XRP Commodity Classification: Ripple Lawsuit Settlement Talks And Implications

Table of Contents

The SEC's Case Against Ripple and its Core Arguments

The Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs in December 2020, alleging that Ripple sold XRP as an unregistered security. The SEC's core argument hinges on the application of the Howey Test, a legal framework used to determine whether an investment contract constitutes a security.

- The SEC's definition of a security and how it applies to XRP: The SEC argues that XRP meets the criteria of an investment contract under the Howey Test: an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. They contend that Ripple's distribution of XRP was akin to an ongoing securities offering.

- Key arguments presented by the SEC regarding XRP's sales and distribution: The SEC points to Ripple's programmatic sales of XRP, its partnerships with exchanges, and its marketing efforts as evidence of a deliberate strategy to distribute unregistered securities. They highlight the substantial profits that early investors allegedly made from XRP's price appreciation.

- The legal precedents cited by the SEC in their case: The SEC relies on various legal precedents related to unregistered securities offerings, emphasizing the importance of investor protection and adherence to securities laws.

Ripple's Defense and Counterarguments

Ripple has vigorously defended itself against the SEC's claims, arguing that XRP is a decentralized digital asset that functions as a currency or a commodity, not a security.

- Ripple's argument that XRP is a currency or a commodity: Ripple emphasizes XRP's functionality as a medium of exchange and a store of value, highlighting its use on various decentralized exchanges and its broad adoption within the crypto ecosystem. They argue it's not subject to the same regulations as securities.

- Evidence presented by Ripple to support their claims: Ripple has presented evidence demonstrating the decentralized nature of XRP's network, the widespread use of XRP for payments, and the lack of centralized control over its distribution or price. They've also pointed to numerous other cryptocurrencies that operate similarly.

- Expert testimony and legal analysis used in Ripple's defense: Ripple has engaged leading legal experts and economists to support its position, providing expert testimony and analysis that challenges the SEC's interpretation of securities laws and their application to XRP.

Ongoing Settlement Talks and Potential Outcomes

Settlement negotiations between Ripple and the SEC are ongoing, with various potential outcomes.

- Potential scenarios for a settlement agreement (e.g., partial settlement, consent decree): A settlement could involve Ripple admitting to some wrongdoing while avoiding further litigation, potentially leading to a consent decree with specific conditions. A partial settlement could address certain aspects of the case while leaving others unresolved.

- The likely implications of different settlement outcomes for XRP's classification: A settlement that includes a characterization of XRP as a security could have significant negative implications for XRP's price and adoption. Conversely, a settlement that acknowledges XRP's functionality as a currency or commodity could be more favorable.

- The potential impact on Ripple's future operations and business model: The outcome of the lawsuit will significantly affect Ripple's future operations and ability to conduct business in the United States and globally. A negative outcome could lead to significant restrictions on their operations.

Implications for the Broader Cryptocurrency Market

The outcome of the Ripple lawsuit will have far-reaching implications for the broader cryptocurrency market and regulatory landscape.

- The potential for increased regulatory scrutiny of other crypto assets: The SEC's actions against Ripple could signal increased scrutiny of other crypto assets, potentially leading to more lawsuits and regulatory actions.

- The impact on investor confidence and market volatility: Uncertainty surrounding the XRP commodity classification and the broader regulatory environment is likely to cause increased market volatility. Investor confidence could be significantly impacted depending on the outcome.

- Potential changes to crypto trading and exchange practices: The lawsuit's outcome could prompt changes to how cryptocurrencies are listed on exchanges and traded, potentially increasing compliance costs and reducing market liquidity.

Conclusion

The Ripple lawsuit and its potential settlement are pivotal events impacting the XRP commodity classification and the entire cryptocurrency market. The outcome will likely establish crucial precedents for future regulatory actions, shaping how other crypto assets are classified and traded. Understanding the different possibilities – from a full settlement to a prolonged legal battle – is essential for investors and market participants.

Call to Action: Stay informed about the evolving situation surrounding the XRP commodity classification and its implications. Follow reputable news sources and expert analysis to navigate the complexities of this landmark legal case and make informed investment decisions. Continue to monitor developments related to XRP classification as it impacts the future of the cryptocurrency market.

Featured Posts

-

The Importance Of Middle Management Benefits For Companies And Employees

May 02, 2025

The Importance Of Middle Management Benefits For Companies And Employees

May 02, 2025 -

Analysis Justice Departments School Desegregation Order And Its Consequences

May 02, 2025

Analysis Justice Departments School Desegregation Order And Its Consequences

May 02, 2025 -

Mstqbl Alaleab Nzrt Mtemqt Ela Blay Styshn 6

May 02, 2025

Mstqbl Alaleab Nzrt Mtemqt Ela Blay Styshn 6

May 02, 2025 -

France Wins Six Nations Englands Powerful Performance Scotland And Ireland Underperform

May 02, 2025

France Wins Six Nations Englands Powerful Performance Scotland And Ireland Underperform

May 02, 2025 -

School Suspensions Harmful Consequences And Effective Alternatives

May 02, 2025

School Suspensions Harmful Consequences And Effective Alternatives

May 02, 2025

Latest Posts

-

Guevenlik Goerevlileri Ile Esir Aileleri Arasindaki Olay Israil Meclisi Nde Gerilim Tirmaniyor

