Overcoming Lack Of Funds: A Step-by-Step Guide To Financial Wellness

Table of Contents

Assessing Your Current Financial Situation

Before you can start building financial wellness, you need a clear understanding of your current financial standing. This involves honestly evaluating your income, expenses, debts, and assets.

Creating a Realistic Budget

A realistic budget is the cornerstone of financial wellness. It's a roadmap that helps you track your income and expenses, allowing you to identify areas for improvement.

- Track Income and Expenses: Use budgeting apps like Mint, YNAB (You Need A Budget), or Personal Capital, or a simple spreadsheet to monitor your income from all sources and meticulously record all your expenses. Be honest – even small purchases add up!

- Choose a Budgeting Method: Popular methods include the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), or zero-based budgeting (allocating every dollar to a specific category). Experiment to find what suits your lifestyle best.

- Categorize Your Expenses: Common budget categories include housing (rent/mortgage), transportation (car payments, gas, public transport), food (groceries, dining out), utilities (electricity, water, internet), debt payments, healthcare, entertainment, and savings.

- Identify Areas for Savings: Once you've tracked your spending for a month, analyze where your money goes. Are there subscriptions you don't use? Can you reduce dining out or find cheaper grocery options? Even small cuts can significantly impact your financial health.

Identifying Sources of Debt

Understanding your debt is crucial for improving your financial wellness. High-interest debt can significantly hinder your progress.

- Categorize Your Debts: List all your debts, including credit cards, student loans, personal loans, and medical bills.

- Note Interest Rates and Minimum Payments: Knowing the interest rates and minimum payments for each debt helps you prioritize repayment strategies. High-interest debts should generally be tackled first.

- Assess the Impact of High-Interest Debt: High-interest debt significantly impacts your financial wellness, as a large portion of your payments go towards interest rather than principal. This can lead to a vicious cycle of debt.

Evaluating Your Assets

Knowing your assets provides a clearer picture of your overall financial health.

- List Your Assets: Include savings accounts, checking accounts, investments (stocks, bonds, mutual funds), retirement accounts, and any property you own.

- Calculate Your Net Worth: Subtract your total liabilities (debts) from your total assets to determine your net worth. This gives you a snapshot of your overall financial standing.

- Understand Your Financial Standing: A positive net worth indicates you have more assets than liabilities, while a negative net worth means you owe more than you own. Understanding this is a crucial step towards improving your financial wellness.

Developing Strategies for Improved Financial Wellness

Once you've assessed your financial situation, you can develop strategies to improve your financial wellness.

Increasing Your Income

Boosting your income is a powerful way to accelerate your journey towards financial wellness.

- Explore Additional Income Streams: Consider a part-time job, freelance work, or selling unused items online. The gig economy offers many opportunities for supplemental income.

- Negotiate a Raise or Seek a Higher-Paying Position: Research industry salaries and confidently negotiate for a raise based on your performance and value. Alternatively, actively seek higher-paying opportunities in your field.

- Develop In-Demand Skills: Investing in your skills through education or training can significantly increase your earning potential in the long run.

Reducing Expenses

Reducing unnecessary expenses frees up more money for savings and debt repayment.

- Cut Unnecessary Spending: Identify and eliminate recurring expenses like unused subscriptions, entertainment services, or premium features you don't need.

- Save on Groceries, Utilities, and Transportation: Look for cheaper grocery options, compare energy providers, and explore cost-effective transportation alternatives.

- Practice Mindful Spending: Avoid impulse purchases and create a waiting period before buying non-essential items. This helps you make more informed financial decisions.

Building an Emergency Fund

An emergency fund is a crucial element of financial wellness, providing a safety net during unexpected financial setbacks.

- Aim for 3-6 Months of Living Expenses: This cushion helps prevent debt accumulation when faced with job loss, medical emergencies, or unexpected repairs.

- Save Consistently: Start small; even saving a little each month adds up over time. Automate your savings to make it effortless.

- Prevent Debt Accumulation: An emergency fund is your first line of defense against accumulating debt when unexpected expenses arise.

Seeking Professional Guidance

Sometimes, seeking professional help is essential to achieve financial wellness.

