Lack Of Funds: A Guide To Financial Freedom And Stability

Table of Contents

Understanding Your Current Financial Situation

Before you can embark on your journey to financial freedom, you need to understand your current financial landscape. This involves a thorough assessment of your income and expenses, as well as identifying and addressing any existing debt.

Assessing Your Income and Expenses

The first step is to get a clear picture of your financial inflow and outflow.

- Track income sources: List all your sources of income, including salary, part-time jobs, investments, and any other income streams. Be as detailed as possible.

- Categorize expenses: Divide your expenses into needs (housing, food, transportation, utilities) and wants (entertainment, dining out, subscriptions). This helps identify areas where you can potentially cut back.

- Identify areas for potential savings: Once you've categorized your expenses, analyze where you can reduce spending without significantly impacting your quality of life.

Several budgeting methods can help you manage your finances effectively. The 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Zero-based budgeting involves starting from scratch each month, allocating every dollar to a specific purpose. Many free budgeting apps and tools, like Mint and YNAB (You Need A Budget), can simplify this process. For example, tracking your spending with a spreadsheet or app for a month can reveal surprising insights into your spending habits.

Identifying Debt and Creating a Repayment Plan

Facing debt can be overwhelming, but creating a structured repayment plan is crucial for achieving financial stability.

- List all debts: Make a comprehensive list of all your debts, including credit cards, loans, and other outstanding balances. Note the interest rates and minimum payments for each.

- Prioritize high-interest debts: Focus on paying down debts with the highest interest rates first, as these accrue the most interest over time. This is often referred to as the debt avalanche method. Alternatively, the debt snowball method involves paying off the smallest debts first for a psychological boost of motivation.

- Explore debt consolidation options: Consider consolidating high-interest debts into a lower-interest loan to simplify repayments and potentially save money on interest.

Negotiating lower interest rates with your creditors can also significantly reduce your debt burden. Many resources are available online to help you manage debt effectively; exploring these can provide invaluable support.

Building a Budget and Sticking to It

Creating and sticking to a budget is fundamental to overcoming a lack of funds and achieving long-term financial stability.

Creating a Realistic Budget

A realistic budget considers your income, expenses, and financial goals.

- Allocate funds for necessities: Ensure you allocate enough for essential expenses like housing, food, transportation, and healthcare.

- Prioritize savings: Even small amounts saved consistently can accumulate over time.

- Allocate for debt repayment: Include your debt repayment plan within your budget.

- Allow for discretionary spending: Include a small amount for non-essential expenses to avoid feeling deprived.

Budgeting templates and worksheets are widely available online to help you organize your finances. Regularly review and adjust your budget as your circumstances change to maintain its effectiveness.

Strategies for Saving Money

Saving money requires conscious effort and creative strategies.

- Reduce unnecessary expenses: Identify areas where you can cut back, such as subscriptions, eating out, and impulse purchases.

- Find cheaper alternatives: Explore affordable alternatives for goods and services, such as generic brands, secondhand shopping, or free entertainment options.

- Explore side hustles: Consider taking on a part-time job or freelancing to supplement your income.

- Automate savings: Set up automatic transfers from your checking account to your savings account each month to make saving effortless.

Meal prepping, using coupons, negotiating bills, and exploring freelance platforms are excellent examples of practical money-saving strategies. There are numerous side hustles that require different skill sets. You could offer tutoring services, pet-sitting, virtual assistant work, or sell crafts online.

Increasing Your Income

Boosting your income is a powerful strategy to overcome a lack of funds and accelerate your journey towards financial freedom.

Exploring Additional Income Streams

Diversifying your income sources can significantly improve your financial situation.

- Side hustles: Explore freelancing, gig work, or part-time jobs that align with your skills and interests. Popular platforms like Upwork and Fiverr offer numerous freelance opportunities.

- Selling unused items: Declutter your home and sell unwanted items online or at consignment shops.

- Investing in income-generating assets: Explore options like dividend-paying stocks or rental properties for passive income. However, research any investment thoroughly before committing.

The choice of side hustle depends heavily on individual skills and interests. For example, someone with writing skills could offer freelance writing services, while someone with a car could consider ride-sharing.

Investing for Long-Term Financial Growth

Investing wisely is crucial for building long-term financial security.

- Start small: Even small investments can grow significantly over time through the power of compounding.

- Diversify investments: Spread your investments across different asset classes to reduce risk.

- Consider low-cost index funds or ETFs: These offer diversified exposure to the market at a low cost.

- Learn about different investment options: Familiarize yourself with various investment options, such as stocks, bonds, and real estate.

Investing involves risk, and it's crucial to understand the potential for loss before investing. Start by learning the basics of investing and consider consulting a financial advisor for personalized guidance.

