Live Now, Pay Later: Your Guide To Smart Spending

Table of Contents

Understanding Buy Now, Pay Later (BNPL) Services

Buy now pay later services offer a flexible way to pay for goods and services, typically splitting the cost into installments over a short period, usually a few weeks or months. Several types of BNPL services exist:

- Point-of-sale financing: This is the most common type, offered directly at the checkout of online or brick-and-mortar stores. Examples include services like Klarna, Afterpay, and Affirm.

- Installment loans: These are similar but often involve a longer repayment period and may have a fixed interest rate. They can be obtained through lenders or directly from retailers for larger purchases.

Advantages of BNPL:

- Immediate gratification: Access goods and services immediately without paying the full price upfront.

- Budgeting flexibility: Spreading payments makes larger purchases more manageable within your monthly budget.

- Potential for building credit: Responsible use of BNPL, with on-time payments, can positively impact your credit score (check provider policies, as not all report to credit bureaus).

Disadvantages of BNPL:

-

High interest rates: Missing payments can lead to significantly high interest charges, quickly escalating your debt.

-

Potential for debt accumulation: Easy access to credit can encourage overspending if not managed carefully, leading to debt accumulation.

-

Impact on credit score: Late or missed payments negatively affect your credit score, potentially making it harder to obtain loans or credit cards in the future.

-

Compare interest rates and fees: Different providers have varying fees and interest rates. Compare before choosing a service.

-

Discuss the implications of late payments and missed payments: Late payments incur fees and can damage your credit score.

-

Explain the potential impact on your credit report: Many BNPL providers report payment history to credit bureaus, influencing your credit score.

Budgeting and Financial Planning with BNPL

Before using any BNPL service, a solid budget is essential. This prevents overspending and ensures you can comfortably afford the repayments.

-

Incorporate BNPL payments into your monthly budget: Treat BNPL payments like any other bill, allocating a specific amount each month.

-

Track spending and payments effectively: Use budgeting apps (Mint, YNAB), spreadsheets, or even a notebook to monitor your spending and ensure you stay on track with repayments.

-

Use budgeting apps or spreadsheets to monitor expenses: These tools provide a clear overview of your income and expenses.

-

Set realistic payment plans: Choose repayment plans that align with your financial capacity, avoiding stretching yourself too thin.

-

Prioritize essential expenses over non-essential purchases using BNPL: Use BNPL judiciously for necessary items, avoiding impulse buys.

Responsible Use of Buy Now Pay Later

Responsible BNPL usage is paramount to avoid financial hardship.

-

Only use BNPL for necessary purchases: Avoid impulse buys; only use it for essential items or purchases you can comfortably afford.

-

Set up automatic payments: Automate your payments to avoid late fees and ensure timely repayments.

-

Pay off the balance in full and on time: Paying the full balance by the due date is crucial for avoiding interest charges and protecting your credit score.

-

Avoid impulse purchases fueled by the convenience of BNPL: Don't let the ease of BNPL lead to irresponsible spending.

-

Consider alternative payment methods: If you struggle with repayments, consider alternative payment options like saving up or using a credit card with a manageable credit limit.

-

Explore credit counseling resources: If you're facing financial difficulties, seek professional help from a credit counseling agency.

Protecting Your Credit Score with BNPL

While responsible BNPL usage can potentially boost your credit score, misuse can have detrimental effects.

-

How BNPL usage can affect your credit score: On-time payments improve your credit history, while late payments negatively impact it.

-

Maintain a good credit score while using BNPL: Careful planning, prompt payments, and low credit utilization are key.

-

Regularly check your credit report: Monitor your credit report for any errors or inaccuracies.

-

Maintain a low credit utilization ratio: Avoid maxing out your BNPL credit limits.

-

Pay off your BNPL balances promptly and consistently: This is the most important aspect of maintaining a good credit score while using BNPL.

Conclusion

"Live now, pay later" services can be beneficial tools for managing expenses, but only when used responsibly. By understanding the advantages and disadvantages, creating a solid budget, and practicing disciplined spending habits, you can leverage BNPL to your advantage without jeopardizing your financial health. Remember, smart spending is key to avoiding debt and maintaining a strong credit score.