May 02, 2025

Guevenlik Goerevlileri Ile Esir Aileleri Arasindaki Olay Israil Meclisi Nde Gerilim Tirmaniyor

May 02, 2025 -

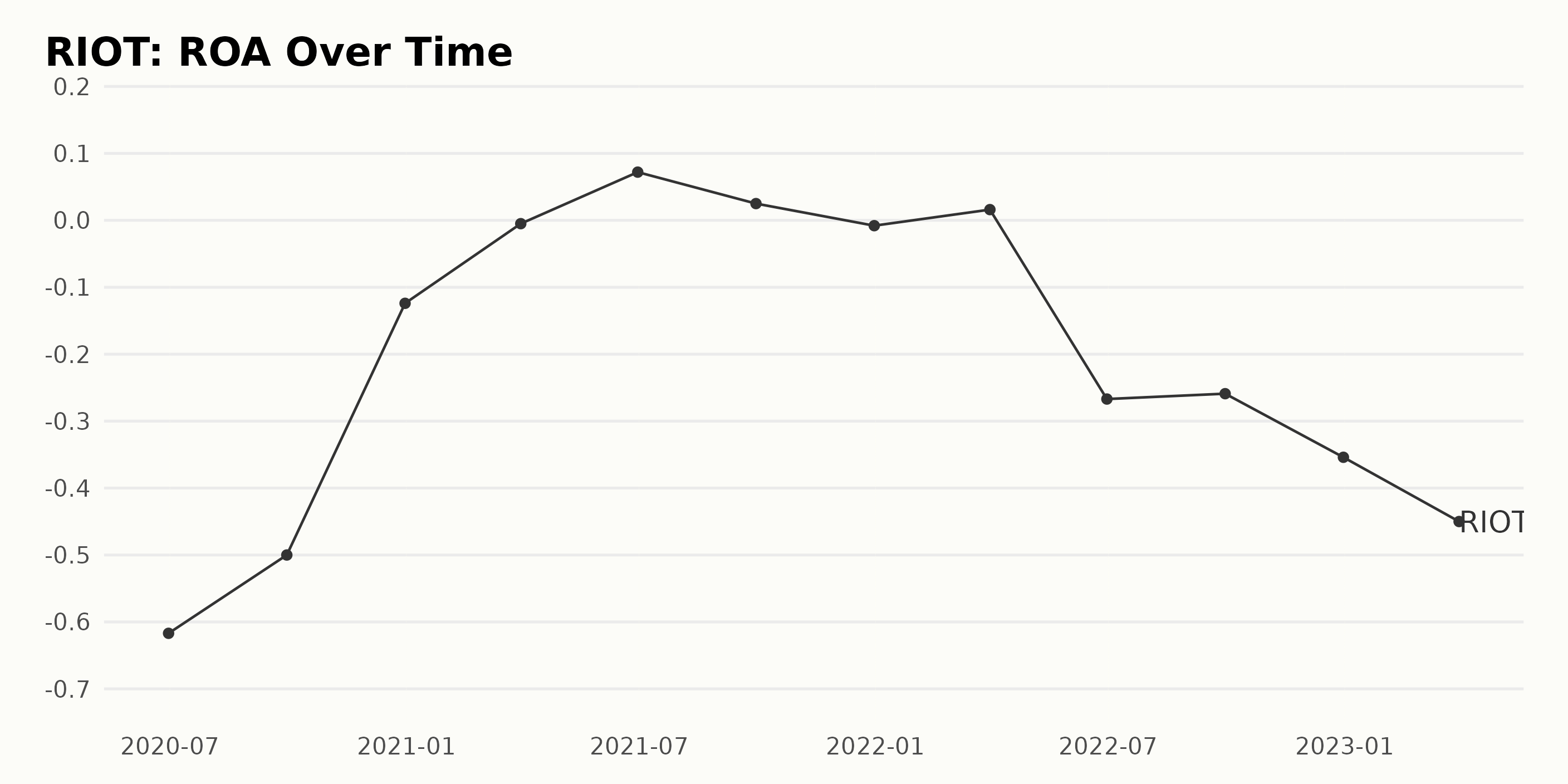

Is Riot Platforms Stock Riot A Good Investment Analyzing Riot And Coin

May 02, 2025

Is Riot Platforms Stock Riot A Good Investment Analyzing Riot And Coin

May 02, 2025 -

Israil Meclisi Esir Yakinlari Ile Guevenlik Guecleri Arasindaki Catisma

May 02, 2025

Israil Meclisi Esir Yakinlari Ile Guevenlik Guecleri Arasindaki Catisma

May 02, 2025 -

Riot Platforms Stock Riot A Deep Dive Into Recent Performance

May 02, 2025

Riot Platforms Stock Riot A Deep Dive Into Recent Performance

May 02, 2025 -

Understanding The Riot Platforms Inc Irrevocable Proxy And Waiver

May 02, 2025

Understanding The Riot Platforms Inc Irrevocable Proxy And Waiver

May 02, 2025