AIMSCAP WTT: Strategies For Success In The World Trading Tournament

Table of Contents

Understanding the AIMSCAP WTT Rules and Regulations

Before diving into intricate trading strategies, a thorough understanding of the AIMSCAP World Trading Tournament rules and regulations is paramount. Ignoring even minor details can lead to penalties and significantly impact your final score.

Thorough Rule Review

- Trading Restrictions: Carefully review limitations on asset classes, trading frequencies, and leverage. Understanding these restrictions is fundamental to shaping your trading plan.

- Scoring System: Familiarize yourself with the precise scoring methodology. Points awarded may be based on profit, risk-adjusted returns, or a combination of factors. A clear understanding is critical for optimizing your strategy.

- Penalty Clauses: Understand penalties for violating any rules, such as exceeding leverage limits or engaging in prohibited trading activities. These penalties can dramatically affect your final ranking.

Understanding these rules directly translates into better trading decisions. For instance, knowing the penalty for excessive losses can encourage more cautious risk management, increasing your chances of a higher score.

Interpreting Scoring Mechanisms

The AIMSCAP WTT scoring system often incorporates several key components:

- Profit Maximization: High profits are crucial, but they must be balanced with risk management.

- Risk Management: Minimizing losses is as important as maximizing gains. The scoring system likely penalizes excessive risk-taking.

- Trading Frequency: The frequency and size of trades might influence your score. Some tournaments may reward consistent, smaller profits over infrequent, larger ones.

A strategy focused solely on profit without considering risk might yield losses that outweigh the gains, resulting in a lower score. Conversely, excessive risk aversion might prevent you from capitalizing on profitable opportunities.

Developing a Winning AIMSCAP WTT Trading Strategy

Crafting a robust trading strategy tailored to the AIMSCAP WTT is vital. This involves a combination of effective risk management and strategic trading techniques.

Risk Management in the WTT

Effective risk management is not just important; it's crucial for survival in the competitive AIMSCAP World Trading Tournament.

- Stop-Loss Orders: Implement stop-loss orders to limit potential losses on each trade. This prevents catastrophic drawdowns that could derail your entire tournament.

- Position Sizing: Carefully determine the appropriate size of your positions relative to your overall capital. Avoid overexposure to any single asset.

- Diversification: Spread your investments across multiple asset classes to reduce the impact of losses in any one area.

Poor risk management can lead to rapid depletion of your trading capital, effectively ending your participation in the WTT prematurely.

Optimizing Trading Techniques for AIMSCAP WTT

The AIMSCAP WTT environment requires adaptation. Consider these trading styles:

- Swing Trading: Holding positions for several days or weeks can allow you to capitalize on longer-term market trends.

- Day Trading: This strategy, which involves holding positions for only a single day, is more suitable for active traders who can track market trends consistently.

- Scalping: Taking many short-term positions with minimal price movements can potentially lead to significant profitability, if executed expertly.

The best choice depends on your trading style, risk tolerance, and the specific market conditions during the tournament. Remember to consider the tournament rules and scoring system when choosing your style.

Utilizing AIMSCAP WTT-Specific Resources

AIMSCAP likely provides resources to assist participants:

- Tutorials: Check for official tutorials that provide insights into the WTT platform and strategies.

- Practice Platforms: Utilize any practice platforms offered to test your strategies before the actual tournament.

- Past Data: If available, analyze past tournament data to discover winning trends and strategies.

Leveraging these resources is crucial in boosting your preparation and ultimate performance.

Mastering the Psychological Aspects of the AIMSCAP WTT

The psychological aspects of trading are often underestimated, but can significantly impact performance.

Maintaining Emotional Discipline

The pressure of competition can lead to impulsive decisions.

- Stress Management: Develop techniques to manage stress and maintain focus during the tournament.

- Avoiding Emotional Trading: Refrain from making decisions based on fear or greed. Stick to your plan.

Emotional trading, driven by fear or greed, will typically lead to poor decisions and losses, damaging your overall performance.

Strategic Analysis and Adaptability

Market conditions are dynamic.

- Technical Indicators: Utilize technical analysis tools to identify potential entry and exit points.

- Fundamental Analysis: Consider fundamental factors influencing the markets.

- Adaptability: Be prepared to adjust your strategy based on changing market conditions.

Rigid adherence to a single strategy without considering market shifts might lead to suboptimal results.

Pre-Tournament Preparation for AIMSCAP WTT Success

Thorough preparation is essential for success.

