Joe Biden And The Economy: Examining The Causes Of Slow Growth

Table of Contents

Inflation's Impact on Economic Growth Under Biden

The current inflation rate, while down from its peak, remains a significant headwind for economic growth. This sustained inflation, exceeding the Federal Reserve's target rate for an extended period, has a direct impact on consumer spending and overall GDP growth. Historically, such elevated inflation rates haven't been seen since the 1980s.

Several factors contribute to this persistent inflation:

- Increased Post-Pandemic Demand: The reopening of the economy following the COVID-19 pandemic led to a surge in consumer demand, outpacing the ability of supply chains to meet this increased need.

- Supply Chain Disruptions: Global supply chains remain fragile, with ongoing disruptions impacting the availability and cost of goods.

- Energy Price Volatility: Fluctuations in global energy markets, exacerbated by geopolitical events, have significantly impacted inflation across various sectors.

- Government Spending: While the infrastructure plan and stimulus packages aimed to boost the economy, some economists argue that excessive government spending contributed to inflationary pressures.

High inflation erodes purchasing power, forcing consumers to cut back on spending. This reduction in consumer spending directly translates to lower GDP growth, creating a challenging environment for businesses and impacting the overall economic outlook. Analyzing the consumer price index (CPI) and its components provides further insight into the drivers of inflation and its impact on "Joe Biden and the Economy."

Supply Chain Bottlenecks and Their Economic Consequences

Global supply chain disruptions continue to pose a significant challenge to economic recovery. These bottlenecks manifest in various ways:

- Semiconductor Shortages: The global chip shortage has hampered the production of automobiles, electronics, and other goods reliant on semiconductors.

- Port Congestion: Overcrowded ports and logistical delays have led to increased shipping costs and reduced efficiency in goods transportation.

- Labor Shortages: A shortage of workers in key sectors has further constrained production and contributed to supply chain bottlenecks.

These disruptions have ripple effects throughout the economy. Reduced manufacturing output, increased costs of goods, and decreased availability of consumer goods all contribute to slower economic growth. While the Biden administration has implemented measures to address these issues, such as investing in infrastructure and promoting domestic manufacturing, the full impact of these efforts is yet to be seen. The effectiveness of these policies in alleviating supply chain pressures remains a key area of debate in discussions on "Joe Biden and the Economy."

The Role of Geopolitical Factors in Economic Slowdown

Geopolitical instability significantly impacts the US economy. The war in Ukraine, for example, has led to:

- Increased Energy Prices: Disruptions to global energy markets have resulted in higher energy costs for consumers and businesses.

- Commodity Market Volatility: The conflict has created uncertainty in global commodity markets, affecting the prices of various goods.

- Reduced Investor Confidence: Geopolitical risks often lead to reduced investor confidence, impacting investment decisions and economic growth.

These external shocks create uncertainty and instability, hindering economic growth and further complicating the economic picture. Understanding the intricate links between global events and domestic economic performance is crucial when assessing "Joe Biden and the Economy."

Government Policies and Their Effect on Economic Growth

The Biden administration has implemented various policies aimed at stimulating economic growth, including:

- American Rescue Plan: This massive stimulus package aimed to provide relief to individuals and businesses impacted by the pandemic.

- Infrastructure Investment and Jobs Act: This plan focuses on investing in infrastructure projects across the nation.

- Social Spending Initiatives: These initiatives aim to expand social safety nets and address social inequalities.

While these policies offer potential benefits, such as improved infrastructure and increased social support, their effectiveness in driving sustained economic growth is subject to ongoing debate. Some economists argue that these policies have contributed to inflationary pressures, while others believe they are necessary to address long-term economic challenges. A comprehensive analysis of the "fiscal policy" and "monetary policy" implemented during the Biden administration is essential for evaluating their impact on economic growth.

Conclusion: Understanding the Biden Administration's Economic Performance

The slower-than-expected economic growth under President Biden is a result of a complex interplay of factors. Inflation, supply chain disruptions, geopolitical instability, and government policies are all interconnected and contribute to the current economic climate. It's crucial to maintain a balanced perspective, acknowledging both the challenges and potential positive developments. While the current economic climate presents significant headwinds, understanding these factors is essential for informed discussions about "Joe Biden and the Economy." Further research into the long-term effects of these policies and global events is necessary. We encourage you to engage in informed discussions and explore resources to deepen your understanding of this complex issue.