Seeking Professional Financial Advice

While self-help resources are beneficial, seeking professional financial advice can provide personalized guidance and support.

When to Consult a Financial Advisor

Consulting a financial advisor can be particularly helpful in these situations:

- Significant debt: A financial advisor can help develop a comprehensive debt management plan.

- Complex financial situations: Navigating complex financial matters, like inheritance or business ownership, requires professional expertise.

- Need for personalized investment strategies: A financial advisor can tailor an investment strategy based on your specific risk tolerance and goals.

- Planning for retirement: A financial advisor can help you plan for a secure retirement.

Finding a reputable financial advisor involves thorough research. Look for advisors with relevant qualifications and a strong track record.

Conclusion

Overcoming a lack of funds requires a multi-pronged approach. By understanding your financial situation, creating a realistic budget, increasing your income, and making smart investment decisions, you can build a solid foundation for financial freedom and stability. Remember, even small steps can lead to significant progress. Overcome your lack of funds today by taking the first step: assess your current financial situation and create a budget. Start your journey to financial stability now and take control of your finances to build a path towards financial freedom. Utilize resources such as budgeting apps, debt management tools, and online financial education platforms to support your journey.

Featured Posts

-

Peppa Pigs Cinema Event 10 Episodes Featuring Baby This May

May 21, 2025

Peppa Pigs Cinema Event 10 Episodes Featuring Baby This May

May 21, 2025 -

Love Monster Exploring The Symbolism And Meaning

May 21, 2025

Love Monster Exploring The Symbolism And Meaning

May 21, 2025 -

Abn Amro Rapport De Kwetsbaarheid Van De Voedingssector Door Goedkope Arbeidsmigranten

May 21, 2025

Abn Amro Rapport De Kwetsbaarheid Van De Voedingssector Door Goedkope Arbeidsmigranten

May 21, 2025 -

Vanja Mijatovic Novo Ime Novi Pocetak

May 21, 2025

Vanja Mijatovic Novo Ime Novi Pocetak

May 21, 2025 -

Ancelotti Den Sonra Real Madrid In Yeni Teknik Direktoerue Kim Olacak Juergen Klopp Guendemde

May 21, 2025

Ancelotti Den Sonra Real Madrid In Yeni Teknik Direktoerue Kim Olacak Juergen Klopp Guendemde

May 21, 2025

Latest Posts

-

Brexits Toll Uk Luxury Exports Struggle In The Eu Market

May 21, 2025

Brexits Toll Uk Luxury Exports Struggle In The Eu Market

May 21, 2025 -

Are Bmw And Porsche Losing Their Grip On The Chinese Market

May 21, 2025

Are Bmw And Porsche Losing Their Grip On The Chinese Market

May 21, 2025 -

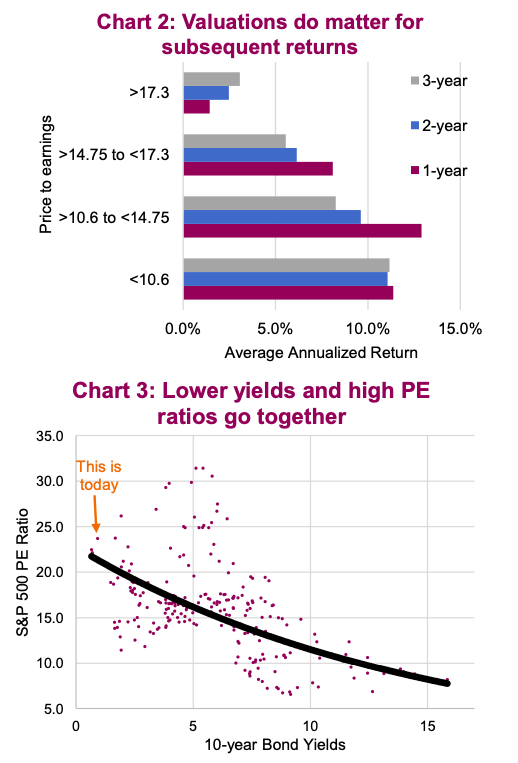

Understanding High Stock Market Valuations Bof As Take And Investor Implications

May 21, 2025

Understanding High Stock Market Valuations Bof As Take And Investor Implications

May 21, 2025 -

Uk Luxury Sector Brexits Contribution To Export Lag In The Eu

May 21, 2025

Uk Luxury Sector Brexits Contribution To Export Lag In The Eu

May 21, 2025 -

The China Factor Why Bmw And Porsche Are Facing Headwinds

May 21, 2025

The China Factor Why Bmw And Porsche Are Facing Headwinds

May 21, 2025