Understanding High Stock Market Valuations: BofA's Take

Table of Contents

BofA's Current Assessment of Stock Market Valuations

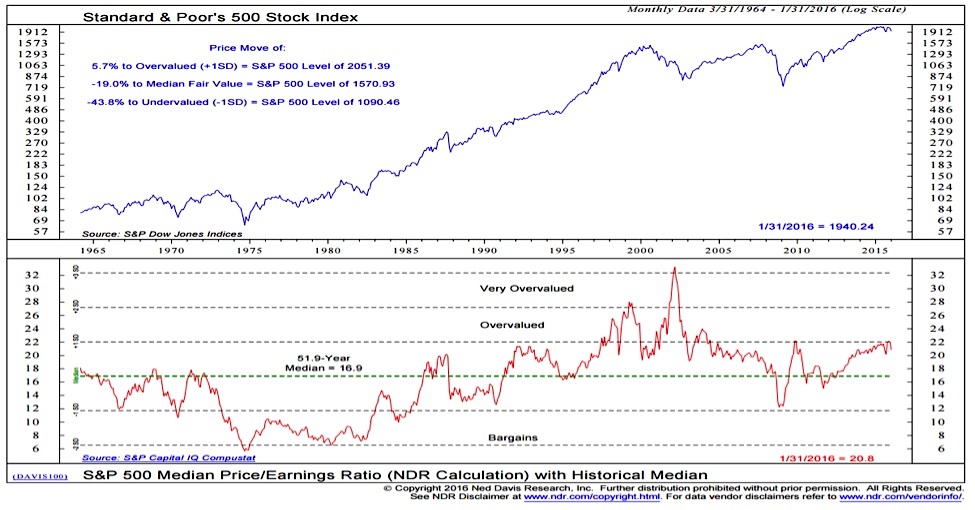

BofA regularly publishes reports and statements offering their assessment of stock market valuations. Their analysis often incorporates various metrics to gauge market health and potential risks. While specific data points change frequently, BofA's overall stance tends to reflect a nuanced view, acknowledging both the potential for continued growth and the inherent risks associated with elevated valuations.

-

Metrics Used: BofA utilizes a range of metrics to assess valuations, including the widely followed Shiller PE ratio (CAPE ratio), which considers inflation-adjusted earnings over a longer period, providing a more historical context. They also consider Tobin's Q, which compares a company's market capitalization to its asset replacement cost, offering another perspective on valuation. They frequently analyze market cap to GDP ratios, offering a broader macro-economic perspective.

-

Overall Stance: BofA's stance on stock market valuations shifts, reflecting ongoing economic changes and market dynamics. While they might express concerns about specific sectors or overall valuations reaching historically high levels, a purely "bullish," "bearish," or "neutral" label rarely captures the complexity of their analysis. Their reports usually emphasize the need for careful risk management and diversification.

-

Sector-Specific Views: BofA's analysis frequently identifies specific sectors as potentially overvalued or undervalued. For example, they may highlight technology stocks as potentially overvalued in periods of rapid growth followed by slower expansion, while pointing to undervalued sectors within the energy or infrastructure space based on their economic projections.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high stock market valuations. Understanding these factors is crucial for interpreting BofA's assessment and forming your investment strategy.

-

Low Interest Rates: Historically low interest rates have a significant impact on valuations. Low borrowing costs encourage companies to invest, fueling growth and increasing investor demand for equities. This makes bonds less attractive, increasing capital flowing into the stock market, thereby boosting prices.

-

Quantitative Easing (QE) and Monetary Policies: Central banks' QE programs, involving large-scale asset purchases, inject liquidity into the financial system. This increased liquidity often finds its way into the stock market, further inflating valuations. Other accommodative monetary policies also contribute to this effect.

-

Technological Innovation and Growth Expectations: Rapid technological advancements and the resulting growth expectations in sectors like technology, artificial intelligence, and renewable energy contribute to elevated valuations. Investors are willing to pay a premium for companies perceived to be at the forefront of innovation.

-

Global Economic Growth (or Slowdown): Periods of strong global economic growth generally lead to higher stock valuations as company earnings increase. Conversely, concerns about a global economic slowdown or recession can impact investor sentiment and potentially trigger market corrections.

-

Geopolitical Risks: Geopolitical events, such as trade wars, political instability, or international conflicts, influence investor sentiment and market volatility. Periods of heightened geopolitical risk can either depress or elevate stock market valuations depending on the nature of the events and their perceived impact on the economy.

