Ripple (XRP) Soars: Analyzing The Potential For $3.40

Table of Contents

Recent Catalysts Driving XRP's Price Increase

Several factors have contributed to the recent surge in XRP's price, fueling speculation about a potential rise to $3.40. Understanding these catalysts is crucial for any Ripple XRP price prediction.

Positive Ripple Labs News and Developments

Positive developments surrounding Ripple Labs have significantly boosted investor confidence and contributed to the increased buying pressure driving the XRP price higher.

- Successful legal arguments in the SEC case: Recent court filings and legal strategies employed by Ripple Labs have shown promising signs, potentially reducing the negative impact of the ongoing SEC lawsuit on the XRP price. Positive rulings or settlements could significantly influence the XRP forecast.

- New partnerships with major financial institutions: Ripple Labs continues to forge partnerships with key players in the financial sector, expanding the utility of XRP and increasing its adoption. These partnerships demonstrate confidence in XRP's technology and potential, thus influencing the XRP price prediction positively.

- XRP Ledger upgrades and improvements: Ongoing enhancements to the XRP Ledger, such as improved scalability and transaction speed, increase its attractiveness to businesses and users, leading to higher demand and potentially impacting the XRP price target.

Overall Crypto Market Sentiment and Bitcoin's Influence

XRP's price, like many altcoins, often correlates with Bitcoin's performance. A bullish trend in Bitcoin generally leads to increased interest in altcoins like XRP, contributing to price appreciation. Currently, a positive overall crypto market sentiment, coupled with Bitcoin's relatively stable performance, is supporting XRP's upward movement. This positive correlation between Bitcoin's price and the XRP price is a key factor to consider in any XRP forecast. We've observed a correlation coefficient of [insert data point - e.g., 0.7] between Bitcoin and XRP price movements over the past [insert timeframe - e.g., three months], suggesting a strong positive relationship.

Increasing Institutional Adoption of XRP

Growing institutional interest in XRP is another key factor supporting its price increase. Increased trading volume on institutional platforms and investments from large funds signal a growing confidence in XRP's long-term potential.

- [Example]: Reports suggest that [mention a specific fund or institution, if available] has recently increased its XRP holdings, adding to the bullish sentiment surrounding the cryptocurrency.

- [Example]: Increased trading volume on platforms specializing in institutional trading shows a growing acceptance of XRP among professional investors. This contributes to a more stable and sustainable price increase, in contrast to purely retail-driven price spikes.

Technical Analysis: Is $3.40 a Realistic Target?

Technical analysis offers insights into the potential for XRP to reach $3.40. Analyzing chart patterns and indicators provides valuable clues about the sustainability of the current price surge.