Featured Posts

-

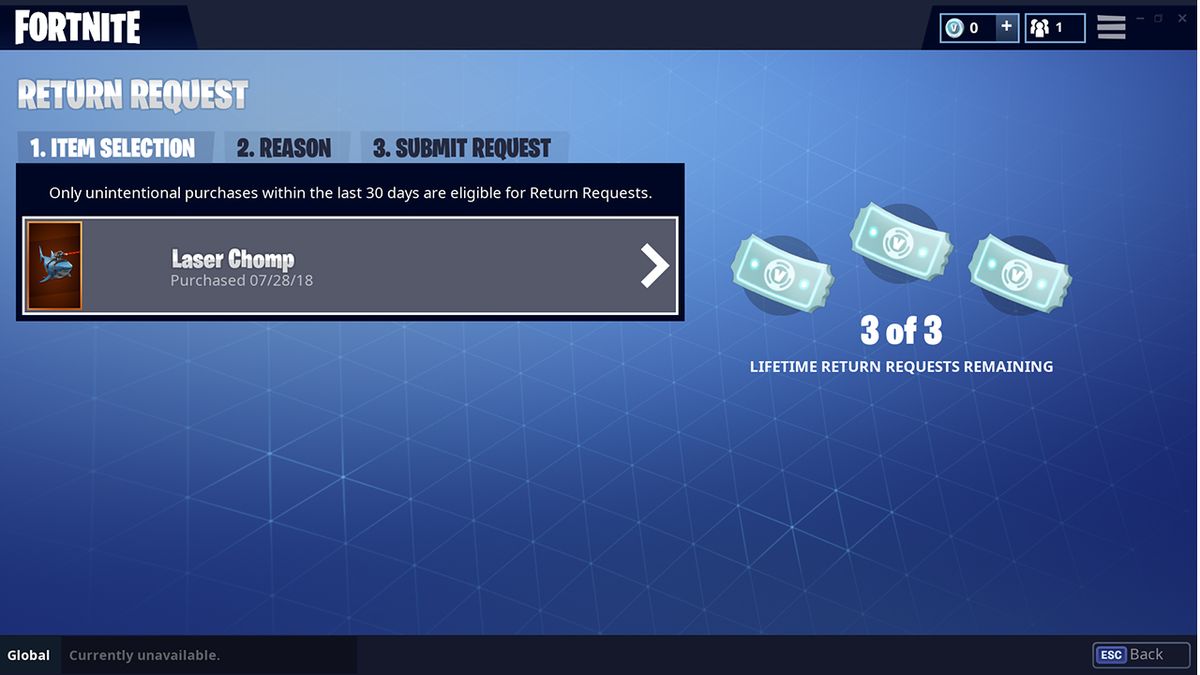

Fortnite Refund Signals Potential Cosmetic Changes

May 03, 2025

Fortnite Refund Signals Potential Cosmetic Changes

May 03, 2025 -

Addressing The Play Station Christmas Voucher Glitch Free Credit For Users

May 03, 2025

Addressing The Play Station Christmas Voucher Glitch Free Credit For Users

May 03, 2025 -

Tesla Rejects Reports Of Elon Musks Impending Dismissal

May 03, 2025

Tesla Rejects Reports Of Elon Musks Impending Dismissal

May 03, 2025 -

Harry Potter Shop Chicago Location Hours And Must See Items

May 03, 2025

Harry Potter Shop Chicago Location Hours And Must See Items

May 03, 2025 -

Two Stars Drop Out Bbcs Celebrity Traitors Hit By Departures

May 03, 2025

Two Stars Drop Out Bbcs Celebrity Traitors Hit By Departures

May 03, 2025

Latest Posts

-

Navigating The Turbulence Airlines Struggle Amidst Oil Supply Shocks

May 04, 2025

Navigating The Turbulence Airlines Struggle Amidst Oil Supply Shocks

May 04, 2025 -

Oil Price Volatility And Its Consequences For Airline Operations

May 04, 2025

Oil Price Volatility And Its Consequences For Airline Operations

May 04, 2025 -

Soaring Fuel Costs The Oil Shocks Devastating Effect On Airlines

May 04, 2025

Soaring Fuel Costs The Oil Shocks Devastating Effect On Airlines

May 04, 2025 -

Airline Industry Faces Headwinds The Impact Of Oil Supply Disruptions

May 04, 2025

Airline Industry Faces Headwinds The Impact Of Oil Supply Disruptions

May 04, 2025 -

Oil Supply Shocks How The Airline Industry Is Feeling The Pinch

May 04, 2025

Oil Supply Shocks How The Airline Industry Is Feeling The Pinch

May 04, 2025