XRP (Ripple) Price Prediction: Should You Invest Below $3?

Table of Contents

XRP's Current Market Position and Recent Price Trends

XRP, the native cryptocurrency of Ripple, currently holds a significant position within the broader cryptocurrency market, though its ranking fluctuates. Analyzing recent price trends reveals considerable volatility, characteristic of the cryptocurrency space. Understanding these fluctuations is critical for any XRP price prediction.

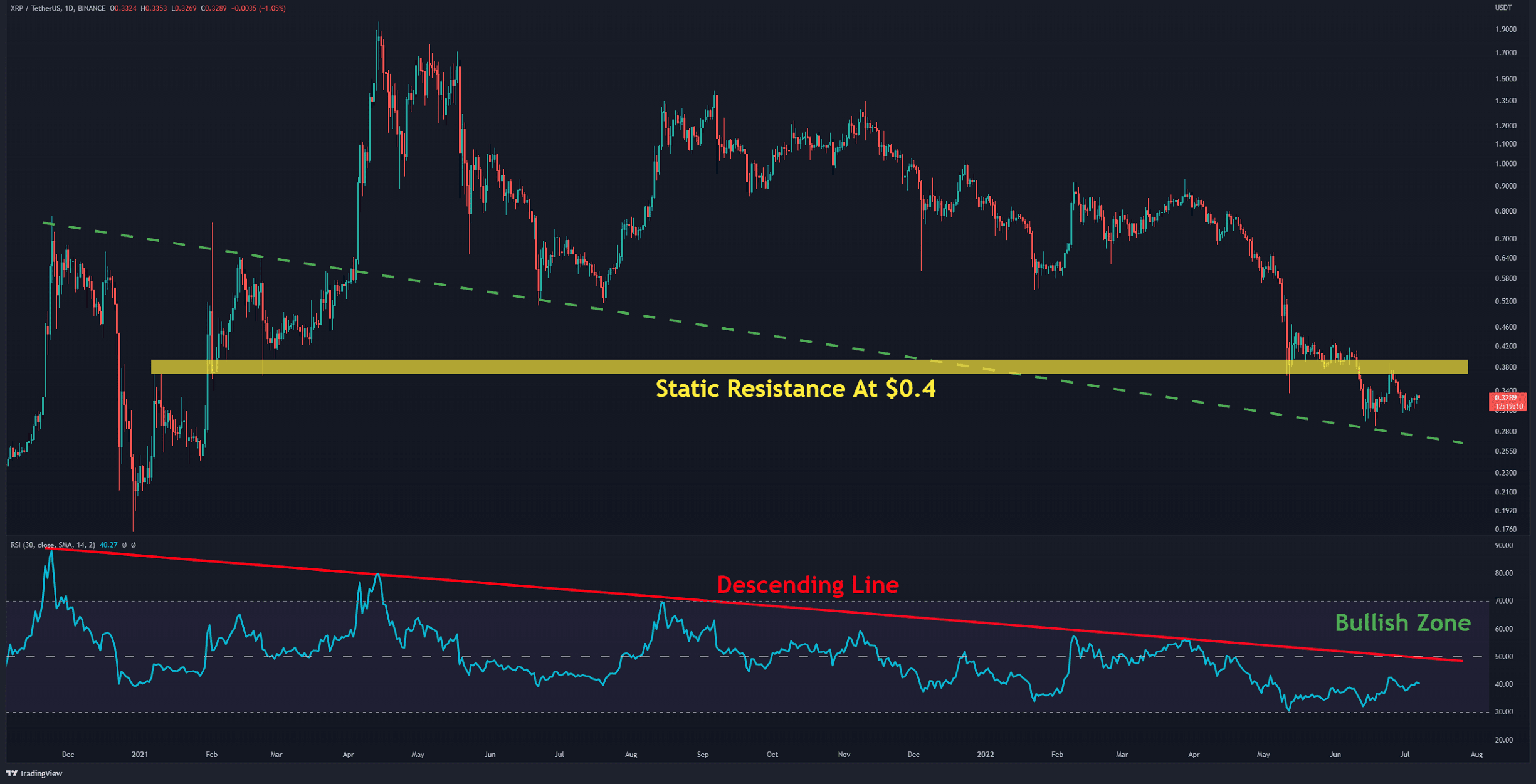

To illustrate, let's consider the following (Note: replace with actual data and chart):

[Insert chart showing XRP price movements over the past few months/year]

- Key Support and Resistance Levels: Identify key price points where XRP has historically found support or faced resistance. These levels can provide insights into potential future price movements. For example, $0.50 might act as significant support, while $1.00 could present a resistance level.

