Conquering Financial Constraints: Strategies To Overcome Lack Of Funds

Table of Contents

Budgeting and Expense Tracking

Effective management starts with understanding where your money is going. This involves both creating a realistic budget and diligently tracking your expenses.

Creating a Realistic Budget

Tracking your income and expenses is crucial for creating a workable budget. This provides a clear picture of your financial inflow and outflow. Several methods can help:

- The 50/30/20 rule: Allocate 50% of your income to needs (housing, food, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

- Zero-based budgeting: Assign every dollar a specific purpose, ensuring all income is allocated. This method eliminates unnecessary spending.

Identifying and cutting unnecessary expenses is key. Analyze your spending habits to pinpoint areas where you can reduce costs.

- Expense Tracking Apps: Mint, Personal Capital, YNAB (You Need A Budget) can automate tracking and offer insightful reports.

- Identifying Hidden Expenses: Review bank and credit card statements for recurring subscriptions you may have forgotten about, such as streaming services or gym memberships. Are you paying for unused services?

Identifying Areas for Savings

Once you have a clear picture of your spending, focus on reducing recurring costs.

-

Reduce Recurring Costs: Negotiate lower rates for utilities (internet, phone, electricity) and cancel unnecessary subscriptions.

-

Save on Groceries: Meal prepping, buying in bulk (when sensible), and utilizing coupons can significantly reduce grocery bills.

-

Transportation Savings: Utilize public transport, carpool, or cycle whenever feasible to reduce fuel and maintenance costs. Consider walking or cycling for short trips.

-

Entertainment Savings: Explore free or low-cost entertainment options, such as parks, libraries, free community events, or home-based activities.

Increasing Income Streams

Diversifying your income sources can significantly alleviate financial constraints.

Exploring Additional Income Opportunities

The gig economy offers numerous possibilities for boosting your income.

-

Freelancing: Leverage your skills (writing, design, programming) on platforms like Upwork or Fiverr.

-

Part-time Jobs: Consider a part-time job in retail, customer service, or hospitality, depending on your availability.

-

Gig Work: Explore options like food delivery (Uber Eats, DoorDash), rideshare driving (Uber, Lyft), or task-based apps (TaskRabbit).

-

Side Hustles: Identify your skills and passions and turn them into income-generating activities. This could range from selling crafts on Etsy to offering tutoring services.

-

Marketing your Freelance Services: Build a professional online portfolio and network actively to attract clients.

Negotiating a Raise or Seeking a Better-Paying Job

Don't undervalue your skills. A raise or a new job can significantly impact your finances.

-

Negotiating a Salary Increase: Research the market value for your role and highlight your accomplishments and contributions to justify a raise.

-

Job Search: Research companies offering roles aligned with your skills and salary expectations. Use job search websites (Indeed, LinkedIn) and network strategically.

-

Interview Preparation: Practice your interviewing skills, highlight transferable skills, and research the company thoroughly.

-

Salary Research Resources: Websites like Glassdoor and Salary.com provide salary data for various positions and locations.

Managing Debt Effectively

Debt can significantly exacerbate financial constraints. Effective management is vital.

Understanding Different Types of Debt

Understanding the difference between good debt and bad debt is essential.

-

Good Debt: Often used for investments with a potential return, such as student loans for education or a mortgage for a home.

-

Bad Debt: High-interest debt, such as credit card debt, with little to no potential for future returns. This should be prioritized for repayment.

-

Examples of Debt and Interest Rates: Research current interest rates for various types of loans (credit cards, personal loans, mortgages) to understand the costs involved.

Debt Repayment Strategies

Several methods can be used to tackle debt:

-

Debt Snowball: Pay off the smallest debt first, regardless of interest rate, for motivation.

-

Debt Avalanche: Pay off the debt with the highest interest rate first to save money on interest.

-

Debt Consolidation: Combine multiple debts into a single loan with a potentially lower interest rate.

-

Balance Transfers: Transfer high-interest credit card balances to cards with introductory 0% APR offers.

-

Debt Counseling Resources: Consider seeking guidance from a non-profit credit counseling agency if you are struggling to manage your debt.

Seeking Financial Assistance and Resources

If you're facing severe financial hardship, exploring available resources can provide crucial support.

Exploring Government Assistance Programs

Many governments offer programs to assist individuals and families in need.

- Eligibility Criteria: Each program has specific eligibility requirements. Research programs relevant to your situation and location.

- Examples of Government Assistance: Food stamps (SNAP), housing assistance (Section 8), unemployment benefits, and other social welfare programs vary by location. Check your local government website for details.

Utilizing Non-Profit Organizations and Charities

Non-profit organizations and charities offer support and resources.

-

Financial Literacy Programs: Many organizations provide free financial education to help you manage your money effectively.

-

Emergency Aid: In times of crisis, these organizations might provide temporary financial assistance for essential needs.

-

Examples of Reputable Charities: Research local and national charities with a strong track record of providing financial assistance.

Conclusion

Conquering financial constraints requires a multi-pronged approach. By implementing these strategies – creating a budget, increasing your income, managing debt effectively, and seeking assistance when needed – you can take control of your finances. Start conquering your financial constraints today! Take control of your finances and overcome lack of funds with these practical strategies. Remember, proactive steps towards financial stability will lead to a more secure and fulfilling future.

Featured Posts

-

Occasionmarkt Bloeit Abn Amro Rapporteert Aanzienlijke Verkoopstijging

May 21, 2025

Occasionmarkt Bloeit Abn Amro Rapporteert Aanzienlijke Verkoopstijging

May 21, 2025 -

Architecture Toscane En Dehors De L Italie Le Cas De La Petite Italie De L Ouest

May 21, 2025

Architecture Toscane En Dehors De L Italie Le Cas De La Petite Italie De L Ouest

May 21, 2025 -

Risicos Voor De Voedingsindustrie Abn Amro Over Afhankelijkheid Van Arbeidsmigranten

May 21, 2025

Risicos Voor De Voedingsindustrie Abn Amro Over Afhankelijkheid Van Arbeidsmigranten

May 21, 2025 -

Fastest Person To Walk Across Australia William Goodges Journey

May 21, 2025

Fastest Person To Walk Across Australia William Goodges Journey

May 21, 2025 -

3 1

May 21, 2025

3 1

May 21, 2025

Latest Posts

-

Brexits Toll Uk Luxury Exports Struggle In The Eu Market

May 21, 2025

Brexits Toll Uk Luxury Exports Struggle In The Eu Market

May 21, 2025 -

Are Bmw And Porsche Losing Their Grip On The Chinese Market

May 21, 2025

Are Bmw And Porsche Losing Their Grip On The Chinese Market

May 21, 2025 -

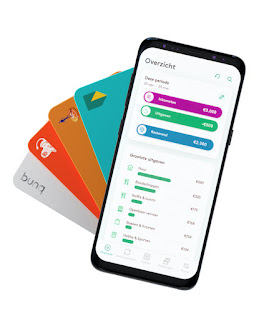

Understanding High Stock Market Valuations Bof As Take And Investor Implications

May 21, 2025

Understanding High Stock Market Valuations Bof As Take And Investor Implications

May 21, 2025 -

Uk Luxury Sector Brexits Contribution To Export Lag In The Eu

May 21, 2025

Uk Luxury Sector Brexits Contribution To Export Lag In The Eu

May 21, 2025 -

The China Factor Why Bmw And Porsche Are Facing Headwinds

May 21, 2025

The China Factor Why Bmw And Porsche Are Facing Headwinds

May 21, 2025