Call to Action: Ready to master the art of smart spending with "live now, pay later" services? Start by creating a detailed budget today and choose your BNPL provider wisely! Learn more about responsible buy now pay later strategies and take control of your finances.

Featured Posts

-

Plummeting Home Sales Signal Housing Market Crisis

May 30, 2025

Plummeting Home Sales Signal Housing Market Crisis

May 30, 2025 -

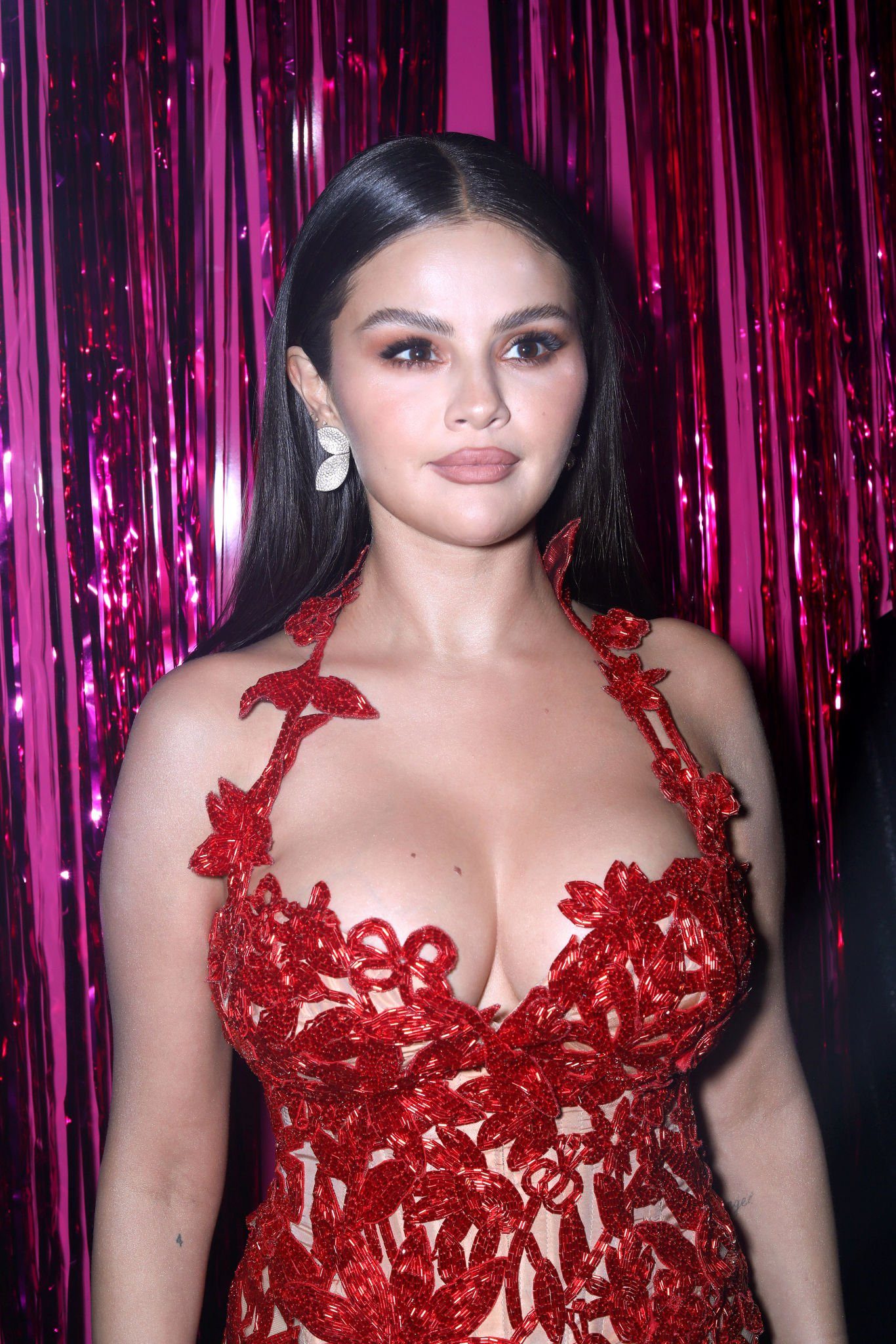

Selena Gomezs Pre Release Top 10 Hit A Chart Anomaly

May 30, 2025

Selena Gomezs Pre Release Top 10 Hit A Chart Anomaly

May 30, 2025 -

Mealm Alastqlal Mhtat Tarykhyt Farqt

May 30, 2025

Mealm Alastqlal Mhtat Tarykhyt Farqt

May 30, 2025 -

2024 G Rekordni Goreschini Za Nad Polovinata Ot Sveta

May 30, 2025

2024 G Rekordni Goreschini Za Nad Polovinata Ot Sveta

May 30, 2025 -

Real Estate Market Crash Home Sales Plummet To Crisis Levels