- Significant Price Spikes and Dips: Highlight instances of sudden price increases or drops, analyzing the underlying reasons (e.g., news events, market sentiment). This historical data offers valuable context for predicting future XRP price action.

- Overall Market Sentiment: Gauge the overall investor sentiment towards XRP using social media analysis, news coverage, and analyst opinions. Positive sentiment often correlates with price increases, while negative sentiment can drive prices down.

Impact of the SEC Lawsuit on XRP Price

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price. The lawsuit alleges that Ripple sold XRP as an unregistered security. The outcome remains uncertain, creating significant volatility in the XRP market. Investor confidence is directly tied to the resolution of this legal battle.

- Key Arguments: Summarize the key arguments presented by both the SEC and Ripple. Understanding these arguments helps assess the potential outcomes of the lawsuit. For example, the SEC argues that XRP is a security, while Ripple claims it's a currency.

- Potential Scenarios and Implications: Explore different potential scenarios—a Ripple victory, a settlement, or an SEC win—and their impact on the XRP price. A favorable ruling for Ripple could trigger a significant price surge, while an SEC victory might lead to a considerable drop.

- Impact on Adoption and Partnerships: The lawsuit's impact extends beyond price, affecting XRP's adoption and partnerships. Uncertainty can deter new partnerships and hinder broader adoption, negatively impacting long-term XRP price prediction.

Technological Advancements and Ripple's Ecosystem Growth

Despite the regulatory challenges, Ripple continues to advance its technology and expand its ecosystem. Improvements to the XRP Ledger, the underlying technology of XRP, enhance efficiency and scalability, potentially increasing XRP's value. The growth of RippleNet, Ripple's payment network, also plays a critical role.

- Use Cases within RippleNet: Highlight specific use cases for XRP within RippleNet, demonstrating its practical application in cross-border payments and facilitating global transactions. This demonstrates real-world utility, which is crucial for price appreciation.

- XRP Ledger Upgrades: Discuss any significant upgrades or innovations in the XRP Ledger, such as improved transaction speeds or enhanced security features. These improvements can attract more users and developers, increasing demand for XRP.

- Increased Demand Due to Network Expansion: Analyze the potential for increased demand driven by RippleNet's expansion into new markets and partnerships with financial institutions. A larger user base and greater network effects contribute to positive XRP price prediction.

Factors Influencing Future XRP Price Prediction

Predicting XRP's future price involves considering various factors beyond the immediate regulatory landscape. Macroeconomic factors, broader cryptocurrency market trends, and institutional adoption all play a significant role.

- Macroeconomic Factors: Discuss how global economic conditions (inflation, interest rates, recessionary fears) can influence investor appetite for riskier assets like cryptocurrencies, potentially impacting XRP's price.

- Bitcoin's Influence: Analyze how Bitcoin's price movements often correlate with those of altcoins like XRP. Bitcoin’s performance can significantly influence investor sentiment towards the entire cryptocurrency market, indirectly affecting XRP's price.

- Institutional Adoption: Evaluate the potential for increased institutional adoption of XRP. If large financial institutions begin using XRP for cross-border payments, it could lead to increased demand and a positive impact on its price.

- Regulatory Clarity: The potential for increased regulatory clarity concerning XRP is a major factor in future price prediction. A clear regulatory framework could foster greater confidence and drive price appreciation.

- Competition: Evaluate the competitive landscape. The emergence of competing cryptocurrencies could impact XRP's market share and its future price.

Risk Assessment and Investment Considerations

Investing in cryptocurrencies, including XRP, carries significant risks. The XRP market is highly volatile, and prices can fluctuate dramatically in short periods. Investors should carefully assess their risk tolerance before investing.

- Potential Downsides: Outline the potential downsides of investing in XRP below $3, such as the ongoing SEC lawsuit, market volatility, and the possibility of substantial losses.

- Responsible Investment Approach: Suggest a responsible investment approach, emphasizing diversification, risk management, and only investing funds one can afford to lose.

- Realistic Investment Goals: Advise investors to set realistic investment goals and avoid get-rich-quick schemes. Long-term investment strategies are often more suitable for the volatile cryptocurrency market.

Conclusion

Predicting the XRP price with certainty is impossible. However, by considering factors such as the SEC lawsuit's outcome, technological advancements, market trends, and inherent risks, we can form a more informed opinion. While the potential for XRP to reach or surpass $3 exists, it depends on several intertwined variables. A positive resolution to the SEC lawsuit, coupled with increased adoption and technological advancements, could significantly boost its price. However, the volatility of the cryptocurrency market and the inherent risks should not be underestimated.

Call to Action: While investing in XRP below $3 could potentially be profitable, thorough research and careful consideration of the risks are crucial. Before making any investment decisions, conduct your own due diligence and consider consulting a financial advisor. Remember to only invest what you can afford to lose. Learn more about XRP price predictions and make informed decisions regarding your XRP investment strategy.

