Retail Sales Surge: Is A Bank Of Canada Rate Cut Off The Table?

Table of Contents

The Unexpected Retail Sales Boom

Recent retail sales figures have shocked many economists, showcasing a significant increase in consumer spending. This unexpected boom raises questions about the overall health of the Canadian economy and the Bank of Canada's upcoming interest rate decisions. The robust performance challenges the narrative of a slowing economy and necessitates a closer examination of the contributing factors.

- Specific data points: Statistics Canada reported a [insert actual percentage]% month-over-month increase in retail sales for [insert month, year], exceeding analyst expectations of [insert expected percentage]%. Year-over-year growth reached [insert percentage]%.

- Strong growth sectors: The automotive sector experienced particularly strong growth, alongside furniture and home improvement sales, suggesting continued consumer confidence in certain areas.

- Data Source: These figures are sourced directly from Statistics Canada's monthly retail trade report.

Several factors could be driving this growth. Pent-up demand from the pandemic lockdowns might still be playing a role. Government stimulus programs, while largely phased out, may have lingering effects on consumer spending. Easing inflation, though still elevated, might be boosting consumer confidence, allowing for increased discretionary spending. However, it's crucial to acknowledge potential caveats. The data may not fully capture the impact of rising interest rates on consumer behaviour, with the full effects potentially lagging.

Inflation's Persistent Grip

Despite the robust retail sales figures, inflation remains a significant concern for the Bank of Canada. The BoC's primary mandate is to control inflation and maintain price stability. The current inflation rate and its trajectory will heavily influence their decision regarding interest rates.

- Current Inflation Rate: The current inflation rate in Canada sits at [insert current inflation rate]%, significantly above the BoC's target of [insert BoC inflation target]%.

- Core Inflation: Core inflation, which excludes volatile components like food and energy, remains stubbornly high at [insert core inflation rate]%, indicating persistent inflationary pressures.

- BoC's Inflation Target: The BoC aims to maintain inflation at an average of 2% over the medium term.

Persistent inflation necessitates a cautious approach from the BoC. Even with strong retail sales, the central bank might prioritize controlling inflation over stimulating further economic growth. This could involve maintaining current interest rates or even considering further rate hikes, despite the potential negative impact on consumer spending and economic growth. The trade-off between economic growth and inflation control is a complex one that the BoC must carefully navigate.

The BoC's Tightrope Walk

The Bank of Canada faces a significant challenge: balancing economic growth with inflation control. The strong retail sales data complicates their decision-making process, creating uncertainty regarding the next steps in monetary policy. A rate cut, while potentially stimulating economic activity, could exacerbate inflation. Maintaining current rates risks slowing the economy, while further rate hikes could trigger a recession.

- Possible Scenarios: The BoC could choose to cut interest rates, hold them steady, or even implement a further rate hike.

- Impact of Each Scenario: A rate cut could boost consumer spending and business investment but potentially fuel inflation. Maintaining rates could lead to a slowdown in economic activity but stabilize inflation. Further rate hikes could curb inflation but also risk a recession.

- BoC Communication: The BoC’s recent communication indicates a data-dependent approach, suggesting they will closely monitor various economic indicators before making a decision.

The BoC is closely monitoring key economic indicators such as employment data, housing market performance, and consumer confidence. Predicting economic outcomes with certainty is impossible, and the BoC’s decisions are based on complex models and projections that carry inherent uncertainty. The potential for unforeseen consequences adds another layer of complexity to their decision-making process.

The Housing Market Factor

The Canadian housing market is intricately linked to interest rates and plays a significant role in the overall economic picture. The BoC must consider the housing sector's sensitivity to interest rate changes when formulating monetary policy.

- Current State of the Housing Market: The Canadian housing market is currently [insert description of current market conditions - e.g., cooling down, showing signs of recovery etc.].

- Impact of Interest Rates: Interest rate increases typically cool down the housing market by reducing affordability and decreasing buyer demand. Conversely, interest rate cuts could stimulate the market, potentially driving up prices.

