Net Asset Value (NAV) Fluctuations: Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

Factors Influencing NAV Fluctuations in the Amundi MSCI World II UCITS ETF USD Hedged Dist

Several key factors contribute to the fluctuations observed in the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist. Understanding these factors is vital for any investor considering this ETF.

Underlying Asset Performance

The primary driver of NAV fluctuations is the performance of the underlying assets. The Amundi MSCI World II UCITS ETF USD Hedged Dist tracks the MSCI World Index, a broad market-capitalization weighted index of global equities. Therefore, the ETF's NAV directly reflects the collective performance of these global equities.

- Economic Growth: Strong global economic growth typically leads to higher company profits and increased stock prices, positively impacting the ETF's NAV. Conversely, economic slowdowns or recessions can negatively affect the NAV.

- Interest Rates: Changes in interest rates influence borrowing costs for companies and investor sentiment towards equities. Rising interest rates can make bonds more attractive, potentially leading to lower equity prices and a decrease in the ETF's NAV.

- Geopolitical Events: Major geopolitical events, such as wars or political instability, can create market uncertainty and volatility, significantly impacting the NAV of the ETF.

- Industry Trends: Performance within specific sectors or industries can also affect the overall NAV. For example, strong performance in the technology sector will positively impact the NAV if the MSCI World Index has a significant technology weighting.

- MSCI World Index Composition: The MSCI World Index's composition, including its weighting of different countries and sectors, directly influences the ETF's holdings and thus its sensitivity to various market factors. Changes to the index's composition will be reflected in the ETF's NAV.

Currency Hedging Impact

The Amundi MSCI World II UCITS ETF USD Hedged Dist employs a USD hedging strategy to mitigate currency risk. This means the ETF aims to reduce the impact of fluctuations between the USD and other currencies on the value of its underlying assets. However, perfect hedging is impossible.

- Exchange Rate Fluctuations: Even with hedging, residual currency risk remains. Unexpected movements in exchange rates can still subtly influence the NAV. For example, if the Euro strengthens significantly against the USD, the hedging strategy might not fully offset the impact on the ETF's holdings denominated in Euros.

- Hedging Strategy Mechanics: The specific hedging techniques used by the ETF manager influence the effectiveness of the hedging. Understanding the nuances of their strategy is crucial for assessing the level of currency risk exposure.

- Cost of Hedging: The process of hedging itself involves costs which, while usually small, can have a slight negative impact on NAV.

Expense Ratio and Management Fees

The ETF's expense ratio, encompassing management fees and other operational costs, gradually diminishes the NAV over time.

- Impact on Returns: A higher expense ratio reduces the overall return an investor receives. While seemingly minor, these fees compound over time, significantly impacting long-term NAV growth.

- Comparison with Competitors: Comparing the expense ratio of the Amundi MSCI World II UCITS ETF USD Hedged Dist with similar ETFs is essential for evaluating its cost-effectiveness.

Supply and Demand

The market price of the ETF, while usually closely tracking the NAV, can be influenced by supply and demand dynamics.

- Trading Volume: High trading volume generally suggests a more efficient market with tighter price spreads, minimizing discrepancies between market price and NAV.

- Investor Demand: Increased investor demand can push the market price above the NAV, creating a premium. Conversely, decreased demand can lead to a discount.

- Arbitrage Opportunities: Market inefficiencies might create arbitrage opportunities, where sophisticated investors buy or sell the ETF to profit from discrepancies between the market price and the NAV. This activity helps to maintain alignment between the two.

Conclusion: Monitoring NAV Fluctuations in the Amundi MSCI World II UCITS ETF USD Hedged Dist

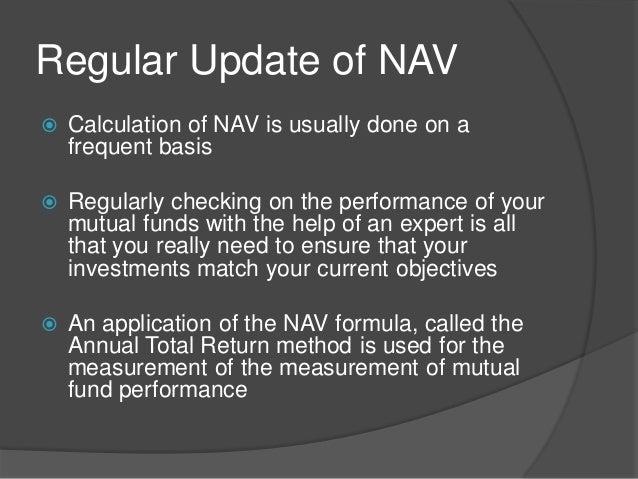

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is influenced by a complex interplay of factors, including the performance of global equities, currency fluctuations despite hedging, expense ratios, and market supply and demand. Understanding these factors is crucial for making informed investment decisions. Regularly monitoring the ETF's NAV and its underlying assets, along with understanding its expense ratio and the performance of comparable ETFs, is vital. You can find resources for monitoring NAV and ETF performance on the Amundi website and through various financial news sources. Before investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist or any other ETF, thoroughly research its investment strategy and consider seeking professional financial advice tailored to your individual circumstances and risk tolerance. Remember to monitor your Amundi MSCI World II UCITS ETF USD Hedged Dist NAV regularly to make the most informed investment decisions.

