Trump Tariffs And Apple: Assessing The Risk To Buffett's Portfolio

Table of Contents

The Impact of Trump Tariffs on Apple's Supply Chain

The Trump tariffs, particularly those targeting goods from China, significantly impacted Apple's intricate global supply chain. This disruption manifested in two key areas: increased production costs and potential supply chain bottlenecks.

Disrupted Manufacturing and Increased Costs

Tariffs on imported components forced Apple to absorb higher costs, squeezing profit margins. These tariffs affected a wide range of crucial components, including:

- Displays

- Processors

- Memory

- Various other electronic components

While precise figures regarding the increased cost per unit are difficult to definitively pinpoint publicly, industry analysts widely reported significant price increases across Apple's product lines during this period. These cost increases were partly absorbed by Apple, leading to reduced profitability, and partly passed on to consumers through higher prices, potentially impacting sales.

Impact on Consumer Demand

The higher prices resulting from tariffs presented a significant challenge to Apple. Increased prices, even for premium brands like Apple, can deter consumers. This translated into potential market share losses to competitors who were either less reliant on Chinese manufacturing or less affected by the tariffs. While concrete sales figures during this period are publicly available, it's evident that higher prices potentially reduced overall demand and influenced consumer spending behaviors. Some consumers may have opted for cheaper alternatives or delayed purchases.

Buffett's Investment Strategy and Risk Tolerance

Understanding the risk to Buffett's portfolio requires examining Berkshire Hathaway's investment philosophy and risk tolerance.

Berkshire Hathaway's Long-Term Approach

Buffett's investment strategy is renowned for its long-term focus. Berkshire Hathaway is known for its patient, value-oriented approach, often weathering short-term market volatility. This long-term perspective implicitly mitigates some of the risk associated with short-term market fluctuations like those caused by the imposition of tariffs.

