Riot Platforms (NASDAQ: RIOT) Stock Dips: Analysis And Outlook

Table of Contents

Analyzing the Causes of the Riot Platforms Stock Dip

Several factors contributed to the recent decline in Riot Platforms stock price. These factors can be broadly categorized into market-wide crypto volatility, Bitcoin price fluctuations, and company-specific issues.

Market-Wide Crypto Volatility

The cryptocurrency market's inherent volatility significantly impacts Bitcoin mining stocks like Riot Platforms. Recent downturns have been fueled by various factors, creating a challenging environment for the entire industry.

- Regulatory Uncertainty: Increased regulatory scrutiny in various jurisdictions creates uncertainty and can lead to investor hesitancy.

- Macroeconomic Factors: Global economic conditions, such as inflation and interest rate hikes, often negatively correlate with riskier assets like cryptocurrencies.

- Geopolitical Events: Major global events can trigger market-wide sell-offs, impacting the entire crypto market, including Bitcoin mining stocks.

- Stablecoin Concerns: Past instances of stablecoin de-pegging have shaken investor confidence, leading to broader market volatility.

Bitcoin Price Fluctuations

The price of Bitcoin is intrinsically linked to Riot Platforms' performance. Since Riot Platforms' primary revenue source is Bitcoin mining, fluctuations in Bitcoin's price directly impact the company's profitability and, consequently, its stock price.

- Direct Revenue Impact: A decrease in Bitcoin's price reduces the value of the Bitcoins mined by Riot Platforms, impacting their revenue.

- Profitability Squeeze: Lower Bitcoin prices, combined with relatively fixed operational costs, can lead to reduced profit margins.

- Investor Sentiment: Negative Bitcoin price movements often lead to negative investor sentiment, resulting in sell-offs in related stocks.

[Insert chart/graph visually representing Bitcoin price vs. RIOT stock price correlation]

Company-Specific Factors

While market forces play a significant role, company-specific events can also contribute to stock price volatility. For Riot Platforms, these might include:

- Production Challenges: Any disruptions in mining operations, such as equipment malfunctions or power outages, can impact output and revenue.

- Financial Reports: Disappointing financial results, particularly lower-than-expected revenue or profit margins, can negatively impact investor confidence.

- Management Changes: Significant changes in leadership can sometimes lead to uncertainty and affect investor sentiment.

- Expansion Delays: Delays in planned expansions or new projects can signal potential operational issues and decrease investor confidence.

Evaluating the Financial Health of Riot Platforms

Understanding Riot Platforms' financial health is crucial for assessing its long-term prospects. Analyzing key metrics, debt levels, and future growth potential provides a comprehensive picture.

Revenue and Profitability

Riot Platforms' recent financial performance should be scrutinized, analyzing:

- Mining Hash Rate: This metric reflects the company's mining capacity and its potential to generate Bitcoin.

- Operating Costs: Understanding the company's operational expenses is essential for assessing profitability.

- Revenue Growth: Comparing revenue figures across quarters and years helps establish trends and identify potential growth areas.

Debt and Liquidity

A thorough assessment of Riot Platforms' financial health involves:

- Debt Levels: High debt levels can present significant risks, particularly during periods of market downturn.

- Liquidity Position: Analyzing the company's cash on hand and its ability to meet short-term obligations is crucial.

- Debt-to-Equity Ratio: This ratio indicates the proportion of a company's financing that comes from debt versus equity.

Future Growth Prospects

Evaluating Riot Platforms' future growth requires consideration of:

- Expansion Plans: The company's plans to expand its mining operations and increase its hash rate are key indicators of future growth.

- Technological Advancements: Investments in new technologies and more energy-efficient mining equipment can improve profitability.

- Industry Trends: Understanding broader industry trends and the future outlook for Bitcoin mining is crucial.

Assessing the Long-Term Outlook for Riot Platforms Stock

While the recent dip presents challenges, it's crucial to assess the long-term outlook for Riot Platforms stock by considering potential risks and opportunities.

Risk Assessment

Riot Platforms, like any company in the cryptocurrency space, faces several risks:

- Regulatory Uncertainty: Changes in regulations regarding cryptocurrency mining can significantly impact operations.

- Competition: Increased competition from other Bitcoin mining companies can put downward pressure on prices.

- Technological Disruptions: Technological advancements could render existing mining equipment obsolete.

- Bitcoin Price Volatility: The inherent volatility of Bitcoin remains a significant risk.

Investment Opportunities

The recent stock price dip may present opportunities for long-term investors.

- Discounted Valuation: The dip may offer a chance to acquire shares at a potentially discounted valuation.

- Growth Potential: Riot Platforms' long-term growth prospects remain relatively strong, given the increasing adoption of Bitcoin.

