Understanding High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Perspective on Current Market Valuations

Bank of America's recent reports and analyses offer valuable insights into current stock market valuations. Their assessments often incorporate key metrics such as Price-to-Earnings (P/E) ratios and the Shiller PE ratio (CAPE ratio), providing a comprehensive view of market pricing. These reports are widely followed by investors and financial professionals for their insightful market outlook.

- BofA's Overall Assessment: BofA's stance on market valuations often shifts, reflecting the dynamic nature of the market. They might express a cautiously optimistic view (neither fully bullish nor bearish), emphasizing the need for careful risk management.

- Key Influencing Factors: BofA frequently cites several factors driving current valuations. These include persistently low interest rates, strong corporate earnings (despite concerns in certain sectors), and generally positive investor sentiment, though this can be volatile.

- Sectoral Analysis: BofA's analysis often highlights specific sectors they deem overvalued or undervalued. For example, they might point to technology stocks as potentially overvalued in periods of high growth and speculative investment, or conversely might note opportunities in undervalued sectors like energy or financials during market corrections. Understanding these sector-specific assessments is crucial for portfolio diversification. Keep up-to-date on BofA's market reports for the latest insights into sector performance and valuations.

Factors Contributing to High Stock Market Valuations

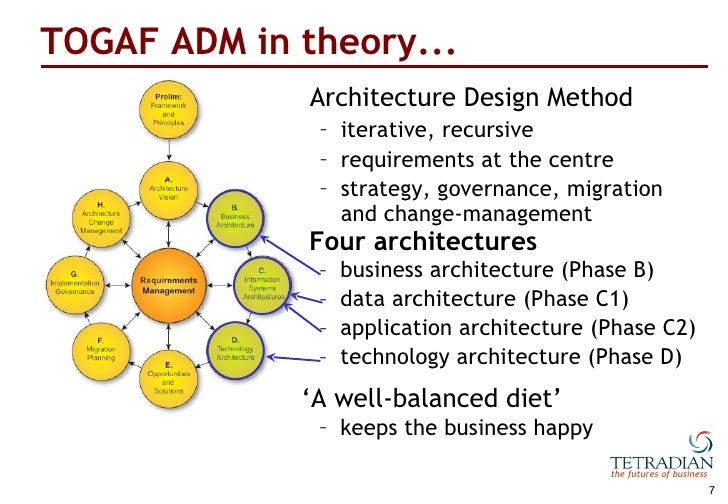

Several macroeconomic and market factors contribute to elevated stock market valuations. Understanding these factors is crucial for informed investment decisions. The interplay of these factors can be complex and requires careful analysis.

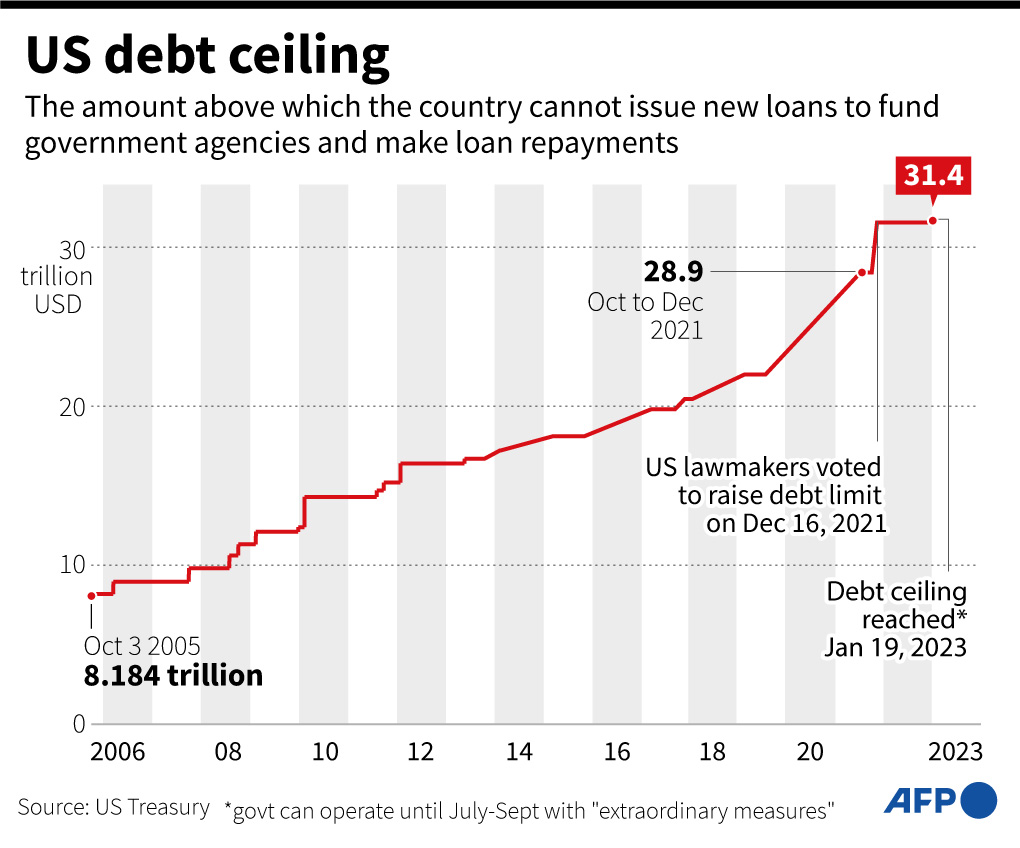

- Impact of Low Interest Rates: Low interest rates decrease the attractiveness of bonds, pushing investors towards higher-yielding assets like equities. This increased demand inflates stock prices, contributing to higher valuations. This is often referred to as the "search for yield."

