Is Lack Of Funds Holding You Back? Practical Strategies For Success

Table of Contents

Creating a Realistic Budget: The Foundation of Financial Success

A realistic budget is the cornerstone of financial success. Without understanding where your money goes, achieving financial goals is nearly impossible. This section outlines how to create a budget that works for you.

Tracking Your Spending: Understanding Your Money Flow

The first step to financial freedom is understanding your spending habits. You need to know where your money is actually going.

- Use budgeting apps or spreadsheets: Numerous free and paid apps (Mint, YNAB, Personal Capital) and spreadsheet templates can simplify this process. These tools categorize expenses and provide visual representations of your spending.

- Categorize expenses: Organize your spending into categories such as housing, food, transportation, utilities, entertainment, debt payments, and savings. This detailed breakdown reveals spending patterns.

- Identify areas for potential savings: Once you see your spending visualized, areas for potential savings will become apparent. Are you spending too much on eating out? Can you reduce your entertainment budget?

Setting Financial Goals: Defining Your Financial Future

Setting clear, achievable financial goals is crucial. These goals should be both short-term and long-term, providing a roadmap for your financial journey.

- Prioritize needs versus wants: Differentiate between essential expenses (needs) and discretionary spending (wants). This helps prioritize allocation of funds.

- Break down large goals into smaller, achievable steps: A large goal like buying a house might seem overwhelming. Break it down into smaller, manageable steps: saving a down payment, improving your credit score, researching mortgage options.

- Examples of financial goals: Saving for a down payment, paying off high-interest debt, funding your child's education, investing for retirement, or even planning a dream vacation.

Allocating Your Resources: The 50/30/20 Rule and Beyond

Once you have a clear picture of your income and expenses, it's time to allocate your resources effectively. The popular 50/30/20 rule provides a helpful framework:

- 50% Needs: Allocate 50% of your after-tax income to essential expenses (housing, food, transportation, utilities).

- 30% Wants: 30% goes towards discretionary spending (entertainment, dining out, hobbies).

- 20% Savings & Debt Repayment: Dedicate 20% to savings (including emergency fund) and debt repayment.

Remember, these percentages are guidelines. Adjust them based on your individual circumstances and financial goals. Regularly review and adjust your budget to ensure it remains relevant to your changing needs and priorities.

Smart Saving Strategies: Growing Your Financial Resources

Saving money consistently is crucial for building financial security and achieving your long-term goals. Here are some effective strategies:

Automate Your Savings: Making Saving Effortless

One of the most effective ways to save is to automate the process.

- Set up automatic transfers: Schedule regular automatic transfers from your checking account to your savings account. Even small amounts consistently transferred add up over time.

Explore High-Yield Savings Accounts: Maximizing Your Returns

Don't let your savings stagnate. Explore options that offer higher interest rates.

- High-yield savings accounts: These accounts offer significantly better interest rates than traditional savings accounts, helping your money grow faster.

Emergency Fund Essentials: Building a Financial Safety Net

An emergency fund is crucial to protect yourself from unexpected expenses.

- 3-6 months of living expenses: Aim to save 3-6 months' worth of living expenses in an easily accessible account to cover unexpected job loss, medical emergencies, or car repairs.

Savings Challenges: Boosting Motivation and Accelerating Saving

Savings challenges can provide motivation and structure to your saving goals.

- 52-week challenge: Save a progressively increasing amount each week for a year.

- No-spend challenges: Challenge yourself to reduce or eliminate spending in specific categories for a set period.

Strategic Debt Management: Reducing Financial Burden

High-interest debt can significantly hinder your financial progress. Effective debt management is essential.

Understanding Your Debt: Taking Stock of Your Financial Obligations

Before tackling debt, you need a clear picture of your financial obligations.

- List all debts: Create a list of all your debts (credit cards, loans, student loans, etc.), including interest rates and minimum payments. This provides a comprehensive overview of your debt situation.

Debt Consolidation: Simplifying Repayment

Debt consolidation can simplify repayment and potentially lower interest rates.

- Consolidation loans: Explore options to consolidate multiple high-interest debts into a single loan with a lower interest rate.

Debt Avalanche or Snowball Method: Choosing Your Repayment Strategy

Two popular debt repayment methods are the debt avalanche and snowball methods.

- Debt Avalanche: Pay off the debt with the highest interest rate first, regardless of the balance. This saves you money on interest in the long run.

- Debt Snowball: Pay off the smallest debt first, regardless of the interest rate. This provides early wins and boosts motivation.

Negotiating with Creditors: Exploring Options for Relief

Don't hesitate to contact your creditors to discuss potential options for relief.

