UK Tax Update: HMRC Contacts Thousands Over £23,000 Income

Table of Contents

Who is Affected by the HMRC Contact?

HMRC's recent outreach targets individuals who may have underpaid tax or failed to meet specific filing deadlines. This primarily affects self-employed individuals, contractors, and those with multiple income streams exceeding the £23,000 income threshold. The reasons for this contact vary, but common culprits include:

- Underpayment of Income Tax: Failing to correctly calculate and pay income tax due on earnings above the personal allowance.

- Missed Self-Assessment Deadlines: Not submitting your self-assessment tax return by the January 31st deadline.

- Inaccurate Reporting of Income: Providing incorrect information on your tax return, leading to discrepancies.

Specific scenarios that trigger HMRC contact include:

- Freelancers: Those with fluctuating income throughout the year might miscalculate their tax liability.

- Company Directors: Directors who haven't accurately reported their dividends or salary.

- Rental Income: Individuals with rental properties who haven't declared rental income accurately.

This HMRC contact shouldn't be ignored. It often signals a potential tax investigation, so acting promptly is crucial. Keywords associated with this include self-assessment, tax liability, income threshold, HMRC contact, and tax investigation.

Understanding the £23,000 Income Threshold and its Implications

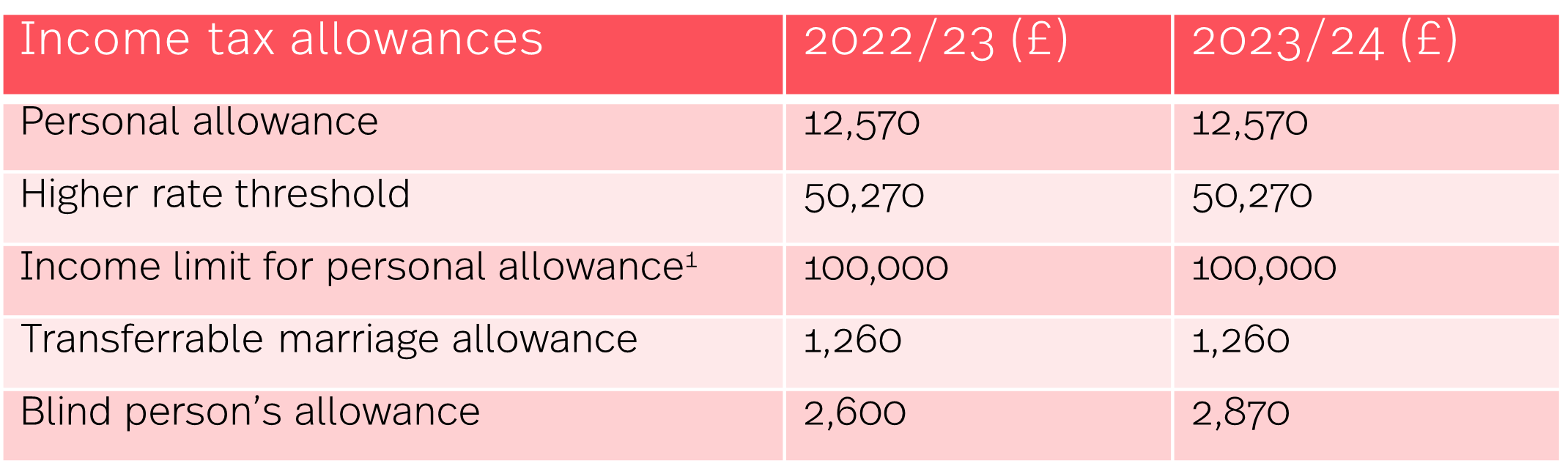

The £23,000 income threshold isn't a magic number that automatically triggers a tax investigation; however, it's a significant marker for several reasons. It signifies a level of income where tax obligations increase. Exceeding this threshold can mean:

- Higher Income Tax Brackets: Your income will be taxed at a higher rate than the basic rate.

- Increased National Insurance Contributions: You'll pay more in National Insurance, contributing to state benefits.

- Potential Penalties for Non-Compliance: Failing to meet your tax obligations can result in substantial penalties and interest charges.

A common misconception is that if your income is just above £23,000, you're automatically in trouble. This is incorrect. The issue lies in accurate reporting and timely payment of the correct amount of tax. Understanding the tax bands and rates relevant to your income is key. Keywords to note here are tax threshold, income tax bands, National Insurance, tax penalties, and tax compliance.