Featured Posts

-

A Smooth Escape To The Country Tips For A Stress Free Relocation

May 24, 2025

A Smooth Escape To The Country Tips For A Stress Free Relocation

May 24, 2025 -

Zuffenhausen Jerman Mengenal Sejarah Produksi Porsche 356

May 24, 2025

Zuffenhausen Jerman Mengenal Sejarah Produksi Porsche 356

May 24, 2025 -

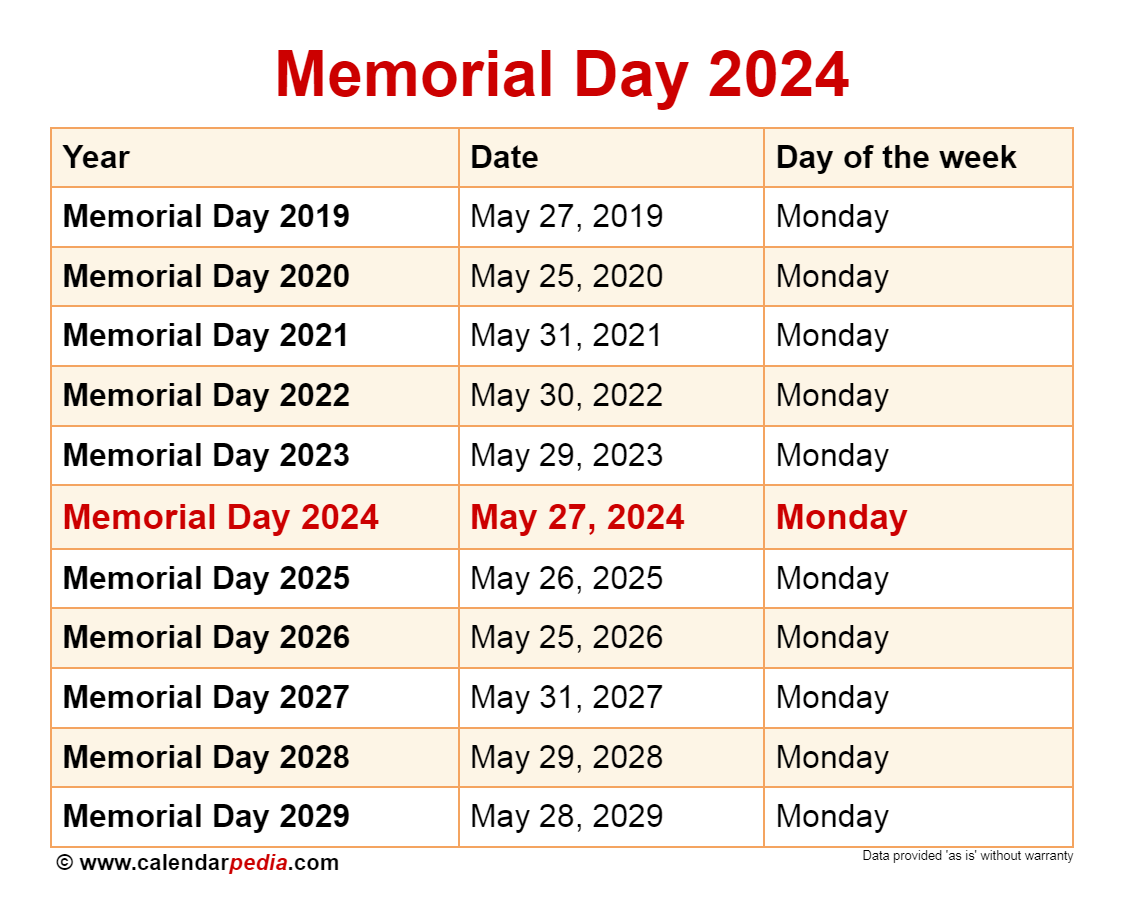

Flying During Memorial Day 2025 When To Book And When To Avoid

May 24, 2025

Flying During Memorial Day 2025 When To Book And When To Avoid

May 24, 2025 -

Avrupa Borsalarinda Karisik Seyir Kazanclar Ve Kayiplar

May 24, 2025

Avrupa Borsalarinda Karisik Seyir Kazanclar Ve Kayiplar

May 24, 2025 -

West Hams Pursuit Of Kyle Walker Peters Transfer Speculation And Facts

May 24, 2025

West Hams Pursuit Of Kyle Walker Peters Transfer Speculation And Facts

May 24, 2025

Latest Posts

-

The Amundi Dow Jones Industrial Average Ucits Etf A Guide To Its Nav

May 24, 2025

The Amundi Dow Jones Industrial Average Ucits Etf A Guide To Its Nav

May 24, 2025 -

How To Interpret The Net Asset Value Of The Amundi Djia Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Of The Amundi Djia Ucits Etf

May 24, 2025 -

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Analysis

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Analysis

May 24, 2025