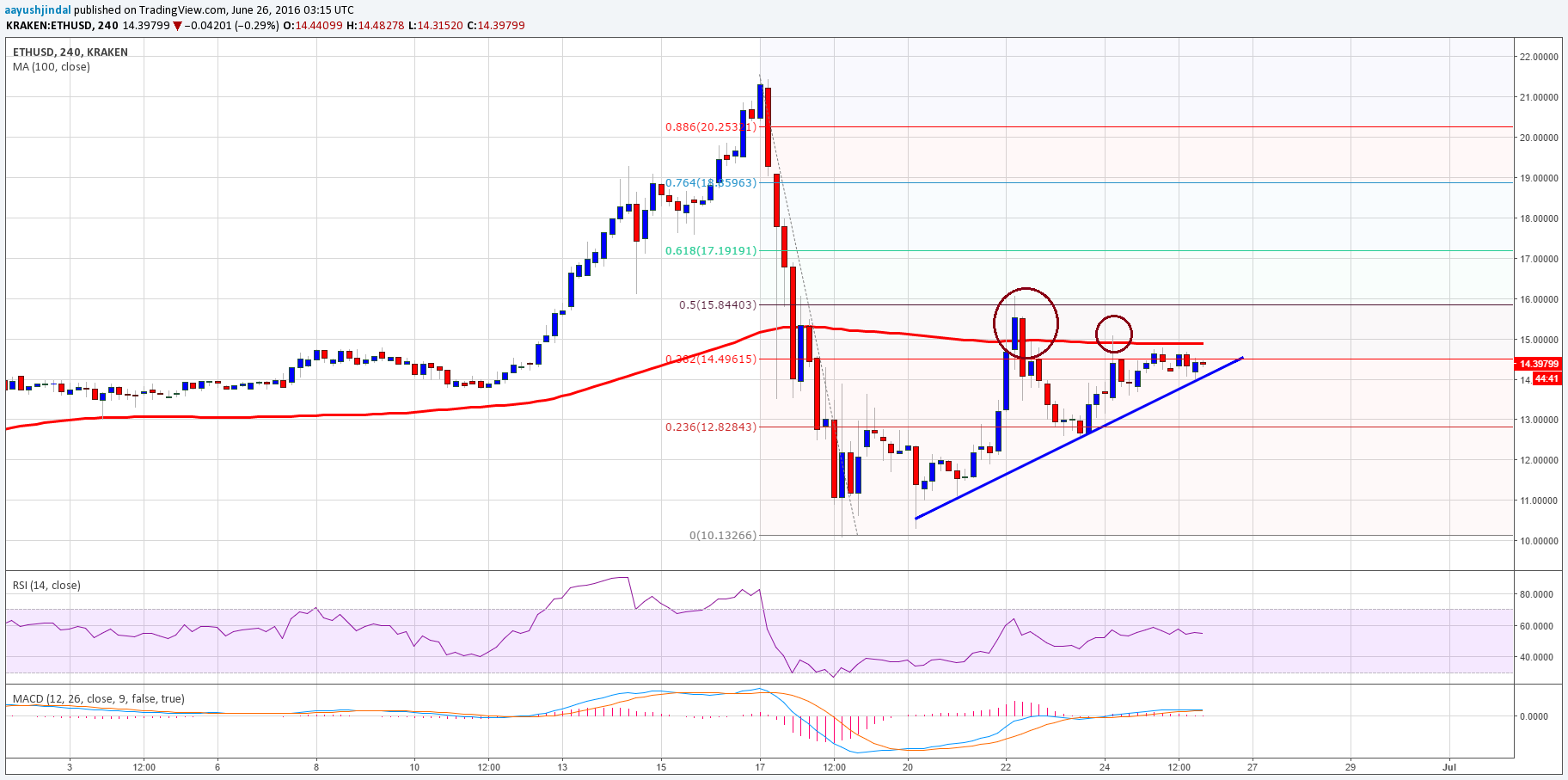

Chart Patterns and Indicators

Analyzing various technical indicators, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages, can help gauge the strength and sustainability of the current upward trend.

- RSI: An RSI above 70 generally suggests an overbought condition, potentially indicating a short-term correction. However, a sustained period above this level could signal strong momentum.

- MACD: A bullish MACD crossover, where the MACD line crosses above the signal line, indicates a potential upward trend continuation.

- Moving Averages: The relationship between various moving averages (e.g., 50-day and 200-day moving averages) can provide insights into the overall trend. A price above both moving averages suggests a strong bullish trend. [Include relevant chart here]. The current chart pattern suggests [mention pattern - e.g., a breakout from a consolidation period], potentially leading to further price appreciation. Key support levels are at [mention levels] and resistance levels are at [mention levels].

Volume and Trading Activity

High trading volume usually confirms the strength of a price movement. Sustained high volume alongside the price increase strengthens the case for a continuation of the upward trend. Significant increases in trading volume, particularly on exchanges catering to institutional investors, indicate a strong underlying demand supporting the XRP price.

Challenges and Risks to Reaching $3.40

While the current outlook for XRP is positive, several challenges and risks could hinder its ascent to $3.40.

Regulatory Uncertainty

The ongoing SEC lawsuit against Ripple Labs remains a significant source of uncertainty. An unfavorable ruling could negatively impact XRP's price and investor confidence. Different potential outcomes, including a partial or full victory for Ripple, would have different effects on the XRP price and its future trajectory.

