Lack Of Funds: Overcoming Financial Barriers

Table of Contents

Creating a Realistic Budget to Manage Lack of Funds

Effective budgeting is the cornerstone of managing lack of funds. It provides a clear picture of your income and expenses, enabling you to make informed financial decisions.

Tracking Your Spending

Meticulously tracking your income and expenses is crucial. Use budgeting apps like Mint, YNAB (You Need A Budget), or Personal Capital, or create a simple spreadsheet. Categorize your spending into needs (housing, food, transportation, utilities) and wants (entertainment, dining out, subscriptions). This clear categorization helps you identify areas for potential savings.

Identifying Areas for Reduction

Once you've tracked your spending, analyze your categories to identify areas where you can cut back. Consider these strategies:

- Reduce entertainment spending: Limit dining out, explore free or low-cost activities.

- Cancel unused subscriptions: Review your subscriptions (streaming services, gym memberships, etc.) and cancel any you don't regularly use.

- Find cheaper alternatives: Explore budget-friendly grocery options, switch to a less expensive mobile phone plan, or negotiate lower rates for utilities.

- Embrace zero-based budgeting: This method requires you to allocate every dollar of your income to a specific expense category, leaving no money unaccounted for.

Prioritizing Essential Expenses

Prioritize allocating funds to essential needs first. If you're facing a lack of funds, ensure you have enough money for housing, food, transportation, and healthcare before allocating funds to non-essential expenses. Consider negotiating lower bills with service providers or finding cheaper alternatives for essential services.

Developing Smart Saving Strategies When Funds Are Tight

Even when dealing with a lack of funds, building a savings cushion is vital. Start small and gradually increase your savings.

Setting Realistic Savings Goals

Set achievable savings targets. Focus on building an emergency fund first—ideally, 3-6 months' worth of essential living expenses. Small, consistent savings are better than sporadic large amounts.

Utilizing High-Yield Savings Accounts

Maximize your returns by using high-yield savings accounts or money market accounts. These accounts typically offer higher interest rates than traditional savings accounts.

Exploring Micro-Saving Techniques

Consider these micro-saving strategies:

- Round-up apps: These apps automatically round up your purchases to the nearest dollar and transfer the difference to your savings account.

- Automatic transfers: Set up automatic transfers from your checking account to your savings account on a regular basis.

- Saving small amounts regularly: Even saving a small amount each day or week can add up over time.

Seeking Financial Assistance and Support for Lack of Funds

If you're struggling with a lack of funds, don't hesitate to seek assistance. Numerous resources are available to help.

Exploring Government Assistance Programs

Many government programs provide financial assistance to those in need. Research programs like food stamps (SNAP), unemployment benefits, housing assistance (Section 8), and Medicaid. Check eligibility requirements on the relevant government websites.

Utilizing Non-Profit Organizations

Numerous non-profit organizations offer financial assistance and support. Local charities, food banks, and credit counseling agencies can provide valuable resources and guidance.

Seeking Professional Financial Advice

Consider consulting with a credit counselor or financial advisor, especially if you're dealing with significant debt. They can help you create a debt management plan and develop a long-term financial strategy to overcome your lack of funds.

Long-Term Strategies to Avoid Future Lack of Funds

Preventing future financial hardship requires proactive long-term planning.

Increasing Income Streams

Explore ways to increase your income:

- Freelancing: Offer your skills or services on freelancing platforms.

- Part-time jobs: Take on a part-time job to supplement your income.

- Selling unused items: Declutter your home and sell unused items online or at consignment shops.

Investing Wisely for Financial Growth

Once you've built an emergency fund, consider investing a portion of your savings for long-term growth. Start with low-risk investment options like index funds or ETFs before exploring more complex investments.

Building Good Credit for Future Opportunities

Maintaining a good credit score is crucial for accessing loans, credit cards, and other financial products in the future. Pay your bills on time, keep your credit utilization low, and monitor your credit report regularly.