- Negotiate lower interest rates or payment plans: Creditors are sometimes willing to work with you to avoid defaults.

Investing for the Future: Building Long-Term Wealth

Investing is a key component of long-term financial success. It allows your money to grow over time, potentially outpacing inflation.

Understanding Investment Options: Exploring Different Investment Vehicles

The investment world offers a wide variety of options. It's important to understand the risks and potential rewards of each.

- Stocks: Represent ownership in a company.

- Bonds: Loans to companies or governments.

- Mutual funds: Pools of money invested in a diversified portfolio of stocks or bonds.

- ETFs (Exchange-Traded Funds): Similar to mutual funds but traded on exchanges like stocks.

Diversification: Spreading Your Risk

Diversification is crucial to mitigate risk. Don't put all your eggs in one basket.

- Spread your investments: Invest across different asset classes (stocks, bonds, real estate) and sectors to reduce the impact of any single investment's underperformance.

Long-Term Investing: Focusing on Growth

Investing is a long-term game. Don't panic sell during market downturns.

- Stay the course: Focus on long-term growth rather than short-term fluctuations.

Seeking Professional Advice: Getting Personalized Guidance

Consider seeking professional advice from a qualified financial advisor.

- Financial advisor: A financial advisor can help you create a personalized investment strategy tailored to your goals, risk tolerance, and time horizon.

Conclusion

Overcoming financial challenges and achieving financial success requires planning, discipline, and a proactive approach. By implementing these strategies—creating a realistic budget, saving strategically, managing debt effectively, and investing wisely—you can take control of your finances and build a brighter financial future. Don't let a lack of funds hold you back any longer. Start taking action today, and watch your financial well-being flourish. Remember, even small steps toward better financial management can lead to significant long-term improvements. Start planning your financial success today!

Featured Posts

-

Unexpected Guest Interruption On Bbc Breakfast Presenter Asks Are You Still There

May 21, 2025

Unexpected Guest Interruption On Bbc Breakfast Presenter Asks Are You Still There

May 21, 2025 -

Voyage Architectural La Petite Italie De L Ouest Et Son Style Toscan

May 21, 2025

Voyage Architectural La Petite Italie De L Ouest Et Son Style Toscan

May 21, 2025 -

Get Ready For Spring Streaming On Teletoon Jellystone Pinata Smashling And More

May 21, 2025

Get Ready For Spring Streaming On Teletoon Jellystone Pinata Smashling And More

May 21, 2025 -

Federal Election Fallout Analyzing Its Impact On Saskatchewan Politics

May 21, 2025

Federal Election Fallout Analyzing Its Impact On Saskatchewan Politics

May 21, 2025 -

Wrigley Field Witness To Adorable Lady And The Tramp Hot Dog Recreation By Cubs Fans

May 21, 2025

Wrigley Field Witness To Adorable Lady And The Tramp Hot Dog Recreation By Cubs Fans

