Indian Bourse Rally: BSE Stock Prices Rise On Strong Earnings

Table of Contents

Strong Corporate Earnings Drive BSE Rally

The direct correlation between robust quarterly earnings reports and the surge in BSE stock prices is undeniable. Major Indian companies have delivered exceptionally strong results, exceeding expectations and boosting investor confidence. This positive performance across several key sectors directly translates into a higher BSE Sensex. This stellar performance isn't just a fleeting phenomenon; the positive outlook for future earnings from leading sectors further solidifies the bullish trend.

- Company X exceeded profit expectations by 15%, showcasing impressive growth in its core business segments.

- Company Z, a leading player in the technology sector, reported record revenues, driven by strong global demand for its products and services.

- The positive outlook for future earnings extends across several key sectors, including IT, banking, and FMCG, fueling further optimism in the market. This strong corporate earnings performance is a key pillar supporting the BSE rally and the overall health of the Indian economy.

Positive Investor Sentiment Fuels BSE Stock Prices

The current BSE stock market rally is not solely driven by corporate earnings; it's also fueled by a significant surge in positive investor sentiment. This optimism stems from a confluence of factors, including supportive government policies, improving macroeconomic indicators, and positive global market trends. Increased investor confidence translates to higher demand for stocks, thereby driving up prices.

- Increased Foreign Institutional Investor (FII) inflows: Significant investment from foreign entities reflects a strong belief in the long-term growth potential of the Indian economy.

- Domestic Institutional Investors (DII) showing strong buying activity: Domestic investors are equally optimistic, further bolstering the upward momentum of the BSE Sensex.

- Improved macroeconomic indicators boosting confidence: Key economic indicators, such as GDP growth and inflation rates, are showing positive trends, strengthening investor confidence. This positive feedback loop between strong earnings and investor sentiment is a crucial driver of the current BSE rally.

Sector-Specific Performance in the BSE Rally

The BSE rally isn't uniform across all sectors; some sectors have outperformed others significantly. This sectoral divergence provides valuable insights into the underlying drivers of the overall market surge.

- IT sector leading the gains: The IT sector is experiencing phenomenal growth, fueled by strong global demand and technological advancements.

- Banking sector benefiting from improved credit growth: Increased lending activity and improved asset quality are propelling the banking sector's performance.

- FMCG sector showing resilience: Despite inflationary pressures, the FMCG sector has demonstrated resilience, indicating strong consumer demand. Understanding this sector-specific performance is critical for investors seeking to optimize their portfolio within the broader Indian Bourse.

Potential Risks and Future Outlook for the BSE

While the current outlook for the BSE is positive, it's crucial to acknowledge potential risks and challenges that could impact the ongoing rally. Maintaining a balanced perspective is key to informed investment decisions.

- Global economic slowdown: A potential global recession could negatively impact investor sentiment and lead to capital outflows.

- Inflationary pressures: Persistent inflation could affect corporate earnings and dampen consumer spending, impacting market performance.

- Potential for interest rate hikes: Central bank actions to curb inflation through interest rate hikes could slow down economic growth and impact the BSE. Careful consideration of these potential risks is crucial for navigating the Indian Bourse effectively.

Conclusion: Navigating the Indian Bourse Rally

The recent surge in BSE stock prices is a result of a powerful combination of strong corporate earnings and buoyant investor sentiment. Understanding the sector-specific performance and acknowledging the potential risks is crucial for navigating this dynamic market. The Indian Bourse offers significant opportunities but also presents challenges. Conduct thorough research, stay updated on market trends, and analyze individual company performance to make informed investment decisions. Stay informed about the Indian Bourse and BSE stock prices to make smart investment choices. Monitor strong earnings reports and market trends for optimal portfolio management.

Featured Posts

-

Trae Young Travel Calls A Breakdown Of The Controversial Plays

May 07, 2025

Trae Young Travel Calls A Breakdown Of The Controversial Plays

May 07, 2025 -

Post Suspension Rally Chinese Equities Rise On Renewed Us Trade Optimism And Positive Economic Signals

May 07, 2025

Post Suspension Rally Chinese Equities Rise On Renewed Us Trade Optimism And Positive Economic Signals

May 07, 2025 -

Barkleys Bold Prediction The Cleveland Cavaliers Future

May 07, 2025

Barkleys Bold Prediction The Cleveland Cavaliers Future

May 07, 2025 -

Rihannas Third Child Pregnancy Journey Revealed

May 07, 2025

Rihannas Third Child Pregnancy Journey Revealed

May 07, 2025 -

6 Billion Streams And Counting The Quick Creation Of A Rihanna Classic

May 07, 2025

6 Billion Streams And Counting The Quick Creation Of A Rihanna Classic

May 07, 2025

Latest Posts

-

Bitcoin Madenciliginin Sonu Yaklasiyor Mu

May 08, 2025

Bitcoin Madenciliginin Sonu Yaklasiyor Mu

May 08, 2025 -

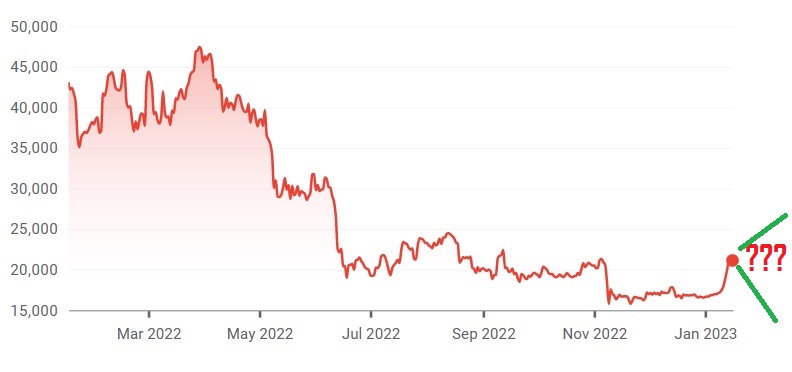

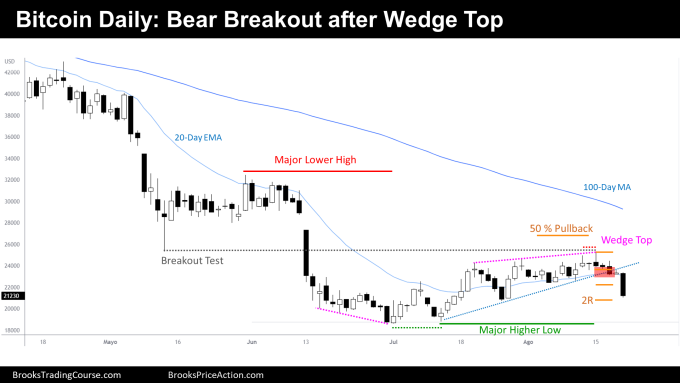

The Bitcoin Rebound Opportunities And Risks

May 08, 2025

The Bitcoin Rebound Opportunities And Risks

May 08, 2025 -

Understanding Bitcoins Rebound Potential For Further Gains

May 08, 2025

Understanding Bitcoins Rebound Potential For Further Gains

May 08, 2025 -

Bitcoins Recent Rebound A Sign Of Future Growth

May 08, 2025

Bitcoins Recent Rebound A Sign Of Future Growth

May 08, 2025 -

Has The Bitcoin Bear Market Ended Analyzing The Recent Rebound

May 08, 2025

Has The Bitcoin Bear Market Ended Analyzing The Recent Rebound

May 08, 2025