Practice and Simulation

- Practice Platforms: Use any provided platforms to simulate trading conditions.

- Simulated Trading: Test your strategy extensively in a risk-free environment.

This practice allows you to refine your approach and boost your confidence before the actual tournament.

Reviewing Past Tournament Data

- Data Sources: Look for official reports or participant discussions.

- Analysis Methods: Identify trends, successful strategies, and common pitfalls.

Understanding past successes and failures can help you strategize more effectively.

Achieving AIMSCAP WTT Victory Through Strategic Planning

Success in the AIMSCAP WTT hinges on a deep understanding of the rules, a well-defined trading strategy, disciplined risk management, and emotional control. Mastering these areas will significantly improve your chances of success.

To master the AIMSCAP WTT, remember to thoroughly review the rules, develop a winning AIMSCAP WTT strategy that incorporates robust risk management and optimized trading techniques, utilize all available AIMSCAP WTT resources, and cultivate emotional discipline and adaptability. Develop your winning AIMSCAP WTT strategy today and achieve AIMSCAP WTT success! With dedicated preparation and strategic execution, you can achieve AIMSCAP WTT victory.

Featured Posts

-

Sesame Street Netflix Debut Full Story And Todays Other Top Stories

May 21, 2025

Sesame Street Netflix Debut Full Story And Todays Other Top Stories

May 21, 2025 -

Jail Sentence After Antiques Roadshow Appraisal Uncovers Theft

May 21, 2025

Jail Sentence After Antiques Roadshow Appraisal Uncovers Theft

May 21, 2025 -

Abn Amro Waarschuwt Voedingssector Te Afhankelijk Van Goedkope Arbeidsmigranten

May 21, 2025

Abn Amro Waarschuwt Voedingssector Te Afhankelijk Van Goedkope Arbeidsmigranten

May 21, 2025 -

The Goldbergs Behind The Scenes Look At The Popular Sitcom

May 21, 2025

The Goldbergs Behind The Scenes Look At The Popular Sitcom

May 21, 2025 -

Defiez Vos Amis Quiz Sur La Loire Atlantique

May 21, 2025

Defiez Vos Amis Quiz Sur La Loire Atlantique

May 21, 2025

Latest Posts

-

Brexits Toll Uk Luxury Exports Struggle In The Eu Market

May 21, 2025

Brexits Toll Uk Luxury Exports Struggle In The Eu Market

May 21, 2025 -

Are Bmw And Porsche Losing Their Grip On The Chinese Market

May 21, 2025

Are Bmw And Porsche Losing Their Grip On The Chinese Market

May 21, 2025 -

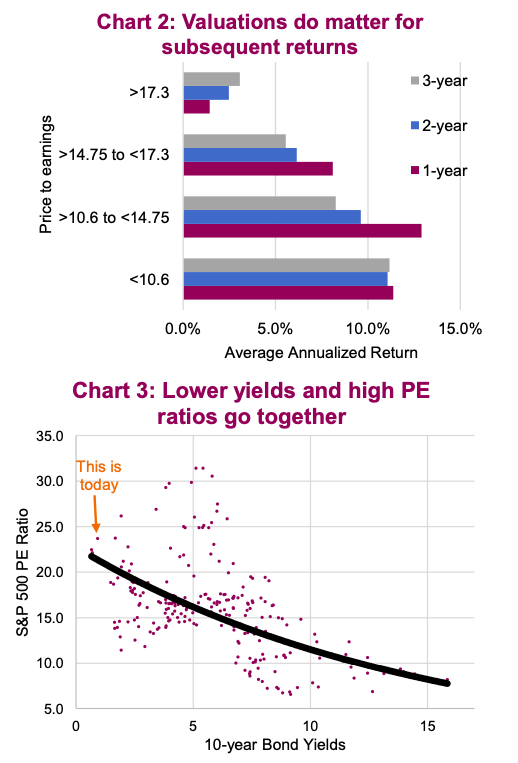

Understanding High Stock Market Valuations Bof As Take And Investor Implications

May 21, 2025

Understanding High Stock Market Valuations Bof As Take And Investor Implications

May 21, 2025 -

Uk Luxury Sector Brexits Contribution To Export Lag In The Eu

May 21, 2025

Uk Luxury Sector Brexits Contribution To Export Lag In The Eu

May 21, 2025 -

The China Factor Why Bmw And Porsche Are Facing Headwinds

May 21, 2025

The China Factor Why Bmw And Porsche Are Facing Headwinds

May 21, 2025