May 21, 2025

Latest Posts

-

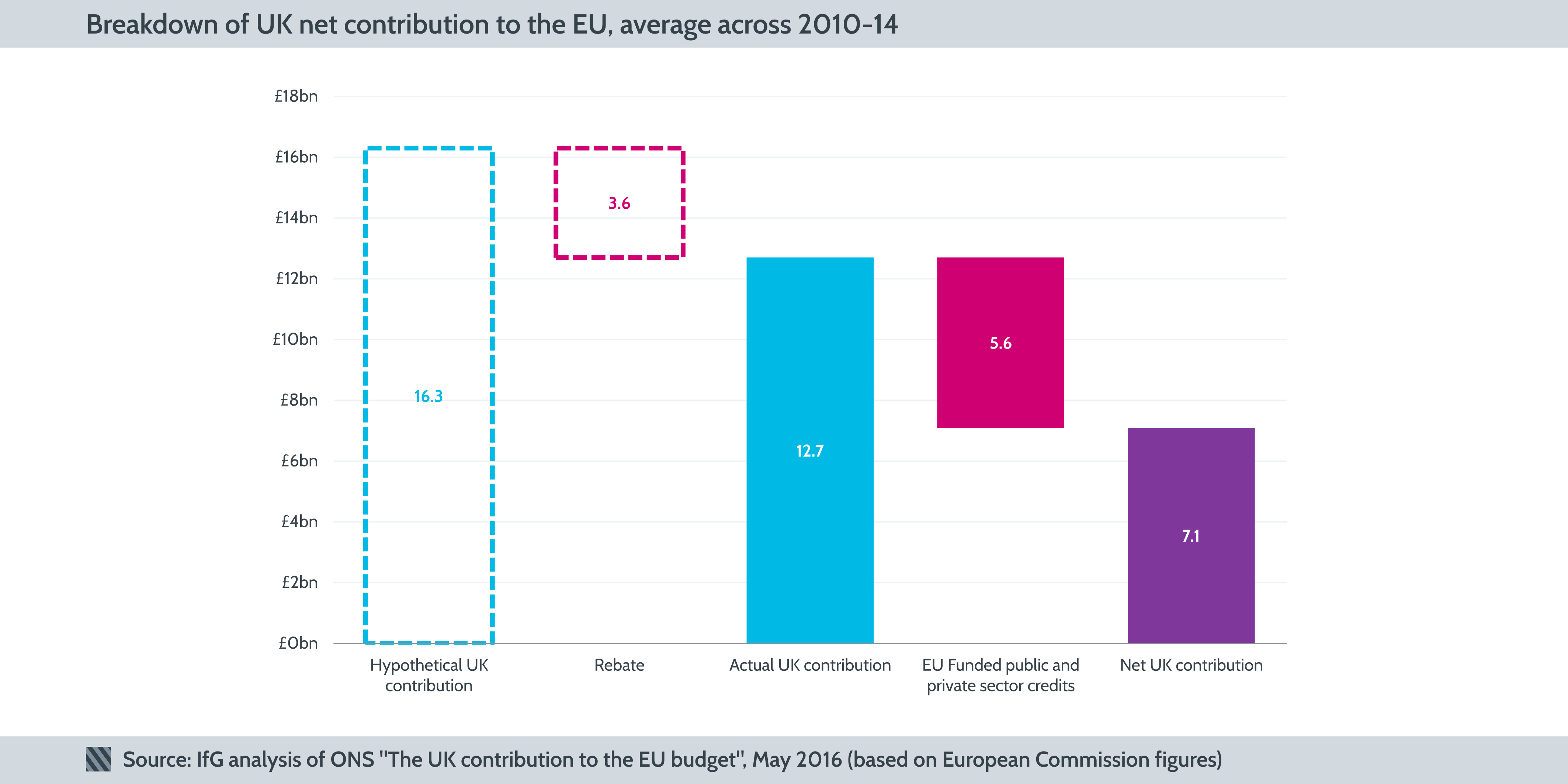

Brexits Toll Uk Luxury Exports Struggle In The Eu Market

May 21, 2025

Brexits Toll Uk Luxury Exports Struggle In The Eu Market

May 21, 2025 -

Are Bmw And Porsche Losing Their Grip On The Chinese Market

May 21, 2025

Are Bmw And Porsche Losing Their Grip On The Chinese Market

May 21, 2025 -

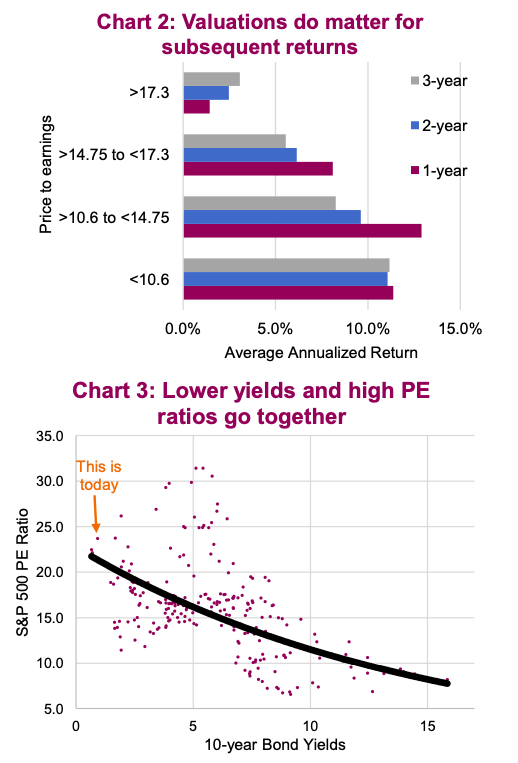

Understanding High Stock Market Valuations Bof As Take And Investor Implications

May 21, 2025

Understanding High Stock Market Valuations Bof As Take And Investor Implications

May 21, 2025 -

Uk Luxury Sector Brexits Contribution To Export Lag In The Eu

May 21, 2025

Uk Luxury Sector Brexits Contribution To Export Lag In The Eu

May 21, 2025 -

The China Factor Why Bmw And Porsche Are Facing Headwinds

May 21, 2025

The China Factor Why Bmw And Porsche Are Facing Headwinds

May 21, 2025