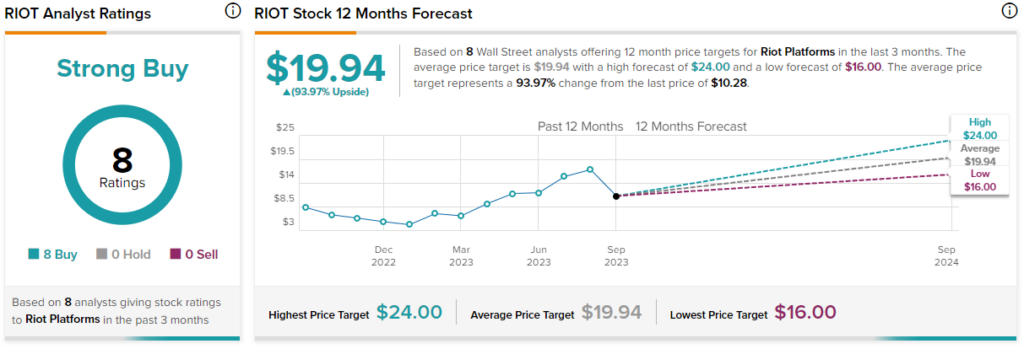

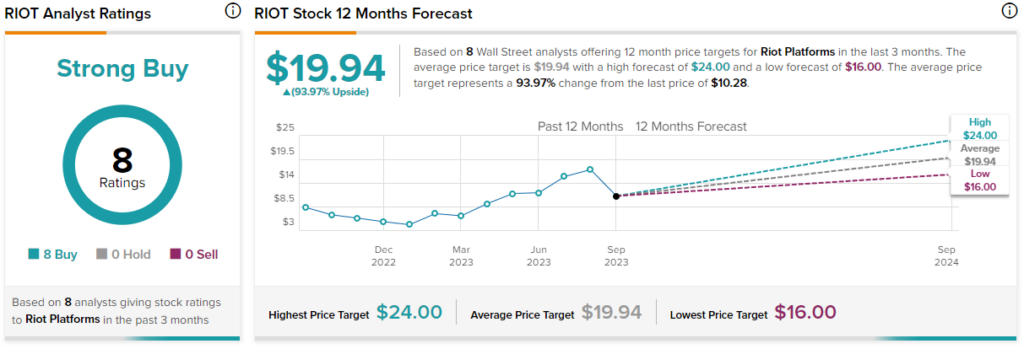

Analyst Ratings and Price Targets

Reviewing analyst ratings and price targets provides valuable insights. [Include a summary of analyst opinions, citing sources]. Remember that analyst opinions should be considered alongside your own research.

Conclusion: Riot Platforms (NASDAQ: RIOT) Stock: A Look Ahead

The recent decline in Riot Platforms (NASDAQ: RIOT) stock can be attributed to a combination of market-wide crypto volatility, Bitcoin price fluctuations, and company-specific factors. While risks exist, the company's financial health and long-term growth potential remain significant considerations. This analysis suggests that the current dip may represent a potential investment opportunity for long-term investors, though thorough due diligence is essential. However, this analysis does not constitute financial advice. Before making any investment decisions related to Riot Platforms (NASDAQ: RIOT) stock, conduct your own thorough research and consider consulting with a qualified financial advisor. Further exploration into "RIOT stock forecast" and "Bitcoin mining stock analysis" can provide additional valuable insights.

Featured Posts

-

Doctor Who Cancellation Fears Rise After Showrunners Pause Reveal

May 03, 2025

Doctor Who Cancellation Fears Rise After Showrunners Pause Reveal

May 03, 2025 -

18 April 2025 Daily Lotto Results

May 03, 2025

18 April 2025 Daily Lotto Results

May 03, 2025 -

Robust Poll Data System Ensuring Election Integrity

May 03, 2025

Robust Poll Data System Ensuring Election Integrity

May 03, 2025 -

Macron Et L Etat Palestinien Netanyahu Denonce Une Grave Erreur

May 03, 2025

Macron Et L Etat Palestinien Netanyahu Denonce Une Grave Erreur

May 03, 2025 -

Des Annees Plus Tard Emmanuel Macron Evoque Sa Vie Privee Avec Brigitte

May 03, 2025

Des Annees Plus Tard Emmanuel Macron Evoque Sa Vie Privee Avec Brigitte

May 03, 2025

Latest Posts

-

Navigating The Turbulence Airlines Struggle Amidst Oil Supply Shocks

May 04, 2025

Navigating The Turbulence Airlines Struggle Amidst Oil Supply Shocks

May 04, 2025 -

Oil Price Volatility And Its Consequences For Airline Operations

May 04, 2025

Oil Price Volatility And Its Consequences For Airline Operations

May 04, 2025 -

Soaring Fuel Costs The Oil Shocks Devastating Effect On Airlines

May 04, 2025

Soaring Fuel Costs The Oil Shocks Devastating Effect On Airlines

May 04, 2025 -

Airline Industry Faces Headwinds The Impact Of Oil Supply Disruptions

May 04, 2025

Airline Industry Faces Headwinds The Impact Of Oil Supply Disruptions

May 04, 2025 -

Oil Supply Shocks How The Airline Industry Is Feeling The Pinch

May 04, 2025

Oil Supply Shocks How The Airline Industry Is Feeling The Pinch

May 04, 2025