Taking Control of Your Finances and Overcoming Lack of Funds

Overcoming a lack of funds requires a multifaceted approach. By diligently budgeting, saving strategically, seeking assistance when needed, and planning for the long term, you can significantly improve your financial situation. Remember, conquering financial hardship is possible. Start taking control of your finances today and begin overcoming your lack of funds by implementing the strategies outlined above!

Featured Posts

-

Obstacles To Clean Energy Adoption Despite Market Success

May 21, 2025

Obstacles To Clean Energy Adoption Despite Market Success

May 21, 2025 -

Tigers 8 Rockies 6 Defying Expectations

May 21, 2025

Tigers 8 Rockies 6 Defying Expectations

May 21, 2025 -

Antiques Roadshow Appearance Leads To Us Couples Arrest In Britain

May 21, 2025

Antiques Roadshow Appearance Leads To Us Couples Arrest In Britain

May 21, 2025 -

Saskatchewan And Western Separation A Political Panel Analysis

May 21, 2025

Saskatchewan And Western Separation A Political Panel Analysis

May 21, 2025 -

Is Lack Of Funds Holding You Back Practical Strategies For Success

May 21, 2025

Is Lack Of Funds Holding You Back Practical Strategies For Success

May 21, 2025

Latest Posts

-

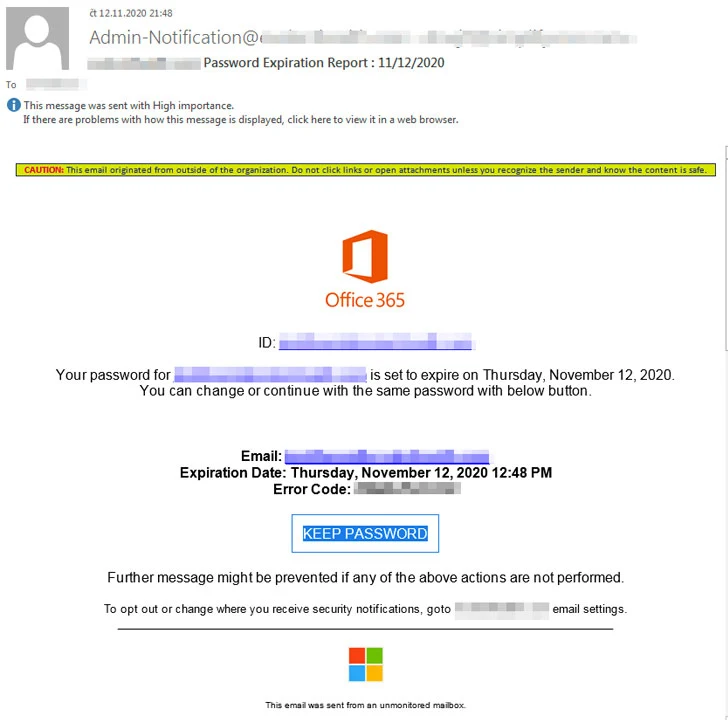

Hacker Makes Millions Targeting Executive Office365 Accounts

May 21, 2025

Hacker Makes Millions Targeting Executive Office365 Accounts

May 21, 2025 -

Unlocking Podcast Potential Ais Role In Transforming Repetitive Documents

May 21, 2025

Unlocking Podcast Potential Ais Role In Transforming Repetitive Documents

May 21, 2025 -

Federal Investigation Millions Stolen Through Compromised Office365 Accounts

May 21, 2025

Federal Investigation Millions Stolen Through Compromised Office365 Accounts

May 21, 2025 -

Pandemic Fraud Lab Owner Convicted Of Falsified Covid Tests

May 21, 2025

Pandemic Fraud Lab Owner Convicted Of Falsified Covid Tests

May 21, 2025 -

Lab Owner Admits To Falsifying Covid Test Results During Pandemic

May 21, 2025

Lab Owner Admits To Falsifying Covid Test Results During Pandemic

May 21, 2025