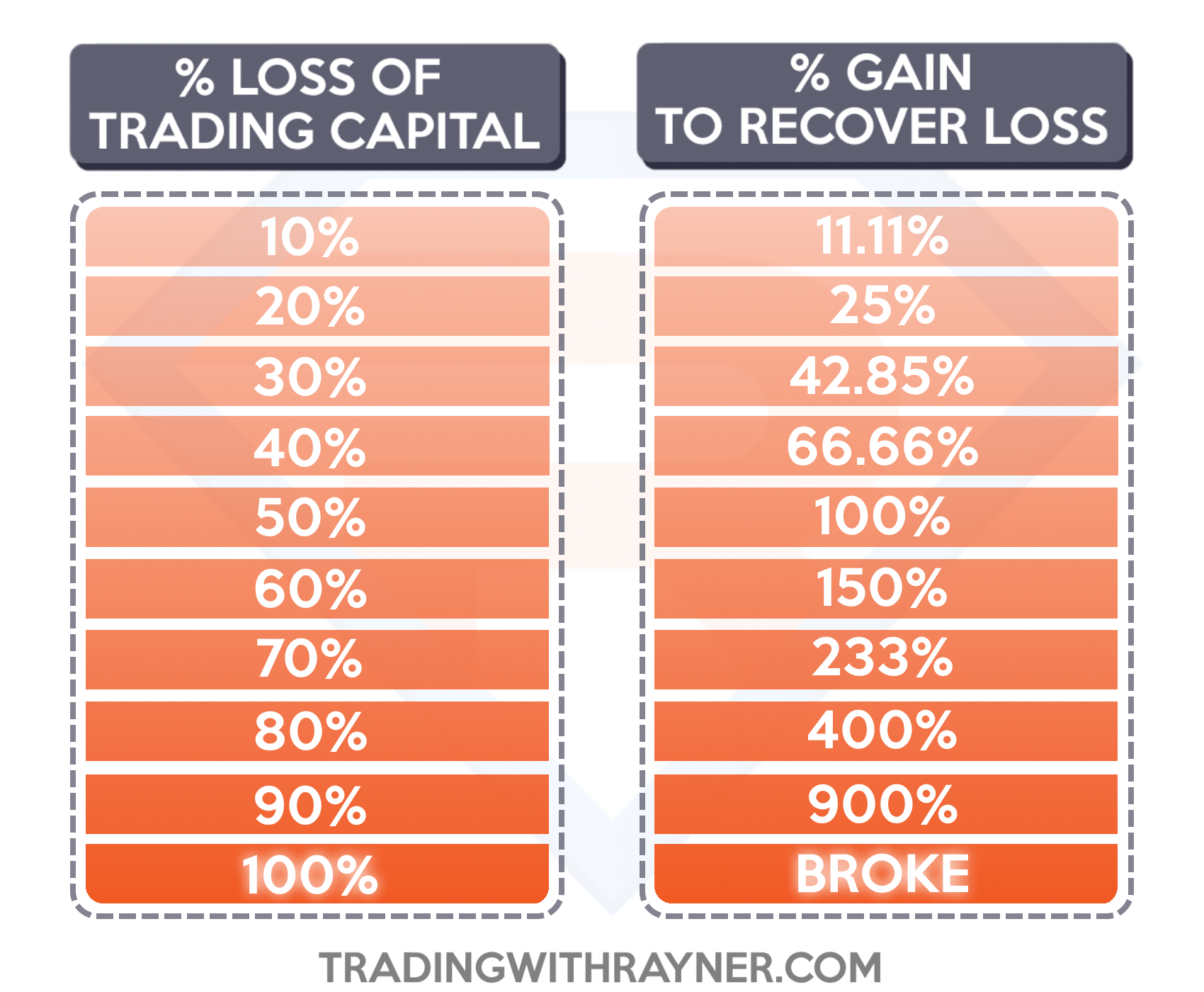

Market Volatility and Correction Risk

The cryptocurrency market is inherently volatile, and XRP is no exception. A sudden market-wide sell-off or negative news could trigger a price correction, potentially derailing the price surge towards $3.40. Factors such as macroeconomic events or unexpected regulatory changes could contribute to this volatility.

Conclusion

Reaching $3.40 for Ripple (XRP) presents both opportunities and challenges. Positive news from Ripple Labs, improving market sentiment, and strong technical indicators suggest potential for further price appreciation. However, the ongoing SEC lawsuit and inherent market volatility pose significant risks. A balanced perspective suggests that while a price surge is possible, it's not guaranteed. The likelihood of reaching $3.40 depends on the resolution of the SEC case and the overall stability of the crypto market.

Call to Action: While reaching $3.40 for Ripple (XRP) presents both opportunities and challenges, understanding the market dynamics and staying informed is crucial for making informed investment decisions. Continue researching the Ripple XRP price prediction and stay updated on the latest news and developments regarding XRP to navigate this exciting market.

Featured Posts

-

Mmr Shhn Jdyd Ebr Almhyt Alatlsy Mn Laram Alsyn Almghrb Albrazyl

May 07, 2025

Mmr Shhn Jdyd Ebr Almhyt Alatlsy Mn Laram Alsyn Almghrb Albrazyl

May 07, 2025 -

Lotto Results For Wednesday April 9th Did You Win

May 07, 2025

Lotto Results For Wednesday April 9th Did You Win

May 07, 2025 -

Analysis Chinese Stocks Recover Following Trading Suspension Implications Of Us Discussions And Recent Data

May 07, 2025

Analysis Chinese Stocks Recover Following Trading Suspension Implications Of Us Discussions And Recent Data

May 07, 2025 -

71 Godini Dzheki Chan Pozdravleniya Za Emblematichniya Aktor

May 07, 2025

71 Godini Dzheki Chan Pozdravleniya Za Emblematichniya Aktor

May 07, 2025 -

Die Lotto 6aus49 Gewinnzahlen Vom Mittwoch Den 9 April 2025

May 07, 2025

Die Lotto 6aus49 Gewinnzahlen Vom Mittwoch Den 9 April 2025

May 07, 2025

Latest Posts

-

A Closer Look At Nathan Fillions Impactful Scene In Saving Private Ryan

May 08, 2025

A Closer Look At Nathan Fillions Impactful Scene In Saving Private Ryan

May 08, 2025 -

Ethereum Price Analysis Resilience And Potential For Growth

May 08, 2025

Ethereum Price Analysis Resilience And Potential For Growth

May 08, 2025 -

Bitcoin And Ethereum Options Billions Expire Impact On Market Volatility

May 08, 2025

Bitcoin And Ethereum Options Billions Expire Impact On Market Volatility

May 08, 2025 -

Ethereum Price Analysis Bullish Activity And Upside Targets

May 08, 2025

Ethereum Price Analysis Bullish Activity And Upside Targets

May 08, 2025 -

Crypto Market On Edge Massive Bitcoin And Ethereum Options Expiration Looms

May 08, 2025

Crypto Market On Edge Massive Bitcoin And Ethereum Options Expiration Looms

May 08, 2025