How to Respond to HMRC Contact Regarding Your Tax Return

Receiving a communication from HMRC concerning your tax return can be daunting, but responding promptly and effectively is vital. Here's how to handle the situation:

- Don't Ignore the Contact: Ignoring HMRC communication will only exacerbate the situation and lead to larger penalties.

- Review Your Tax Return Carefully: Thoroughly check your self-assessment return for any discrepancies or errors.

- Gather Necessary Documents: Collect all relevant documents, including payslips, invoices, bank statements, and any other evidence of income and expenses.

- Contact HMRC Directly: Use the contact details provided in the HMRC communication to clarify any queries and provide any missing information. Be prepared to explain any discrepancies.

- Seek Professional Advice: If you are unsure about how to proceed or if you're facing a complex situation, consider seeking guidance from a qualified tax advisor or accountant. They can help you navigate the process and ensure compliance.

Keywords related to this section include HMRC communication, tax return correction, tax advisor, accounting services, and tax resolution.

Avoiding Future HMRC Contact: Best Practices for Tax Compliance

Proactive tax planning and meticulous record-keeping are your best defenses against future HMRC contact. Here are some best practices:

- Keep Accurate Records: Maintain detailed and organised records of all income and expenses throughout the year. This makes tax preparation much smoother and reduces the risk of errors.

- File Tax Returns on Time: Always submit your self-assessment tax return by the January 31st deadline to avoid late filing penalties.

- Use Tax Software: Utilize reputable tax software to help you accurately calculate your tax liability and prepare your return. Many options offer features to help you stay organised and on top of deadlines.

- Regular Tax Planning: Engage in regular tax planning to ensure you're aware of your obligations and strategies to minimise your tax burden legally.

Keywords for this section include tax compliance, tax planning, record keeping, tax software, and tax deadlines.

Conclusion: Taking Action on Your UK Tax Update

Responding promptly to HMRC communication is crucial. The £23,000 income threshold marks a significant point in your tax obligations. Understanding your responsibilities and ensuring your tax return is accurate and up-to-date are paramount to avoiding penalties. Ignoring HMRC contact can lead to significant financial consequences. Don't delay your UK tax compliance. Review your tax affairs immediately. If you need assistance, seek professional advice from a qualified tax advisor. Understand your responsibilities regarding the £23,000 income threshold and ensure your tax return is accurate and up to date.

