Sasol (SOL) Investor Concerns Following 2023 Strategy Presentation

Table of Contents

Keywords: Sasol, SOL, Sasol stock, investor concerns, 2023 strategy, Sasol strategy presentation, Sasol share price, energy sector, petrochemical industry, investment risk, South African stock market, financial performance, debt reduction

Sasol (SOL), a major player in the global energy and petrochemical industry, recently unveiled its 2023 strategy. While the presentation outlined ambitious goals, it also sparked significant investor concerns regarding the company's financial health, operational capabilities, and ESG performance. This article delves into these key anxieties and their potential implications for Sasol's share price and future prospects.

Debt Levels and Financial Health

Sasol's substantial debt burden remains a primary source of investor concern. The company's high financial leverage poses significant risks, particularly in a volatile energy market.

High Debt-to-Equity Ratio

Sasol's debt-to-equity ratio currently sits considerably higher than industry averages. This signifies a higher reliance on debt financing, increasing vulnerability to economic downturns and interest rate hikes.

- Specific figures on debt levels: While precise figures require referencing Sasol's financial statements, publicly available data shows a consistently high debt load. Any significant increase in interest rates directly impacts debt servicing costs.

- Analysis of interest payments: A large portion of Sasol's cash flow is allocated to interest payments, reducing the funds available for reinvestment in growth initiatives and debt reduction.

- Potential impact on credit rating: The high debt levels could potentially lead to a downgrade in Sasol's credit rating, making it more expensive to secure future financing. This would further constrain the company's financial flexibility. Keywords: Sasol debt, SOL debt, financial leverage, credit rating, debt sustainability.

Free Cash Flow Concerns

Another critical concern revolves around Sasol's free cash flow generation capacity. The ability to generate sufficient free cash flow is crucial for servicing debt, investing in growth projects, and returning value to shareholders.

- Free cash flow projections: Analysts' projections for Sasol's free cash flow vary, reflecting the uncertainty surrounding commodity prices and operational performance.

- Impact of commodity price fluctuations: Sasol's profitability is heavily influenced by fluctuations in the prices of oil, gas, and petrochemicals. Price volatility can significantly impact free cash flow, making financial planning challenging.

- Capital expenditure plans: Sasol's ambitious capital expenditure plans require substantial cash flow. Any shortfall could jeopardize project timelines and potentially exacerbate the debt burden. Keywords: Sasol free cash flow, cash flow generation, capital expenditure, return on capital employed (ROCE).

Execution Risks and Operational Challenges

The successful execution of Sasol's 2023 strategy hinges on overcoming significant operational challenges and mitigating inherent execution risks.

Project Delays and Cost Overruns

Sasol has a history of experiencing project delays and cost overruns. The recurrence of such issues with future projects poses a serious risk to the company's financial health and its ability to meet its strategic objectives.

- Specific examples of past project issues: Past instances of project delays and cost overruns should be reviewed to assess the effectiveness of risk mitigation strategies.

- Risk mitigation strategies: The company needs to demonstrate robust risk mitigation strategies to reassure investors about its ability to manage complex projects effectively.

- Impact on timelines and budgets: Delays and cost overruns inevitably impact project timelines and budgets, potentially delaying the realization of anticipated returns and further straining cash flow. Keywords: Project risk, cost overruns, project management, operational efficiency, Sasol projects.

Competition and Market Dynamics

Sasol operates in a highly competitive energy and petrochemical landscape, facing pressure from established players and new entrants. The ability to maintain market share and pricing power is crucial for profitability.

- Key competitors: Identifying and analyzing the strengths and strategies of key competitors is essential for assessing Sasol's competitive position.

- Market share analysis: Tracking Sasol's market share in key product segments helps assess its ability to compete effectively in a dynamic market.

- Pricing pressures: The company faces considerable pricing pressures, particularly in commodity markets, which can impact margins and profitability. Keywords: Industry competition, market share, pricing strategy, competitive advantage.

