Germany's DAX Soars: Can Wall Street's Recovery Spoil The Party?

Table of Contents

The DAX's Recent Ascent: Understanding the Drivers

The impressive performance of the DAX can be attributed to several key factors contributing to strong economic growth in Germany. Let's examine these drivers in detail:

-

Strong Corporate Earnings: German companies, particularly those in the automotive and industrial sectors, have reported robust earnings. Volkswagen's strong sales figures, for instance, have significantly boosted investor confidence. Similarly, positive results from Siemens and BASF reflect a broader trend of improved corporate performance.

-

Easing Inflation: Signs of easing inflation in Germany and the broader Eurozone are crucial. Decreased inflationary pressures reduce the risk of aggressive interest rate hikes by the European Central Bank (ECB), fostering a more positive investment climate. This improved outlook contributes to increased investor confidence in the DAX.

-

Positive Economic Indicators: Germany's economic indicators are painting a largely positive picture. Data suggesting strong growth in manufacturing and consumer spending contribute to a bullish sentiment surrounding the DAX. This positive momentum is encouraging for both domestic and foreign investors.

-

Government Support: Government stimulus packages and targeted infrastructure investments are also providing a substantial boost. These initiatives aim to stimulate economic activity and further support the DAX's upward trajectory.

-

Decreased Interest Rate Concerns: While interest rates remain a concern globally, the current trajectory suggests less aggressive increases than initially feared. This easing of interest rate concerns has positively impacted investor sentiment, leading to increased investment in the DAX.

The Eurozone's overall economic performance also plays a significant role. A strengthening Eurozone economy naturally supports the DAX, creating a positive feedback loop for German businesses and investors.

Wall Street's Recovery: A Boon or a Bane for the DAX?

While the DAX's performance is impressive, the ongoing recovery on Wall Street introduces a layer of complexity. The relationship between the DAX and Wall Street is intricate, and understanding this correlation is crucial for investors.

-

DAX-Wall Street Correlation: Historically, the DAX and Wall Street indices exhibit a degree of correlation, although this correlation is not always perfectly synchronized. Recent data needs to be carefully analyzed to determine the strength of the current correlation and potential divergences.

-

Capital Flight Potential: A robust US economic recovery could potentially lead to capital flight from European markets, including the DAX, as investors shift their focus toward potentially higher returns in the US. This capital outflow could put downward pressure on the DAX.

-

US Monetary Policy Impact: The Federal Reserve's monetary policy decisions have global implications. Aggressive interest rate hikes in the US can influence capital flows and impact the Eurozone economy, potentially affecting the DAX's performance.

-

Investor Sentiment: Investor confidence is a crucial factor. If investor sentiment shifts strongly in favor of US markets, it could lead to a decrease in risk appetite for European assets, including the DAX. This shift in sentiment can quickly impact market dynamics.

-

Competing Investment Opportunities: The strength of the US market presents competing investment opportunities. Investors might reallocate funds from the DAX to US equities if they perceive better risk-adjusted returns in the US market.

Geopolitical Risks and their Influence on Both Markets

Geopolitical factors significantly impact both the DAX and Wall Street. The ongoing war in Ukraine, for instance, continues to exert pressure on energy prices and supply chains globally.

-

Ukraine War Impact: The war's impact on energy prices and supply chains is felt acutely in both Europe and the US. This volatility creates uncertainty for businesses and investors.

-

Energy Price Volatility: Fluctuations in energy prices directly impact business costs and consumer spending, significantly influencing both the DAX and Wall Street.

-

Supply Chain Disruptions: Global supply chain disruptions caused by geopolitical instability and other factors lead to production delays and increased costs, affecting corporate earnings and market sentiment.

-

Other Geopolitical Factors: Other geopolitical events, such as trade tensions or political instability in other regions, can further exacerbate uncertainty in the markets, impacting investor confidence in both the DAX and Wall Street.

Investment Strategies in the Face of Uncertainty

Navigating the current market environment requires a well-defined investment strategy that prioritizes risk management and diversification.

-

Diversification: A well-diversified portfolio across different asset classes and geographies helps mitigate risk and reduces the impact of market fluctuations. Don't put all your eggs in one basket.