Consulting a Financial Advisor

A financial advisor can provide personalized guidance and create a tailored financial plan to meet your specific goals.

- Benefits of Professional Advice: Financial advisors offer expertise in investing, retirement planning, and debt management.

- Personalized Financial Plans: They can help you create a realistic plan based on your income, expenses, and goals.

- Finding Reputable Advisors: Research and choose a financial advisor with the appropriate qualifications and experience.

Utilizing Credit Counseling Services

Credit counseling services can provide support in managing debt and negotiating with creditors.

- Debt Management Strategies: They can help you develop a debt repayment plan and negotiate lower interest rates.

- Negotiating Lower Interest Rates: Credit counselors can often negotiate lower interest rates with creditors, saving you money on interest payments.

- Reputable Credit Counseling Agencies: Look for non-profit agencies accredited by the National Foundation for Credit Counseling (NFCC).

Conclusion

Overcoming a lack of funds and achieving financial wellness requires a proactive and strategic approach. By assessing your current financial situation, developing effective strategies to increase income and reduce expenses, and seeking professional guidance when needed, you can build a strong foundation for long-term financial security. Remember, building financial wellness is a journey, not a destination. Take the first step today towards a more secure financial future by implementing the strategies outlined in this guide. Start improving your financial wellness now!

Featured Posts

-

Exploring The Sound Perimeter Music As A Unifying Force

May 21, 2025

Exploring The Sound Perimeter Music As A Unifying Force

May 21, 2025 -

Love Monster Activities For Kids Crafts Games And More

May 21, 2025

Love Monster Activities For Kids Crafts Games And More

May 21, 2025 -

Cassis Blackcurrant In Gastronomy Pairing And Applications

May 21, 2025

Cassis Blackcurrant In Gastronomy Pairing And Applications

May 21, 2025 -

Collect Them All The Complete Guide To Dexter Funko Pops

May 21, 2025

Collect Them All The Complete Guide To Dexter Funko Pops

May 21, 2025 -

Liverpools Luck Arne Slot And Luis Enrique On Alisson And The Reds

May 21, 2025

Liverpools Luck Arne Slot And Luis Enrique On Alisson And The Reds

May 21, 2025

Latest Posts

-

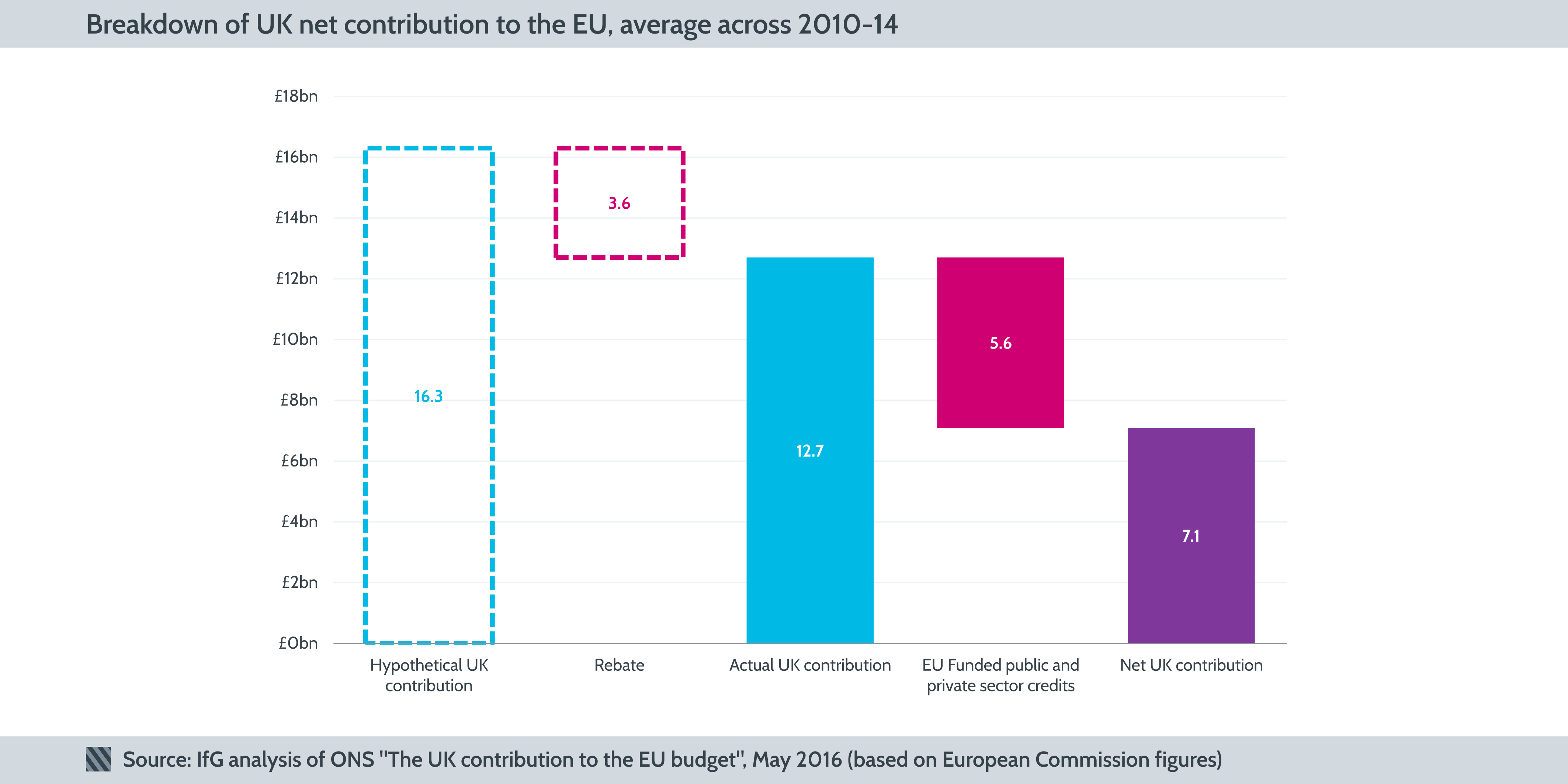

Brexits Toll Uk Luxury Exports Struggle In The Eu Market

May 21, 2025

Brexits Toll Uk Luxury Exports Struggle In The Eu Market

May 21, 2025 -

Are Bmw And Porsche Losing Their Grip On The Chinese Market

May 21, 2025

Are Bmw And Porsche Losing Their Grip On The Chinese Market

May 21, 2025 -

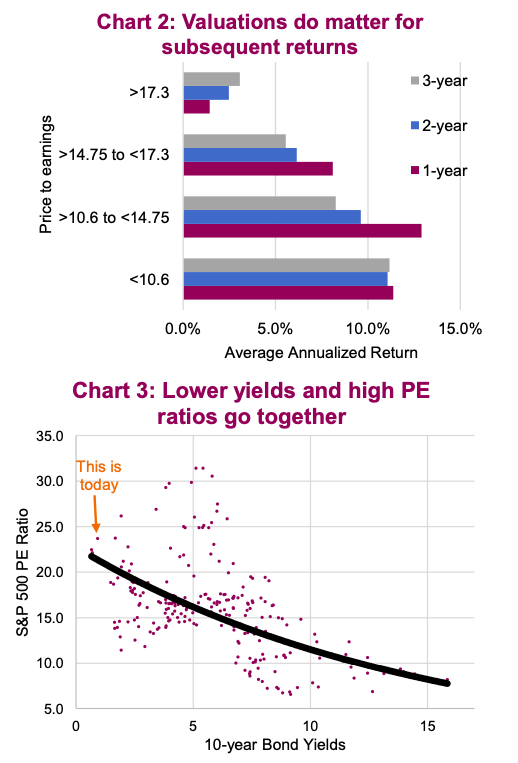

Understanding High Stock Market Valuations Bof As Take And Investor Implications

May 21, 2025

Understanding High Stock Market Valuations Bof As Take And Investor Implications

May 21, 2025 -

Uk Luxury Sector Brexits Contribution To Export Lag In The Eu

May 21, 2025

Uk Luxury Sector Brexits Contribution To Export Lag In The Eu

May 21, 2025 -

The China Factor Why Bmw And Porsche Are Facing Headwinds

May 21, 2025

The China Factor Why Bmw And Porsche Are Facing Headwinds

May 21, 2025