Environmental, Social, and Governance (ESG) Concerns

Increasingly, investors prioritize Environmental, Social, and Governance (ESG) factors when making investment decisions. Sasol's performance in these areas is subject to significant scrutiny.

Carbon Emission Reduction Targets

Sasol's commitment to reducing carbon emissions is crucial, given the growing global focus on climate change. The feasibility of achieving its emission reduction targets is a key concern for investors.

- Emission reduction goals: Sasol's stated emission reduction goals need to be analyzed for their ambition and realism, considering technological feasibility and regulatory requirements.

- Investment in renewable energy: Investment in renewable energy and other decarbonization technologies is essential for achieving emission reduction targets.

- Regulatory risks related to climate change: Stringent environmental regulations and potential carbon taxes pose significant regulatory risks. Keywords: ESG factors, carbon emissions, renewable energy, climate change, sustainability.

Social Responsibility and Stakeholder Engagement

Sasol's approach to social responsibility and stakeholder engagement is another critical area for investors. A strong commitment to social responsibility is increasingly viewed as essential for long-term success.

- Community relations: Positive community relations are important for securing social license to operate and mitigating reputational risks.

- Labor relations: Maintaining constructive labor relations minimizes operational disruptions and enhances productivity.

- Corporate governance practices: Sound corporate governance practices build investor confidence and reduce risks associated with poor management. Keywords: Corporate social responsibility (CSR), stakeholder engagement, corporate governance.

Conclusion

Following the 2023 strategy presentation, several significant investor concerns surround Sasol (SOL). These include a substantial debt burden, execution risks associated with large-scale projects, and challenges related to ESG performance. The company's ability to address these concerns will be crucial in determining its future financial performance and share price. Further research and analysis are crucial for investors to form their own informed opinion about Sasol's (SOL) future prospects and potential risks. Understanding these Sasol investor concerns is vital for navigating the complexities of investing in the energy sector. Stay informed about developments in the Sasol (SOL) story and consider engaging with financial advisors for personalized investment advice.