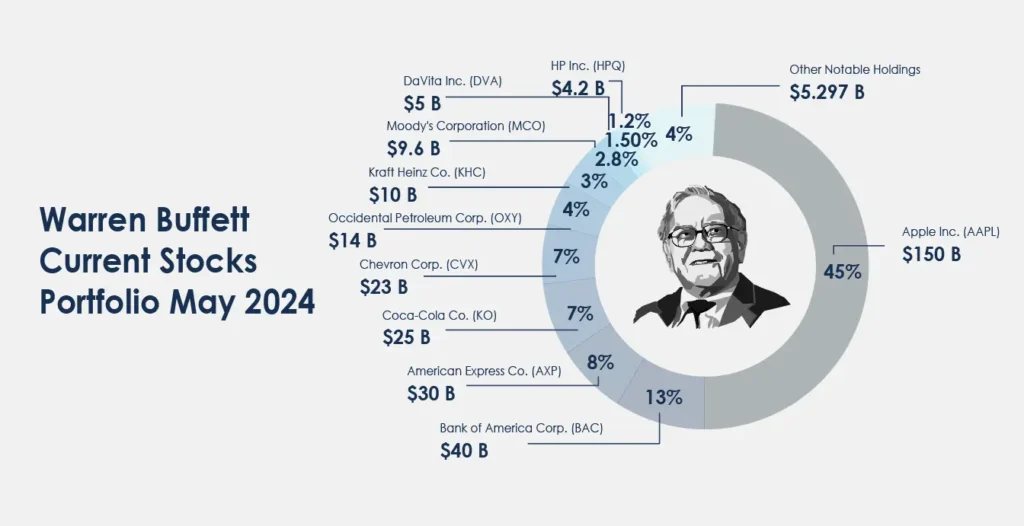

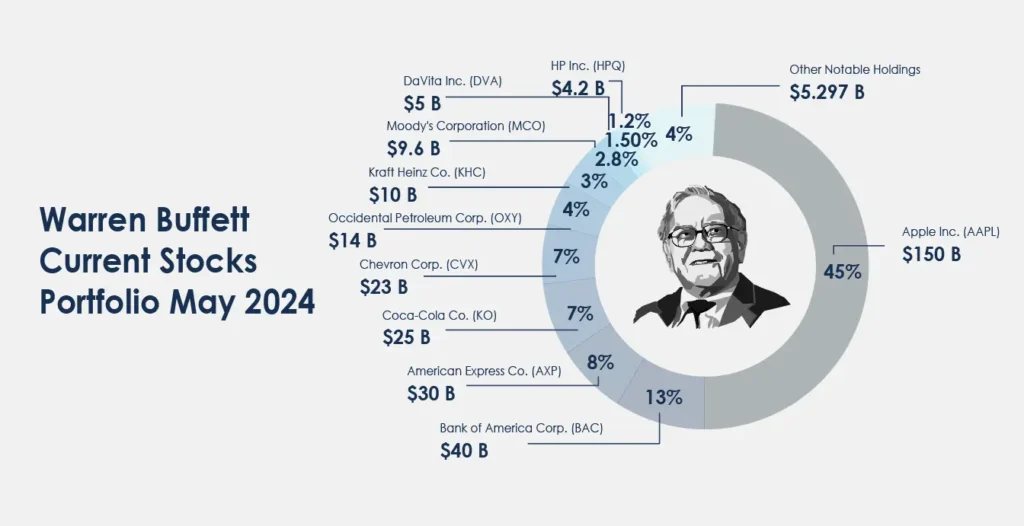

Apple's Significance in Buffett's Portfolio

Berkshire Hathaway's investment in Apple is substantial, representing a significant percentage of its overall portfolio. Precise figures fluctuate with market changes, but at its peak, it constituted a considerable portion of Berkshire Hathaway's holdings. A significant downturn in Apple's stock price would, therefore, have a considerable impact on Berkshire Hathaway's overall performance. The sheer size of this investment makes Apple a crucial component of Buffett’s portfolio, increasing the exposure to any negative impact from external factors like trade disputes.

Analyzing the Long-Term Effects of the Tariffs on Apple

While the immediate impact of the Trump tariffs was undeniable, it's crucial to consider Apple's adaptive strategies and the broader geopolitical context.

Apple's Adaptation Strategies

Faced with tariff-induced challenges, Apple actively worked to diversify its supply chain. This involved exploring alternative manufacturing locations and suppliers, aiming to reduce its reliance on any single region, particularly China. Although the specific details of these strategies often remain confidential for competitive reasons, successful diversification efforts likely mitigated some of the long-term negative effects of the tariffs.

The Geopolitical Landscape and Future Tariff Risk

The geopolitical landscape remains dynamic, with the potential for future trade disputes and shifting tariff policies. The likelihood of future tariff conflicts impacting Apple depends heavily on the evolving relationship between major global economies and the policies of future administrations. Understanding these geopolitical shifts is crucial to assessing the ongoing long-term risk Apple faces in its global operations.

Conclusion

The Trump tariffs undoubtedly presented challenges to Apple's profitability and supply chain, increasing the risk to Buffett's substantial investment. However, Apple's adaptive strategies and Berkshire Hathaway's long-term investment horizon likely mitigated the overall impact. While the short-term effects were noticeable, the long-term consequences were ultimately less devastating than initially feared. The risk posed by the “Trump Tariffs and Apple” was significant but ultimately manageable given the scale and strategies employed by both Apple and Berkshire Hathaway. Continue exploring the complexities of Trump Tariffs and Apple's resilience by researching further into Apple's supply chain diversification efforts and the long-term impacts of trade policies on multinational corporations. Share your perspective on the long-term implications of this trade conflict on the global tech landscape.