-

Long-Term Growth Potential: While short-term market volatility exists, both the DAX and US markets have long-term growth potential. Consider your long-term investment goals when making decisions.

-

Risk Management: Implement robust risk management strategies to protect your investments from potential downsides. Set stop-loss orders and carefully monitor your portfolio's performance.

-

Key Economic Indicator Monitoring: Regularly monitor key economic indicators, such as inflation rates, interest rates, and GDP growth, to anticipate market shifts and adjust your strategy accordingly.

Conclusion

The DAX's recent surge is encouraging, reflecting positive economic fundamentals within Germany and the Eurozone. However, the simultaneous recovery on Wall Street introduces an element of uncertainty. The correlation between these two major markets, the potential for capital flight, and the impact of geopolitical risks all need careful consideration. A well-defined investment strategy incorporating diversification and robust risk management is crucial for navigating this dynamic environment. Understanding the interplay between the DAX and Wall Street is key to making informed investment decisions. Stay informed about the latest developments affecting the DAX and develop a robust investment strategy to navigate this dynamic environment. Learn more about effective DAX investing strategies today!

Featured Posts

-

The Unbuilt M62 Relief Road Burys Bypassed Future

May 25, 2025

The Unbuilt M62 Relief Road Burys Bypassed Future

May 25, 2025 -

Jazda Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

May 25, 2025

Jazda Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

May 25, 2025 -

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 25, 2025

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 25, 2025 -

Amsterdam Stock Market Crash Index Down Over 4 Percent

May 25, 2025

Amsterdam Stock Market Crash Index Down Over 4 Percent

May 25, 2025 -

Annie Kilners Sparkling New Ring Following Kyle Walkers Public Appearance

May 25, 2025

Annie Kilners Sparkling New Ring Following Kyle Walkers Public Appearance

May 25, 2025

Latest Posts

-

Actress Mia Farrows Dire Warning American Democracys 3 4 Month Time Limit

May 25, 2025

Actress Mia Farrows Dire Warning American Democracys 3 4 Month Time Limit

May 25, 2025 -

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 25, 2025

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 25, 2025 -

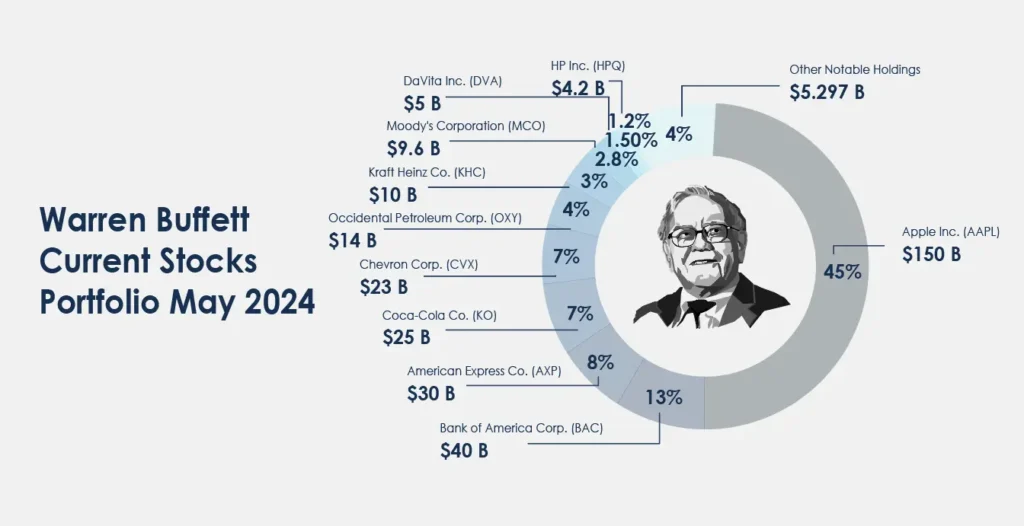

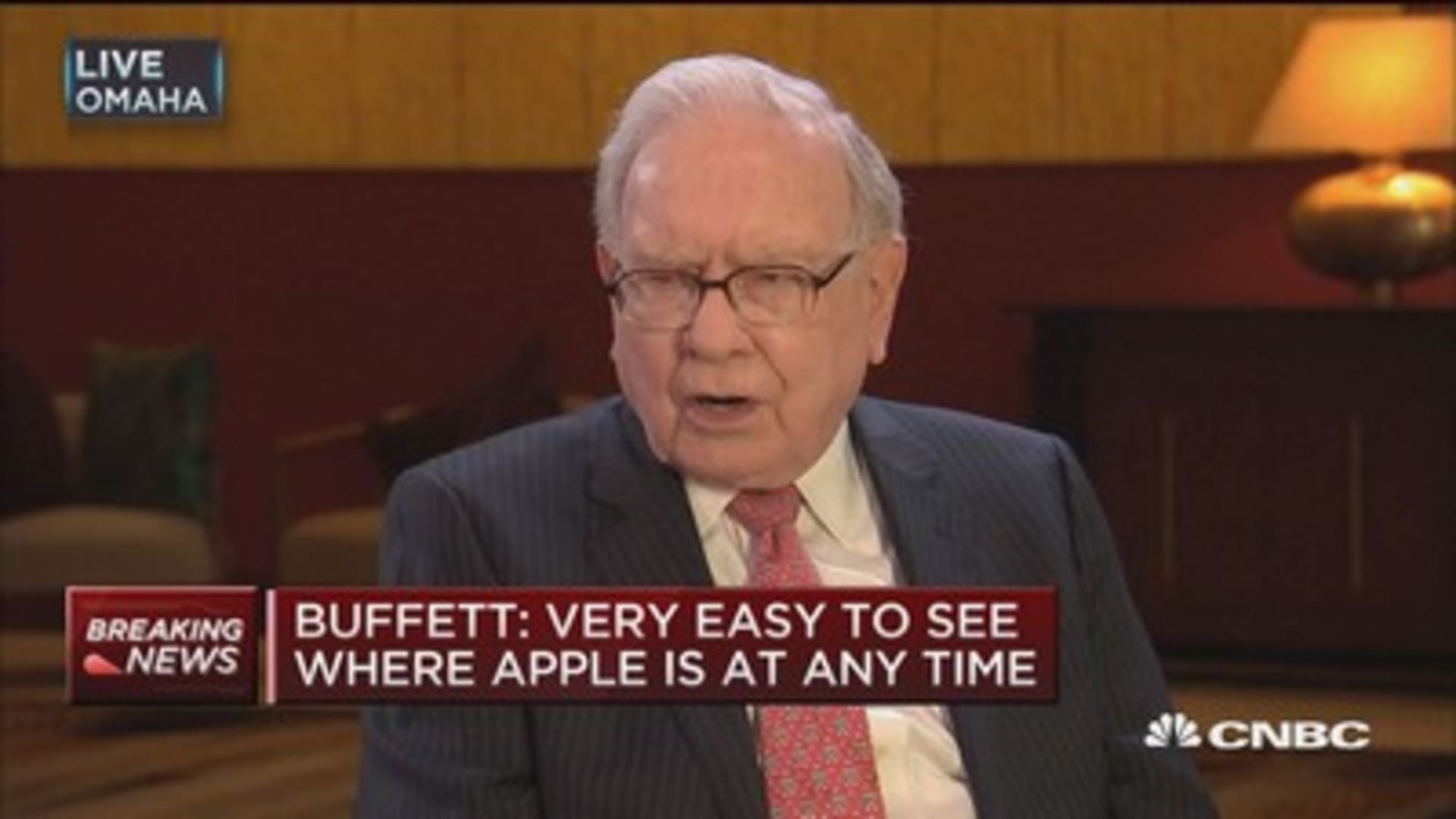

Trump Tariffs And Apple Assessing The Risk To Buffetts Portfolio

May 25, 2025

Trump Tariffs And Apple Assessing The Risk To Buffetts Portfolio

May 25, 2025 -

Sadie Sink And Mia Farrow Backstage At Photo 5162787

May 25, 2025

Sadie Sink And Mia Farrow Backstage At Photo 5162787

May 25, 2025 -

Is Apple Vulnerable Analyzing The Impact Of Tariffs On Buffetts Holdings

May 25, 2025

Is Apple Vulnerable Analyzing The Impact Of Tariffs On Buffetts Holdings

May 25, 2025