Featured Posts

-

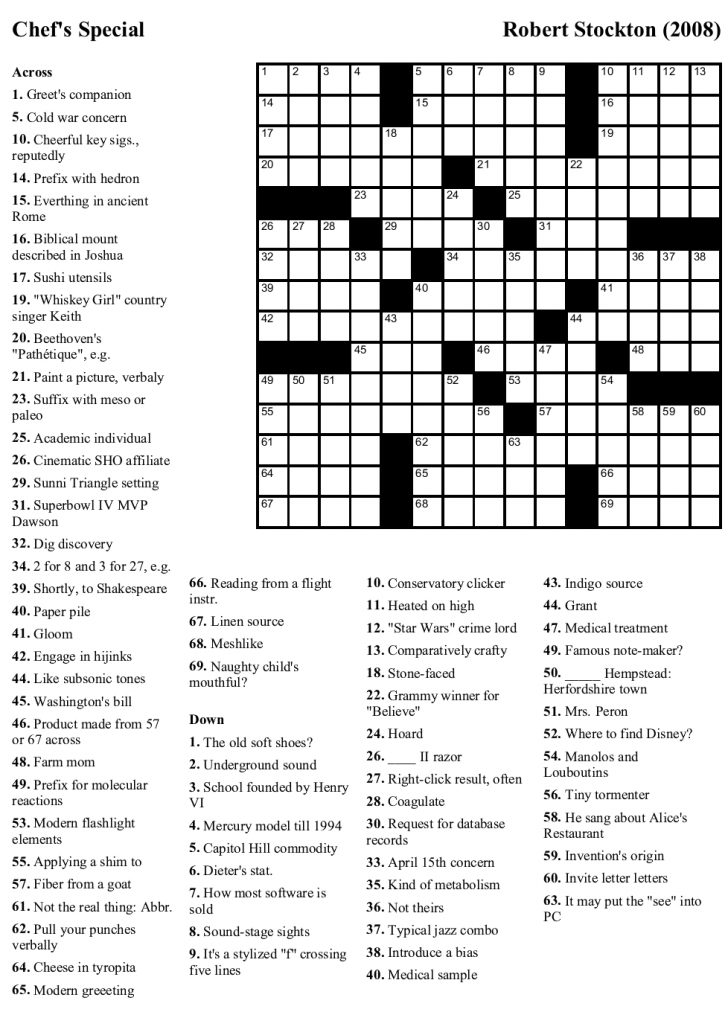

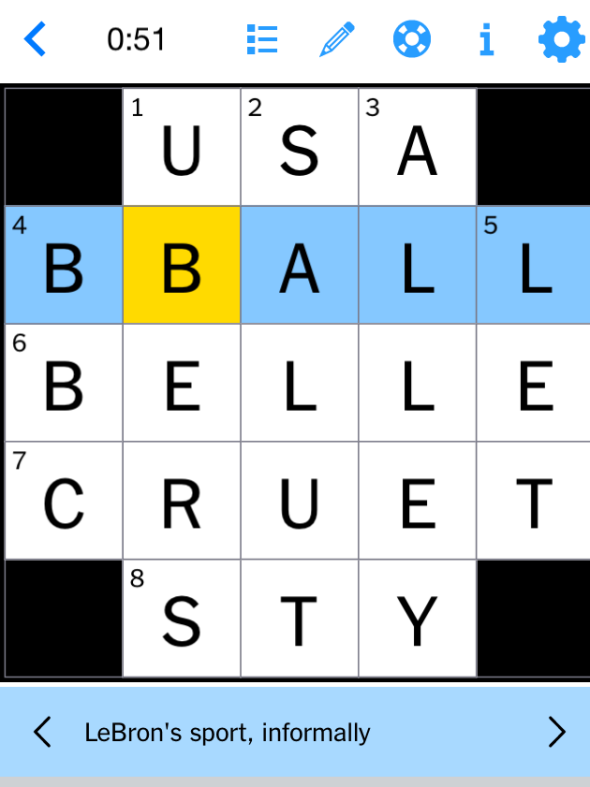

Todays Nyt Mini Crossword Puzzle May 9 Answers

May 20, 2025

Todays Nyt Mini Crossword Puzzle May 9 Answers

May 20, 2025 -

Aghatha Krysty Tewd Ila Alhyat Bfdl Aldhkae Alastnaey

May 20, 2025

Aghatha Krysty Tewd Ila Alhyat Bfdl Aldhkae Alastnaey

May 20, 2025 -

Hamilton Vs Leclerc A Detailed Comparison Of Their 2023 Struggles

May 20, 2025

Hamilton Vs Leclerc A Detailed Comparison Of Their 2023 Struggles

May 20, 2025 -

March 15th Nyt Mini Crossword Answers And Solutions

May 20, 2025

March 15th Nyt Mini Crossword Answers And Solutions

May 20, 2025 -

Find The Answers Nyt Mini Crossword March 16 2025

May 20, 2025

Find The Answers Nyt Mini Crossword March 16 2025

May 20, 2025

Latest Posts

-

Analyzing Big Bear Ai Stock A Practical Guide For Investors

May 20, 2025

Analyzing Big Bear Ai Stock A Practical Guide For Investors

May 20, 2025 -

Preparing For School Delays During Winter Weather Advisories

May 20, 2025

Preparing For School Delays During Winter Weather Advisories

May 20, 2025 -

Big Bear Ai Stock A Potential Investment Opportunity

May 20, 2025

Big Bear Ai Stock A Potential Investment Opportunity

May 20, 2025 -

Big Bear Ai Stock What The Experts Say

May 20, 2025

Big Bear Ai Stock What The Experts Say

May 20, 2025 -

12 Promising Ai Stocks According To Reddit

May 20, 2025

12 Promising Ai Stocks According To Reddit

May 20, 2025