Featured Posts

-

Understanding The Next Key Price Levels Of Aapl Stock

May 25, 2025

Understanding The Next Key Price Levels Of Aapl Stock

May 25, 2025 -

Apple Stock Performance Below Key Levels Ahead Of Q2 Report

May 25, 2025

Apple Stock Performance Below Key Levels Ahead Of Q2 Report

May 25, 2025 -

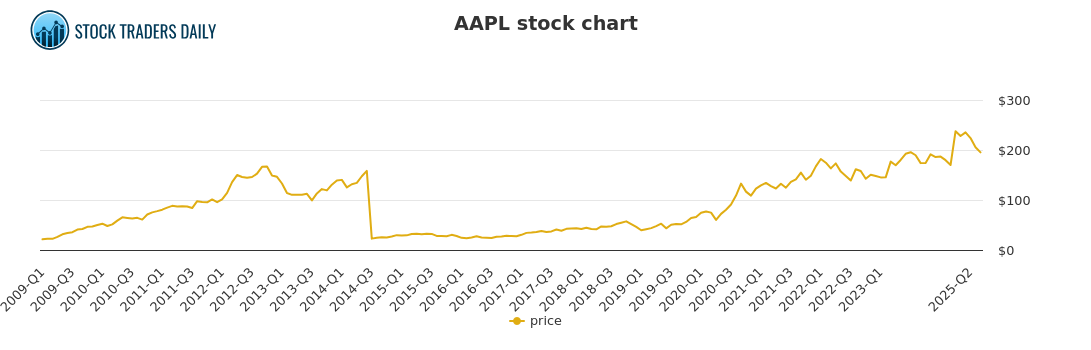

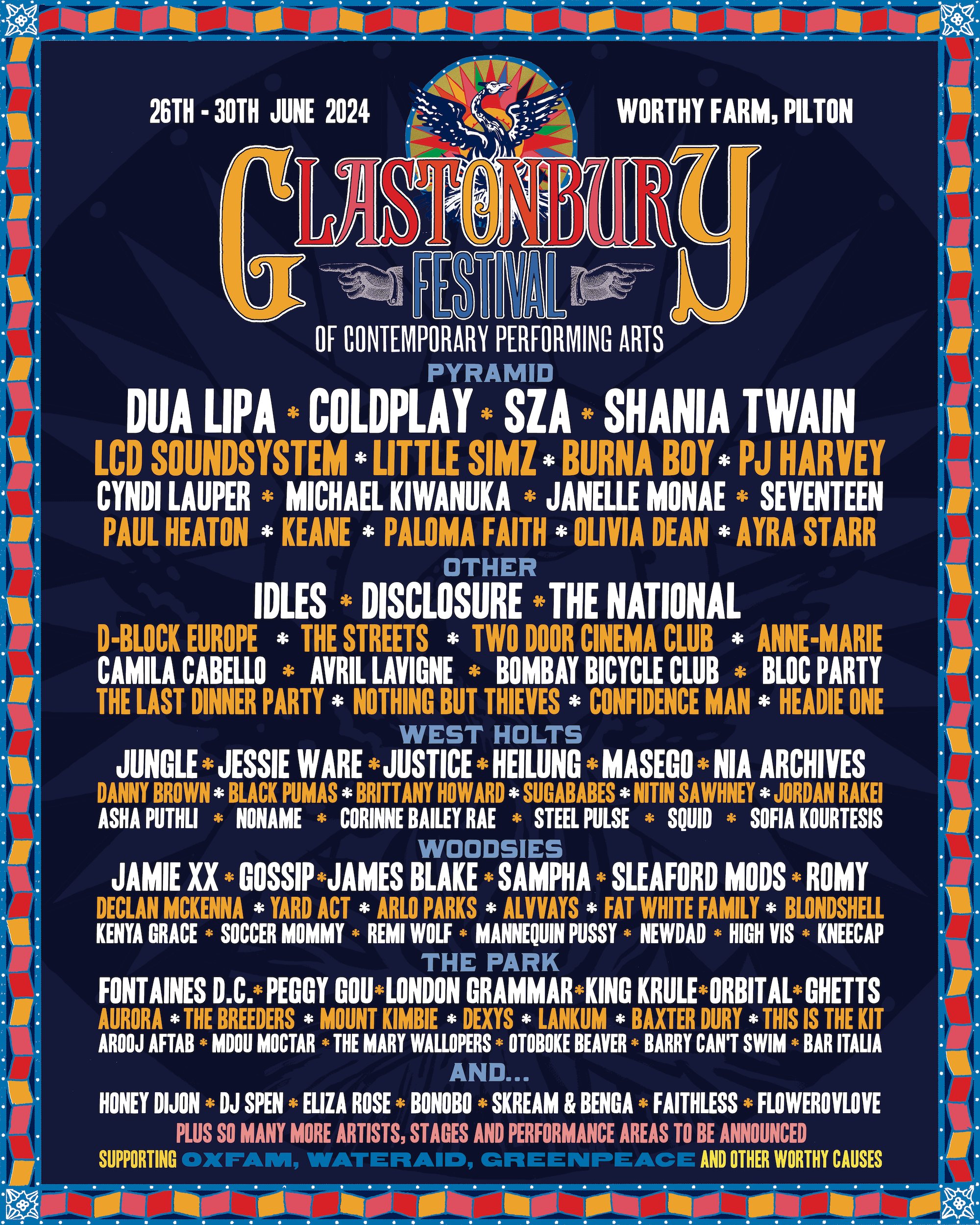

Glastonbury Festival Unconfirmed Us Band To Play

May 25, 2025

Glastonbury Festival Unconfirmed Us Band To Play

May 25, 2025 -

Zhizn I Tvorchestvo Sergeya Yurskogo K 90 Letiyu So Dnya Rozhdeniya

May 25, 2025

Zhizn I Tvorchestvo Sergeya Yurskogo K 90 Letiyu So Dnya Rozhdeniya

May 25, 2025 -

New Music Joy Crookes Unveils Powerful New Song I Know You D Kill

May 25, 2025

New Music Joy Crookes Unveils Powerful New Song I Know You D Kill

May 25, 2025

Latest Posts

-

Trumps Pressure Tactics Forcing A Republican Deal

May 25, 2025

Trumps Pressure Tactics Forcing A Republican Deal

May 25, 2025 -

Buy And Hold Facing The Uncomfortable Truths Of Long Term Investing

May 25, 2025

Buy And Hold Facing The Uncomfortable Truths Of Long Term Investing

May 25, 2025 -

Apple Ceo Tim Cooks Troubled Year A Deeper Look

May 25, 2025

Apple Ceo Tim Cooks Troubled Year A Deeper Look

May 25, 2025 -

A Deep Dive Into The Monaco Corruption Scandal The Prince And His Money Manager

May 25, 2025

A Deep Dive Into The Monaco Corruption Scandal The Prince And His Money Manager

May 25, 2025 -

Buy And Hold Investing The Long Games Harsh Truth

May 25, 2025

Buy And Hold Investing The Long Games Harsh Truth

May 25, 2025