- Implications for the BoC: The BoC's decision on interest rates could significantly impact housing prices and affordability, creating further complexities in their decision-making process.

The interconnectedness of the housing market with other sectors makes it a crucial factor for the BoC. A sudden downturn in the housing market could have broader economic ramifications, impacting consumer confidence and overall economic growth. Therefore, the BoC carefully considers the potential spillover effects of interest rate changes on the housing sector.

Conclusion

The recent surge in retail sales presents a complex dilemma for the Bank of Canada. While strong consumer spending signals economic resilience, persistent inflation complicates the decision on whether to cut interest rates. The BoC must carefully weigh the potential benefits of stimulating growth against the risks of fueling further inflation. The coming months will be crucial in observing the interplay between these economic forces and how they impact the BoC's future monetary policy decisions. Stay informed about the latest developments on Canadian retail sales and the Bank of Canada's response by regularly checking our website for updates on the ongoing retail sales surge and its influence on interest rate decisions. Understanding the factors affecting the Bank of Canada's rate decisions is crucial for informed financial planning, so continue to monitor this crucial economic indicator.

Featured Posts

-

Coriolanus Snow Casting News Ralph Fiennes Considered Kiefer Sutherland A Fan Favorite

May 26, 2025

Coriolanus Snow Casting News Ralph Fiennes Considered Kiefer Sutherland A Fan Favorite

May 26, 2025 -

Pogacars Near Miss Van Der Poel Triumphs Again At Tour Of Flanders

May 26, 2025

Pogacars Near Miss Van Der Poel Triumphs Again At Tour Of Flanders

May 26, 2025 -

Is Elon Musks Anger Good For Tesla Stock

May 26, 2025

Is Elon Musks Anger Good For Tesla Stock

May 26, 2025 -

Addressing The Threat Of Fascism Delaware Governors Response To The Political Climate

May 26, 2025

Addressing The Threat Of Fascism Delaware Governors Response To The Political Climate