- Quantitative Easing and Monetary Policies: Central banks' quantitative easing (QE) programs and other monetary policies designed to stimulate economic growth inject liquidity into the market, further boosting stock prices. The impact of these policies on market valuations is a complex and debated topic.

- Investor Sentiment and Market Demand: Positive investor sentiment, fueled by expectations of future growth, drives increased demand for stocks, pushing up prices and valuations. Conversely, negative sentiment can lead to market corrections or crashes. Investor sentiment can be heavily influenced by news, economic data and political events.

- Potential Bubbles and Speculative Behavior: In periods of high valuations, there's always a risk of speculative bubbles forming. This occurs when asset prices rise rapidly, driven by speculation rather than fundamentals. Identifying potential bubbles requires careful analysis of market conditions and valuation metrics.

Assessing the Risks of High Stock Market Valuations

High stock market valuations inherently carry risks. Understanding these risks is crucial for effective risk management and informed investment decisions.

- Market Corrections and Crashes: High valuations increase the probability of a market correction, a significant price decline, or even a more severe crash. While corrections are a normal part of the market cycle, the severity of the drop can be amplified by high prior valuations. Investors should prepare for potential market volatility.

- Risk Management Strategies: Several strategies can help mitigate risk in a high-valuation market. These include diversifying your portfolio across different asset classes, focusing on fundamentally strong companies, and carefully managing your risk tolerance.

- Portfolio Diversification: Diversification is key to reducing risk. Spreading investments across various sectors, asset classes (e.g., stocks, bonds, real estate), and geographic regions can cushion the impact of potential market downturns. This protects against concentrated losses in a single sector or region.

- Valuation Metrics and Risk Identification: Analyzing valuation metrics, such as P/E ratios and dividend yields, can help identify potentially overvalued stocks and sectors. This requires a careful understanding of financial statement analysis and appropriate valuation benchmarks.

Investment Strategies in a High-Valuation Market

Navigating a high-valuation market requires a well-defined investment strategy tailored to your risk tolerance and investment horizon.

- Long-Term Investment Strategies: Investors with a long-term horizon can consider dollar-cost averaging (investing a fixed amount regularly), focusing on companies with strong fundamentals and a proven track record.

- Short-Term Investment Strategies: Short-term investors might adopt more cautious approaches, potentially reducing equity exposure and increasing allocations to less volatile assets like bonds or cash. This would help mitigate losses in a market downturn.

- Value vs. Growth Investing: In a high-valuation market, value investing (focusing on undervalued companies) might offer better risk-adjusted returns than growth investing (focusing on rapidly growing companies, often at high valuations). A balanced approach is often recommended.

- Individual Company Fundamentals: Analyzing individual company fundamentals is crucial. Focus on companies with strong earnings, healthy balance sheets, and sustainable competitive advantages. This helps identify companies that may hold their value even in a market downturn.

Conclusion

BofA's insights on high stock market valuations highlight the interplay of factors such as low interest rates, strong corporate earnings, and investor sentiment. While these factors contribute to current market levels, the associated risks, including the potential for corrections, should not be overlooked. Understanding high stock market valuations is crucial for successful investing. Develop a robust investment strategy that incorporates diversification, risk management, and a thorough analysis of individual company fundamentals. Stay informed about BofA's ongoing analysis of stock market valuations and other key market indicators to make well-informed investment decisions.

Featured Posts

-

Lograr Tus Metas Con La Garantia De Alberto Ardila Olivares

Apr 27, 2025

Lograr Tus Metas Con La Garantia De Alberto Ardila Olivares

Apr 27, 2025 -

Grand National Horse Deaths A Look At The Statistics Before 2025

Apr 27, 2025

Grand National Horse Deaths A Look At The Statistics Before 2025

Apr 27, 2025 -

Juliette Binoche Appointed President Of The Cannes Jury For 2025

Apr 27, 2025

Juliette Binoche Appointed President Of The Cannes Jury For 2025

Apr 27, 2025 -

Bundestag Elections And Their Impact On The Dax

Apr 27, 2025

Bundestag Elections And Their Impact On The Dax

Apr 27, 2025 -

Resultados Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Resultados Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Latest Posts

-

New York Yankees 2000 Season A Game Recap Royals Vs Yankees

Apr 28, 2025

New York Yankees 2000 Season A Game Recap Royals Vs Yankees

Apr 28, 2025 -

Impact Of Musks Debt Sale A Financial Analysis Of X Corp

Apr 28, 2025

Impact Of Musks Debt Sale A Financial Analysis Of X Corp

Apr 28, 2025 -

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025 -

Decoding Xs Finances Key Takeaways From Musks Recent Debt Offering

Apr 28, 2025

Decoding Xs Finances Key Takeaways From Musks Recent Debt Offering

Apr 28, 2025 -

Xs Financial Transformation Unpacking The Data From Musks Debt Sale

Apr 28, 2025

Xs Financial Transformation Unpacking The Data From Musks Debt Sale

Apr 28, 2025