Featured Posts

-

Buy Xrp Ripple Now Analyzing The Current Price Below 3

May 02, 2025

Buy Xrp Ripple Now Analyzing The Current Price Below 3

May 02, 2025 -

Secret Service Investigation Ends Cocaine Found At White House

May 02, 2025

Secret Service Investigation Ends Cocaine Found At White House

May 02, 2025 -

Six Nations Frances Convincing Win Sets Up Ireland Showdown

May 02, 2025

Six Nations Frances Convincing Win Sets Up Ireland Showdown

May 02, 2025 -

Fortnites Cowboy Bebop Collaboration Grab Free Items Now

May 02, 2025

Fortnites Cowboy Bebop Collaboration Grab Free Items Now

May 02, 2025 -

Northumberland Mans Epic Voyage A Self Built Boat Circumnavigates The Globe

May 02, 2025

Northumberland Mans Epic Voyage A Self Built Boat Circumnavigates The Globe

May 02, 2025

Latest Posts

-

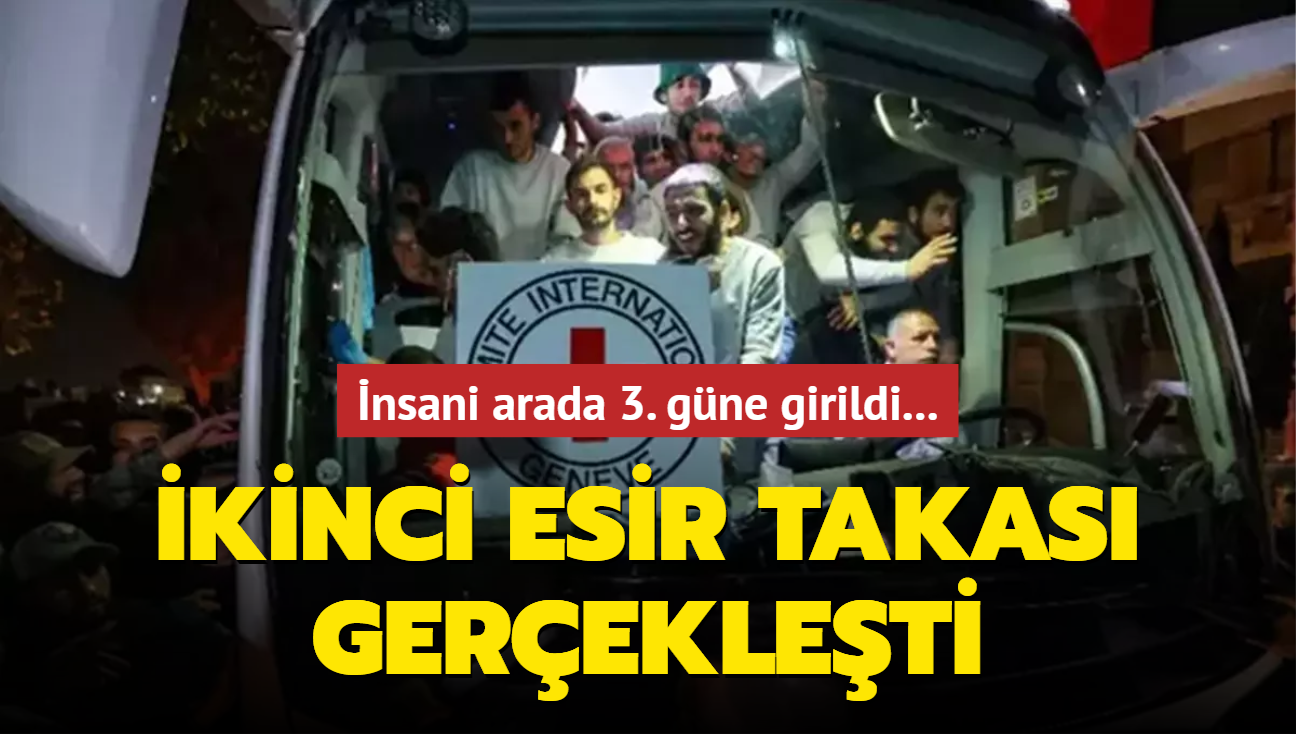

Guevenlik Goerevlileri Ile Esir Aileleri Arasindaki Olay Israil Meclisi Nde Gerilim Tirmaniyor

May 02, 2025

Guevenlik Goerevlileri Ile Esir Aileleri Arasindaki Olay Israil Meclisi Nde Gerilim Tirmaniyor