Featured Posts

-

Hmrc Refunds Could Millions Be Entitled To Money Back

May 20, 2025

Hmrc Refunds Could Millions Be Entitled To Money Back

May 20, 2025 -

Cadillac F1 Seat Support Grows For Mick Schumacher

May 20, 2025

Cadillac F1 Seat Support Grows For Mick Schumacher

May 20, 2025 -

Aldhkae Alastnaey Ykhlq Rwayat Jdydt Baslwb Aghatha Krysty

May 20, 2025

Aldhkae Alastnaey Ykhlq Rwayat Jdydt Baslwb Aghatha Krysty

May 20, 2025 -

Ajax Fenerbahce Yildizini Transfer Etti Mourinho Etkisi

May 20, 2025

Ajax Fenerbahce Yildizini Transfer Etti Mourinho Etkisi

May 20, 2025 -

Suki Waterhouses Surface Tour A Look At The Production Design

May 20, 2025

Suki Waterhouses Surface Tour A Look At The Production Design

May 20, 2025

Latest Posts

-

Understanding The Countrys Newest Business Hubs A Data Driven Approach

May 20, 2025

Understanding The Countrys Newest Business Hubs A Data Driven Approach

May 20, 2025 -

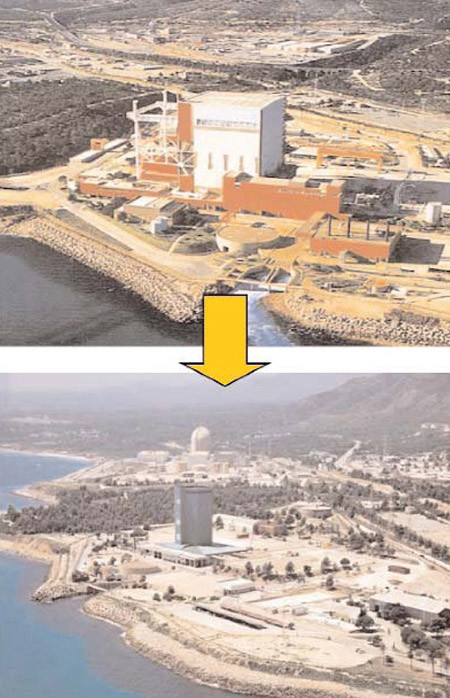

Taiwans Energy Future A Focus On Lng Following Nuclear Plant Decommissioning

May 20, 2025

Taiwans Energy Future A Focus On Lng Following Nuclear Plant Decommissioning

May 20, 2025 -

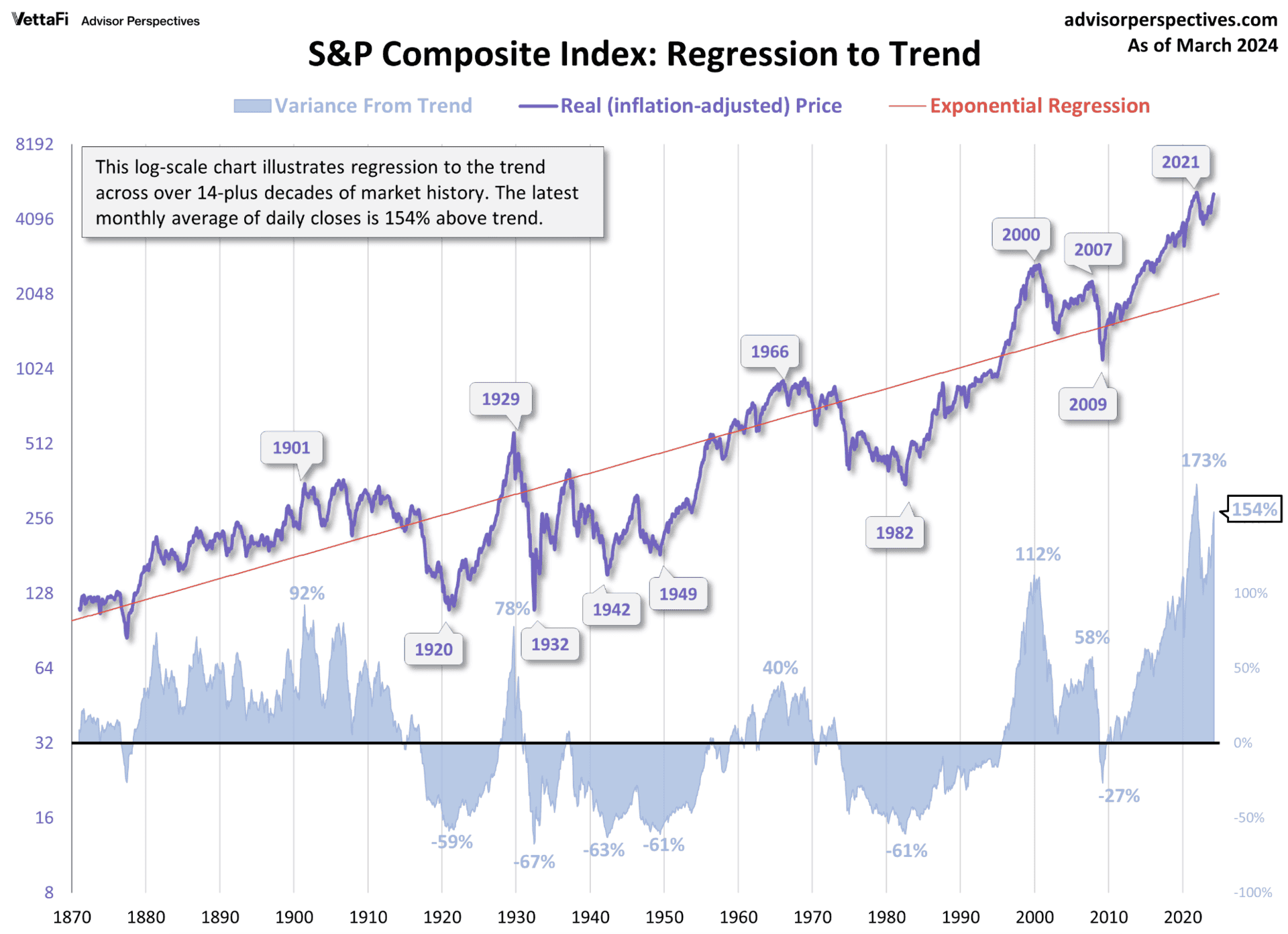

Should Investors Worry About Elevated Stock Market Valuations Bof As View

May 20, 2025

Should Investors Worry About Elevated Stock Market Valuations Bof As View

May 20, 2025 -

New Business Hotspots Regional Trends And Investment Opportunities

May 20, 2025

New Business Hotspots Regional Trends And Investment Opportunities

May 20, 2025 -

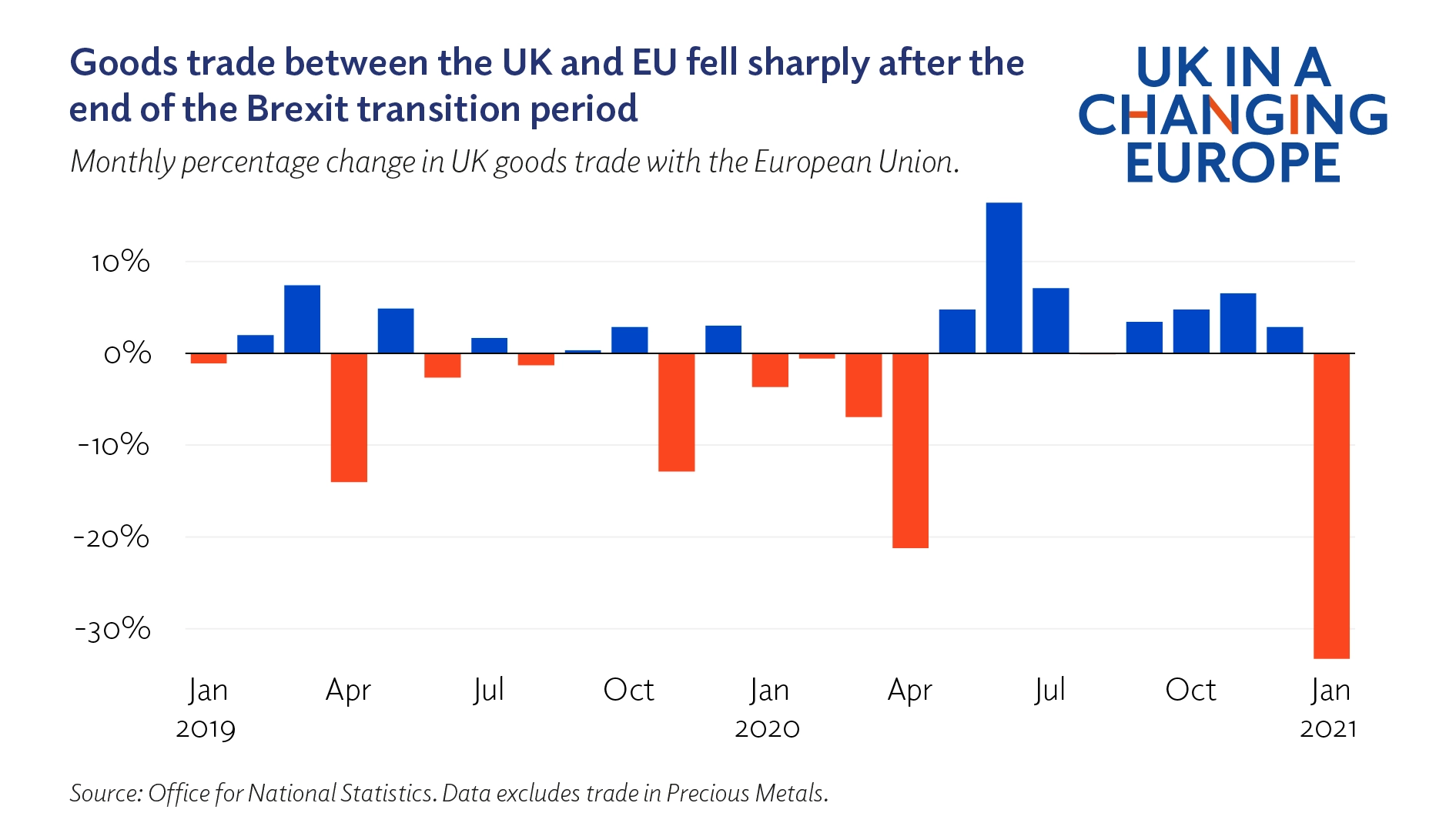

Brexit How Its Hampering Uk Luxury Exports To The Eu

May 20, 2025

Brexit How Its Hampering Uk Luxury Exports To The Eu

May 20, 2025