May 26, 2025 -

Governors Warning Identifying And Confronting Fascism In The United States

May 26, 2025

Governors Warning Identifying And Confronting Fascism In The United States

May 26, 2025

Latest Posts

-

Top 5 Smartphones Avec Une Batterie Longue Duree Autonomie Toute La Journee

May 28, 2025

Top 5 Smartphones Avec Une Batterie Longue Duree Autonomie Toute La Journee

May 28, 2025 -

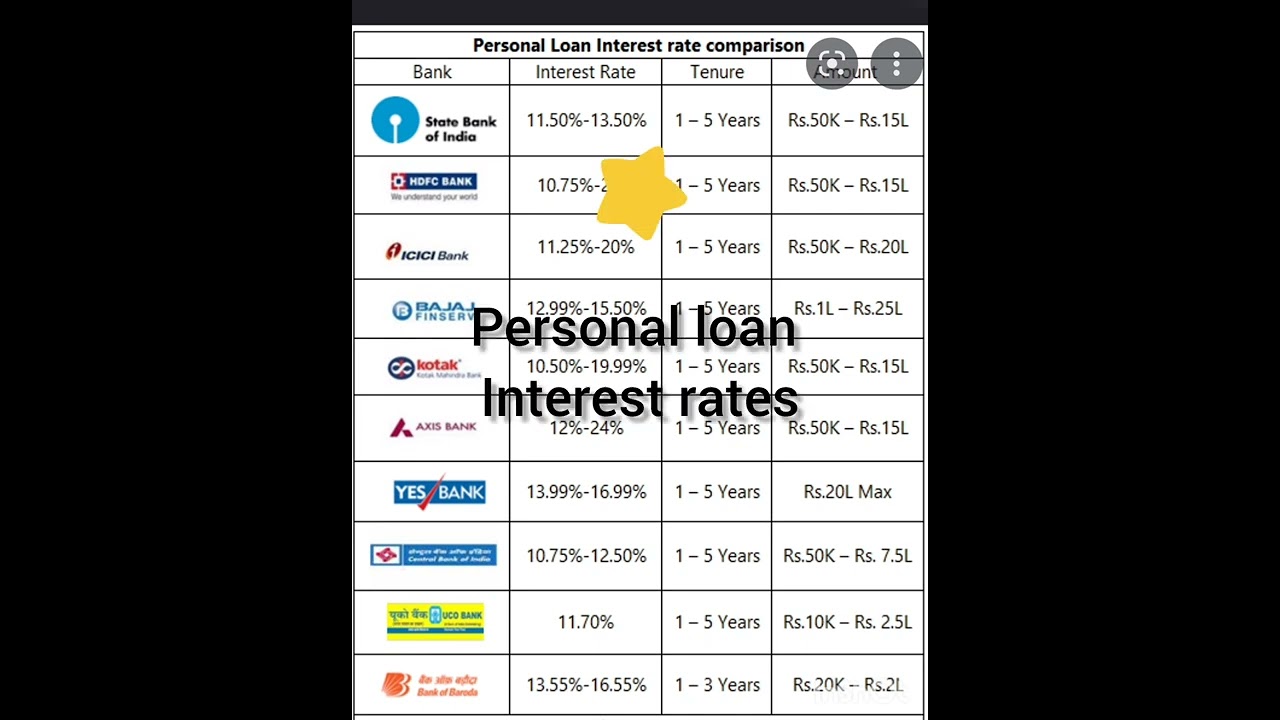

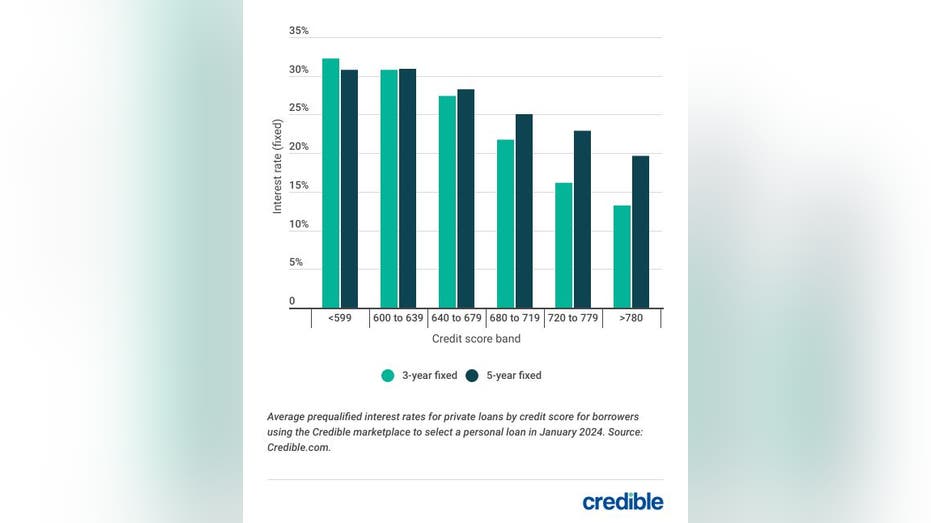

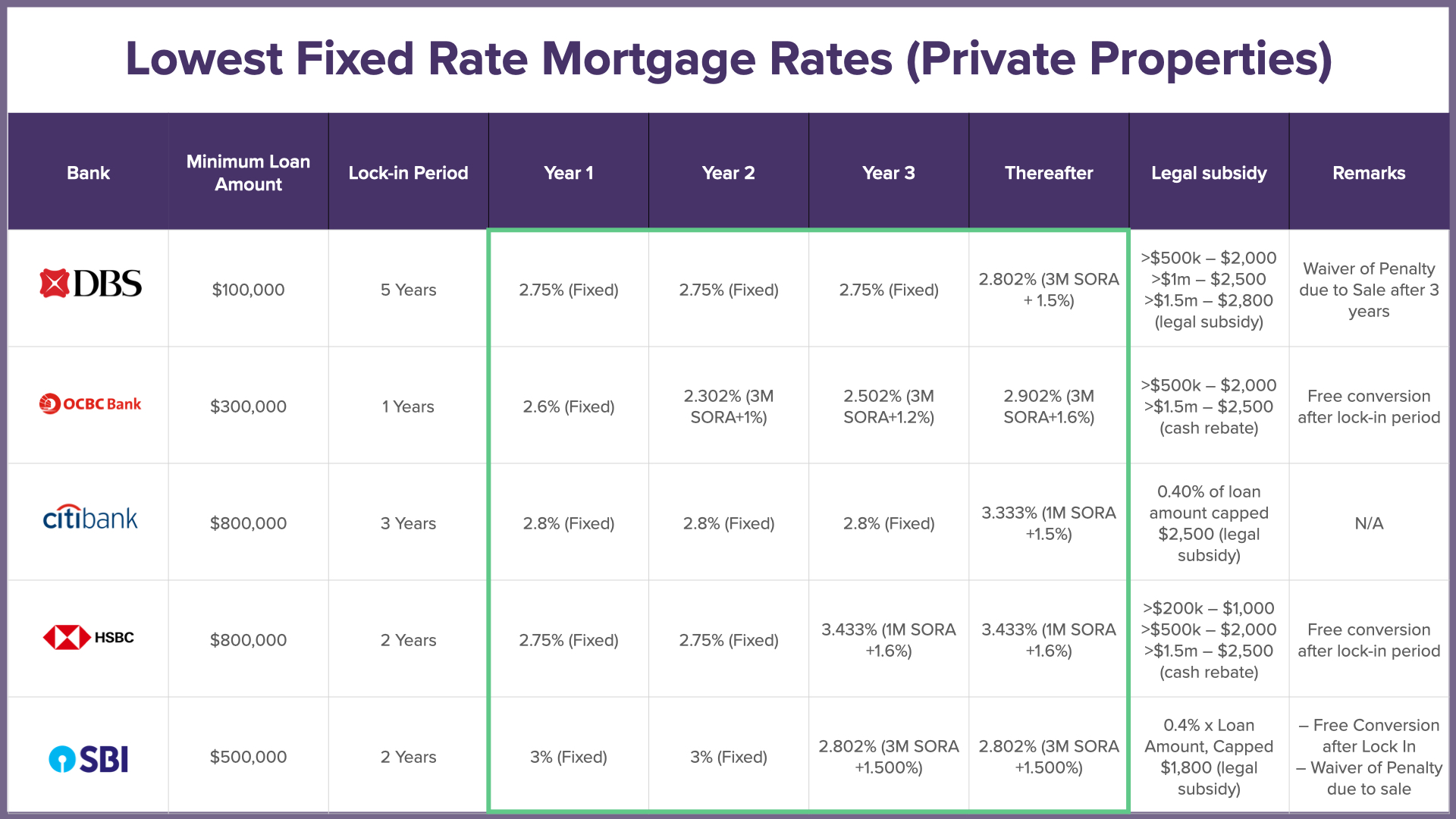

Understanding Personal Loan Interest Rates A Simple Guide

May 28, 2025

Understanding Personal Loan Interest Rates A Simple Guide

May 28, 2025 -

Personal Loan Interest Rates Today A Quick Comparison

May 28, 2025

Personal Loan Interest Rates Today A Quick Comparison

May 28, 2025 -

Compare Personal Loan Rates Today And Choose The Right Loan

May 28, 2025

Compare Personal Loan Rates Today And Choose The Right Loan

May 28, 2025 -

Personal Loans Compare Interest Rates And Find The Best Deal

May 28, 2025

Personal Loans Compare Interest Rates And Find The Best Deal

May 28, 2025