Bitcoin Price Surge: Trump's Actions Ease Market Uncertainty

Table of Contents

Trump's Actions and their Impact on Market Sentiment

The Announcement and its Immediate Effect

A key event triggering the Bitcoin price surge was Trump's announcement regarding [insert specific action/announcement here, e.g., a potential policy shift related to trade or regulation]. The immediate market reaction was a palpable sense of relief. Investor confidence, previously shaken by [mention the source of previous market uncertainty], saw a marked increase.

- Bitcoin price: Increased by X% within Y hours of the announcement.

- Trading volume: Experienced a Z% surge, indicating increased trading activity.

- S&P 500: The S&P 500 also showed a positive response, rising by A% suggesting a broader market improvement influenced by Trump’s action.

- Analyst Quote: "[Insert quote from a reputable financial analyst regarding the immediate market reaction and its connection to Trump's actions]."

Reduced Geopolitical Uncertainty

Trump's actions, or rather the lack of certain anticipated negative actions, contributed significantly to a decrease in global geopolitical uncertainty. This reduction in tension had a positive ripple effect on Bitcoin, often seen as a safe-haven asset during times of instability.

- Reduced Tensions: [Provide specific examples of reduced geopolitical tensions, with links to supporting news articles. For example: Easing of trade disputes with [Country X], de-escalation of tensions in [Region Y]].

- Investor Confidence: This newfound stability encouraged investors to move capital into riskier assets, including Bitcoin, contributing to the price increase. The perception of reduced risk directly influenced investment decisions.

Impact on the Dollar and its Correlation with Bitcoin

The relationship between the US dollar and Bitcoin is complex. Trump's actions, depending on their effect on the dollar's strength, directly or indirectly impacted the Bitcoin price surge. A weakening dollar can often lead to increased demand for alternative assets, such as Bitcoin.

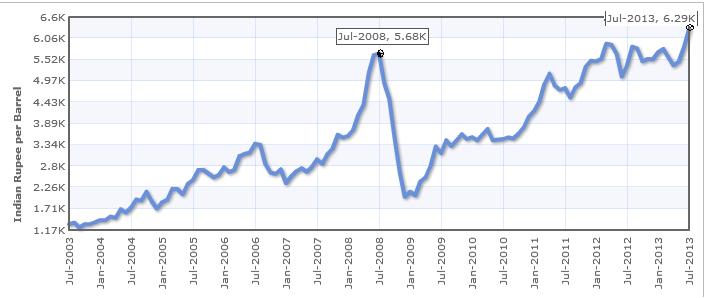

- Dollar Index Correlation: [Insert a chart illustrating the correlation between the US dollar index and Bitcoin's price during the period in question]. A clear inverse correlation suggests that a weakening dollar (possibly due to Trump’s actions) fueled the Bitcoin price surge.

- Economic Principles: The underlying economic principle here is that a weaker dollar makes Bitcoin, priced in dollars, relatively cheaper for investors holding other currencies, thus increasing demand.

Analyzing the Bitcoin Price Surge: Beyond Trump's Actions

Other Contributing Factors

While Trump's actions played a significant role in the Bitcoin price surge, it's crucial to acknowledge other contributing factors. This wasn't a single-cause event.

- Institutional Investment: Increased interest from institutional investors, such as hedge funds and corporations, has consistently driven up demand.

- Regulatory Developments: Positive regulatory developments or a lack of negative news in key jurisdictions can boost investor confidence.

- Technological Advancements: Improvements in Bitcoin's underlying technology and scalability solutions can positively impact its long-term prospects.

Technical Analysis of the Surge

Technical indicators confirm the significant price movement. The price broke through key resistance levels, coupled with increased trading volume, strongly suggesting a sustained upward trend.

- RSI (Relative Strength Index): Showed a reading above [Insert value], suggesting overbought conditions, a common occurrence during significant price surges.

- MACD (Moving Average Convergence Divergence): A bullish crossover confirmed the upward momentum.

- Moving Averages: Price movement consistently stayed above key moving averages (e.g., 50-day and 200-day), reinforcing the bullish trend. [Link to relevant charts showcasing these indicators].

Long-Term Implications for Bitcoin

The Bitcoin price surge, partly fueled by Trump's actions, has significant long-term implications. While short-term volatility is expected, the event highlights Bitcoin's sensitivity to both geopolitical developments and broader market sentiment.

- Future Predictions: Experts are divided on Bitcoin's long-term trajectory, but the recent surge suggests continued growth potential.

- Volatility: While the price increased significantly, Bitcoin's inherent volatility means future fluctuations are inevitable.

Conclusion

In summary, Trump's actions played a notable role in easing market uncertainty, contributing significantly to the substantial Bitcoin price surge. Other factors, including institutional investment and supportive technical indicators, played crucial supporting roles. While the long-term effects remain to be seen, this event underlines Bitcoin's sensitivity to global events and overall market sentiment.

Call to Action: Stay informed about future developments influencing the Bitcoin price surge and its potential consequences. Continue researching and monitoring the cryptocurrency market to make informed investment decisions. Learn more about factors influencing Bitcoin price fluctuations and stay updated on the latest Bitcoin price news.

Featured Posts

-

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th

Apr 24, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th

Apr 24, 2025 -

Canadian Dollar Fluctuations A Deep Dive Into Recent Market Trends

Apr 24, 2025

Canadian Dollar Fluctuations A Deep Dive Into Recent Market Trends

Apr 24, 2025 -

Canadian Dollar A Case Study In Currency Appreciation And Depreciation

Apr 24, 2025

Canadian Dollar A Case Study In Currency Appreciation And Depreciation

Apr 24, 2025 -

Crude Oil Market Report Prices And Analysis April 23 2024

Apr 24, 2025

Crude Oil Market Report Prices And Analysis April 23 2024

Apr 24, 2025 -

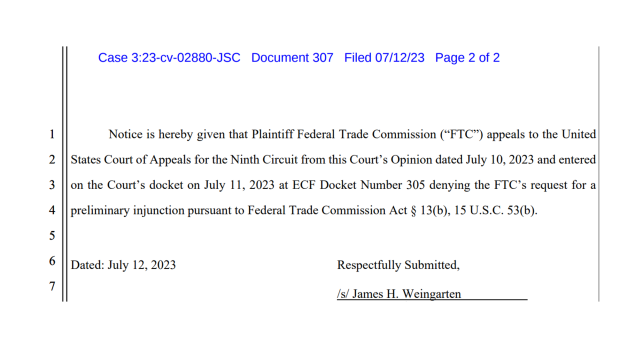

Ftc Challenges Microsoft Activision Merger A Legal Battle Ahead

Apr 24, 2025

Ftc Challenges Microsoft Activision Merger A Legal Battle Ahead

Apr 24, 2025