement, while a more directive style may prioritize efficiency and stability.

Ensuring Stability During the Transition

Minimizing disruption during the leadership change requires proactive strategies:

- Clear communication: Open and transparent communication with CFP professionals, stakeholders, and the public will alleviate concerns and build trust.

- Maintaining ongoing operations: Ensuring the smooth continuation of all CFP Board operations, including certifications, exams, and professional development programs, is paramount.

- Ensuring continuity of services to CFP professionals: The CFP Board must maintain its commitment to providing high-quality services and support to CFP professionals throughout the transition.

The existing Board of Directors plays a critical role in facilitating a smooth handover, providing guidance and support to both the outgoing and incoming CEOs.

Implications for Financial Planners

The CFP Board CEO retirement will have direct implications for financial planners.

Potential Changes to Professional Development Resources

The leadership change may affect the resources available to CFP professionals:

- Potential adjustments to continuing education requirements: The new CEO might introduce changes to the continuing education requirements to better reflect evolving industry trends and best practices.

- Updates to professional development programs: New leadership could bring fresh perspectives to the design and delivery of professional development programs, offering enhanced learning opportunities.

- Changes to available support systems: The CFP Board may restructure or expand its support systems for CFP professionals, offering better resources and guidance.

The implications of these changes will likely differ based on the size of the firm. Smaller firms may rely more heavily on CFP Board resources, while larger institutions may have more internal resources to support their CFP professionals.

The Future of the Financial Planning Profession

The retirement of the CEO has broader implications for the financial planning profession:

- Potential shifts in industry trends: The new leadership's vision will shape the future direction of the profession, potentially influencing industry trends and best practices.

- Implications for regulation: The CFP Board's interaction with regulators will continue to be crucial. The new CEO's approach will influence the profession's regulatory landscape.

- Adapting to emerging technological advancements: The continued integration of technology into financial planning demands adaptation. The new CEO will play a role in guiding the profession's response to technological change.

The new CEO's leadership will significantly influence the trajectory of the financial planning profession, shaping its future direction and adapting it to the evolving needs of the market.

Conclusion

The retirement of the CFP Board CEO in early 2026 presents both challenges and opportunities for the financial planning profession. A successful transition hinges on a well-executed leadership search, upholding the integrity of the CFP certification, and ensuring a stable environment for CFP professionals. The incoming CEO will play a crucial role in shaping the future direction of the CFP Board and the broader financial planning landscape. Staying informed about the developments surrounding this CFP Board CEO Retirement is vital for all financial planners to adapt and thrive in the evolving profession. Therefore, keep an eye on official CFP Board announcements for updates and insights into this significant transition.

Featured Posts

-

Premiere Naissance De L Annee Un Cadeau Chocolate Gourmand

May 02, 2025

Premiere Naissance De L Annee Un Cadeau Chocolate Gourmand

May 02, 2025 -

Dy Te Vdekur Pas Sulmit Me Thike Ne Qender Tregtare Te Cekise

May 02, 2025

Dy Te Vdekur Pas Sulmit Me Thike Ne Qender Tregtare Te Cekise

May 02, 2025 -

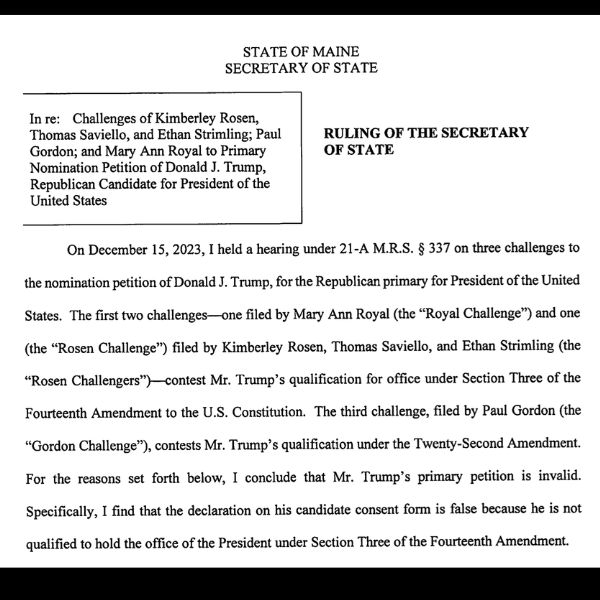

Examining Maines Inaugural Post Election Audit

May 02, 2025

Examining Maines Inaugural Post Election Audit

May 02, 2025 -

Fortnite Cowboy Bebop Freebies A Quick Guide To Redemption

May 02, 2025

Fortnite Cowboy Bebop Freebies A Quick Guide To Redemption

May 02, 2025 -

Complete List Of Fortnite Tmnt Skins And How To Get Them

May 02, 2025

Complete List Of Fortnite Tmnt Skins And How To Get Them

May 02, 2025

Latest Posts

-

Navigating The Turbulence Airlines Struggle Amidst Oil Supply Shocks

May 04, 2025

Navigating The Turbulence Airlines Struggle Amidst Oil Supply Shocks

May 04, 2025 -

Oil Price Volatility And Its Consequences For Airline Operations

May 04, 2025

Oil Price Volatility And Its Consequences For Airline Operations

May 04, 2025 -

Soaring Fuel Costs The Oil Shocks Devastating Effect On Airlines

May 04, 2025

Soaring Fuel Costs The Oil Shocks Devastating Effect On Airlines

May 04, 2025 -

Airline Industry Faces Headwinds The Impact Of Oil Supply Disruptions

May 04, 2025

Airline Industry Faces Headwinds The Impact Of Oil Supply Disruptions

May 04, 2025 -

Oil Supply Shocks How The Airline Industry Is Feeling The Pinch

May 04, 2025

Oil Supply Shocks How The Airline Industry Is Feeling The Pinch

May 04, 2025