May 02, 2025 -

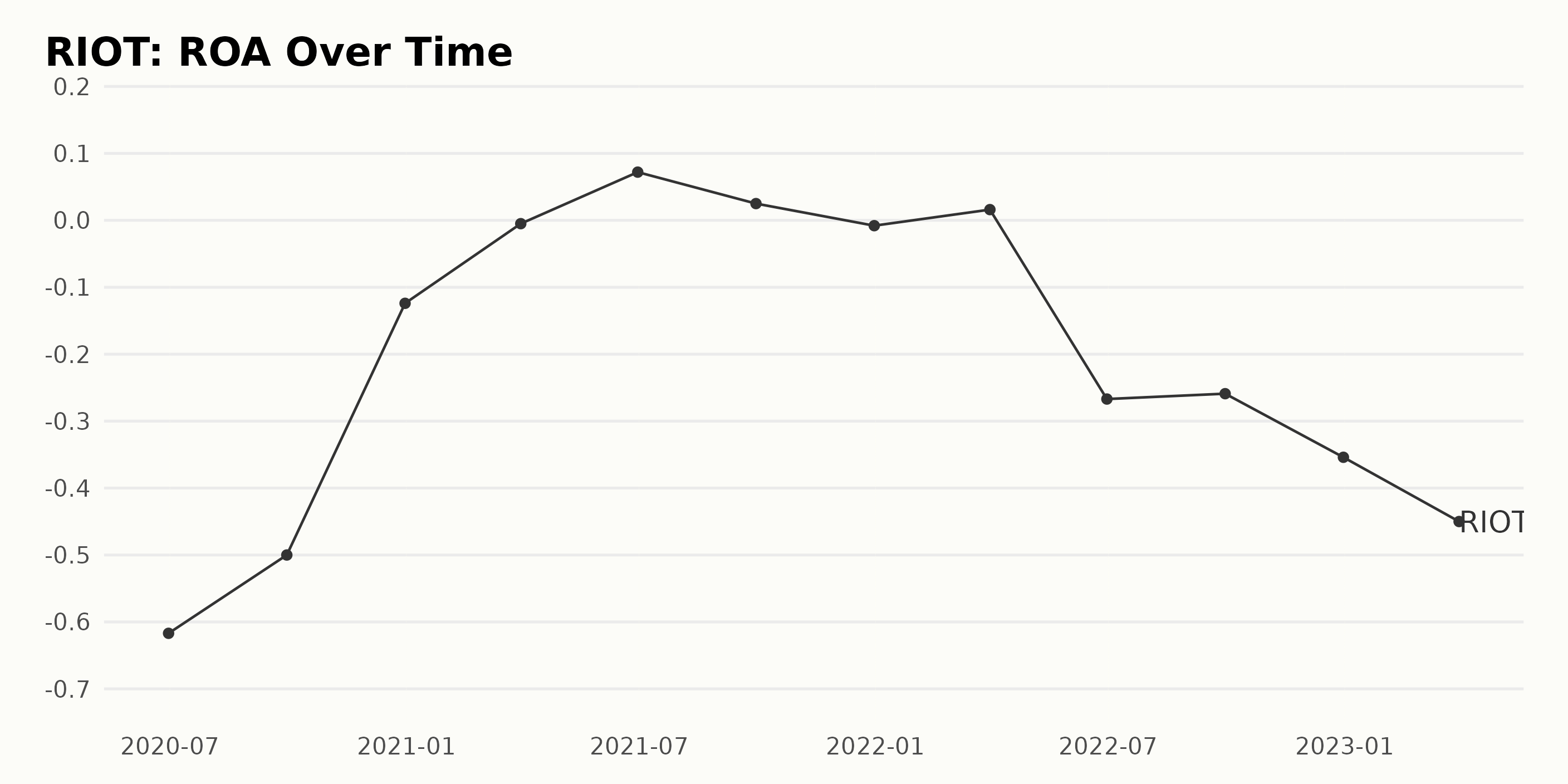

Is Riot Platforms Stock Riot A Good Investment Analyzing Riot And Coin

May 02, 2025

Is Riot Platforms Stock Riot A Good Investment Analyzing Riot And Coin

May 02, 2025 -

Israil Meclisi Esir Yakinlari Ile Guevenlik Guecleri Arasindaki Catisma

May 02, 2025

Israil Meclisi Esir Yakinlari Ile Guevenlik Guecleri Arasindaki Catisma

May 02, 2025 -

Riot Platforms Stock Riot A Deep Dive Into Recent Performance

May 02, 2025

Riot Platforms Stock Riot A Deep Dive Into Recent Performance

May 02, 2025 -

Understanding The Riot Platforms Inc Irrevocable Proxy And Waiver

May 02, 2025

Understanding The Riot Platforms Inc Irrevocable Proxy And Waiver

May 02, 2025