May 30, 2025

Real Estate Market Crash Home Sales Plummet To Crisis Levels

May 30, 2025

Latest Posts

-

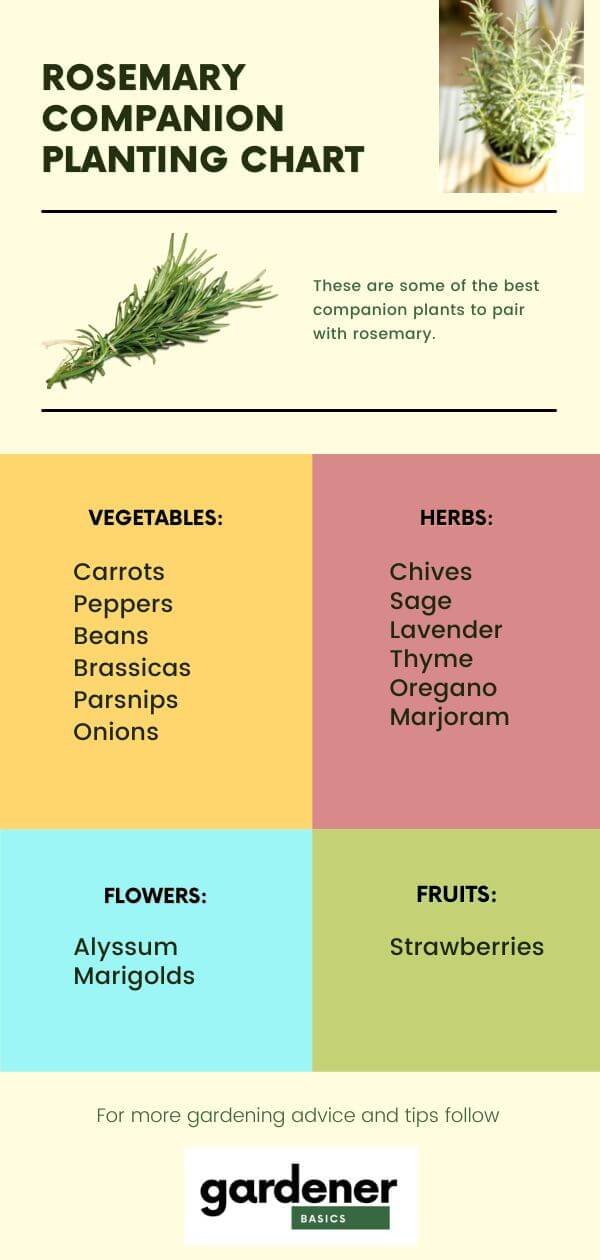

Exploring The Culinary World Of Rosemary And Thyme

May 31, 2025

Exploring The Culinary World Of Rosemary And Thyme

May 31, 2025 -

Rosemary And Thyme History Uses And Cultivation

May 31, 2025

Rosemary And Thyme History Uses And Cultivation

May 31, 2025 -

Simple Recipes With Rosemary And Thyme Easy And Delicious Meals

May 31, 2025

Simple Recipes With Rosemary And Thyme Easy And Delicious Meals

May 31, 2025 -

Creating The Good Life A Journey Of Self Discovery

May 31, 2025

Creating The Good Life A Journey Of Self Discovery

May 31, 2025 -

Rosemary And Thyme Companion Planting For A Thriving Garden

May 31, 2025

Rosemary And Thyme Companion Planting For A Thriving Garden

May 31, 2025