Potential Risks Associated with High Valuations

Investing in a market with high valuations carries inherent risks that investors must carefully consider. BofA's analysis highlights these risks to inform investment decision-making.

-

Market Corrections or Crashes: High valuations increase the likelihood of market corrections or even crashes. When valuations become unsustainable, a sharp decline in prices can occur, potentially leading to significant losses for investors.

-

Rising Interest Rates: A rise in interest rates, often a response to inflation or strong economic growth, typically negatively affects stock market valuations. Higher borrowing costs reduce corporate profits and make bonds a more attractive alternative to equities.

-

Lower Future Returns: Investing in a high-valuation market typically results in lower future returns compared to investing when valuations are historically lower. This is simply because future growth potential is more limited when already at inflated levels.

-

Sector-Specific Declines: Even within a generally high-valuation market, specific sectors can experience sharp declines due to company-specific factors or industry-wide headwinds. Diversification helps mitigate this risk.

BofA's Strategies for Navigating High Valuations

Given the current market conditions, BofA often suggests strategies to help investors navigate the complexities of high stock market valuations.

-

Diversification: BofA emphasizes the importance of diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors. This approach helps reduce the overall risk of your portfolio.

-

Sector-Specific Recommendations: BofA's analysis frequently provides sector-specific recommendations, suggesting overweighting potentially undervalued sectors while avoiding those deemed overvalued.

-

Risk Management: Effective risk management is paramount. This may involve techniques such as value investing (focusing on undervalued companies), adopting a defensive investment strategy (prioritizing stability over high growth), or employing stop-loss orders to limit potential losses.

-

Long-Term Investing: Despite the volatility associated with high valuations, BofA generally advocates for a long-term investment strategy. A long-term horizon allows investors to ride out short-term market fluctuations and benefit from the long-term growth potential of the market.

Conclusion

BofA's assessment of high stock market valuations highlights a complex picture. While economic factors like low interest rates and technological innovation have contributed to elevated prices, the potential risks of market corrections, rising interest rates, and lower future returns cannot be ignored. BofA's recommended strategies emphasize diversification, prudent risk management, and a long-term investment approach. Understanding high stock market valuations is crucial for making informed investment decisions. Stay informed about BofA's ongoing analysis and adapt your investment strategy accordingly to mitigate risk and potentially capitalize on opportunities. Continue learning about high stock market valuations and their impact on your portfolio.

Featured Posts

-

Manhattan Outdoor Dining Your Guide To The Best Spots

May 22, 2025

Manhattan Outdoor Dining Your Guide To The Best Spots

May 22, 2025 -

Blake Lively Alleged Controversies And Recent News

May 22, 2025

Blake Lively Alleged Controversies And Recent News

May 22, 2025 -

Quiz Loire Atlantique Testez Vos Connaissances Sur L Histoire La Gastronomie Et La Culture

May 22, 2025

Quiz Loire Atlantique Testez Vos Connaissances Sur L Histoire La Gastronomie Et La Culture

May 22, 2025 -

Revolutionary Competitive Approach Introduced At Wtt Press Conference

May 22, 2025

Revolutionary Competitive Approach Introduced At Wtt Press Conference

May 22, 2025 -

Conquering Financial Constraints Strategies To Manage Lack Of Funds

May 22, 2025

Conquering Financial Constraints Strategies To Manage Lack Of Funds

May 22, 2025

Latest Posts

-

Investigating The Factors Contributing To Core Weave Crwv S Thursday Stock Decrease

May 22, 2025

Investigating The Factors Contributing To Core Weave Crwv S Thursday Stock Decrease

May 22, 2025 -

Core Weave Crwv Stock Explaining The Tuesday Price Movement

May 22, 2025

Core Weave Crwv Stock Explaining The Tuesday Price Movement

May 22, 2025 -

Core Weave Inc Crwv Stock Surge Reasons Behind Last Weeks Rise

May 22, 2025

Core Weave Inc Crwv Stock Surge Reasons Behind Last Weeks Rise

May 22, 2025 -

Market Reaction Deciphering Core Weave Inc Crwv S Tuesday Stock Dip

May 22, 2025

Market Reaction Deciphering Core Weave Inc Crwv S Tuesday Stock Dip

May 22, 2025 -

Understanding The Reasons Behind Core Weave Crwv Stocks Thursday Drop

May 22, 2025

Understanding The Reasons Behind Core Weave Crwv Stocks Thursday Drop

May 22, 2025