XRP Investment Surge: Trump Endorsement Drives Institutional Adoption

Table of Contents

The Trump Factor: Unforeseen Catalyst for XRP Growth

The unexpected mention of XRP, or even a perceived endorsement, by Donald Trump has sent ripples (pun intended) through the cryptocurrency market. This section analyzes the influence of this high-profile figure on XRP's price and adoption.

Analyzing Trump's Influence on Crypto Markets

- Trump's history of unconventional pronouncements impacting market sentiment: Trump's public statements have historically moved markets, influencing everything from stock prices to the value of the US dollar. His opinions, even if seemingly off-hand, carry significant weight with a large segment of the population.

- Speculation on the reasons behind a potential Trump endorsement of XRP: While no explicit endorsement has been officially confirmed, the mere association with Trump's name has fueled speculation. Some believe this might be due to XRP's potential for disrupting traditional financial systems, aligning with Trump's populist appeal. Others speculate it's simply market manipulation.

- News coverage and social media buzz surrounding Trump’s perceived support: The news cycle exploded with coverage of this event, with various news outlets and social media platforms buzzing with discussions and analyses. This amplified the impact, driving further interest in XRP.

- Impact on investor confidence and subsequent price increase: The increased media attention and speculation led to a significant boost in investor confidence, directly translating into a notable increase in XRP's price.

Ripple's Strategic Response to the Trump Effect

Ripple, the company behind XRP, has found itself in a complex position.

- Ripple's official statements (or lack thereof) regarding Trump's remarks: Ripple has largely remained silent on the matter, likely to avoid any potential regulatory complications or misinterpretations.

- Ripple's ongoing legal battle with the SEC and how this might be affected: The SEC lawsuit against Ripple remains a significant factor. Any public statement relating to Trump's comments could have unintended consequences in this ongoing legal battle.

- Ripple's marketing strategies following the surge in interest: The company may now capitalize on the increased interest, subtly promoting XRP's technological advantages and potential use cases.

- Analysis of Ripple's future plans and their potential impact on XRP's value: Ripple's continued development of RippleNet and its expansion into new markets will be crucial determinants of XRP's long-term value.

Institutional Investors Embrace XRP: A Paradigm Shift?

The Trump-related surge isn't just about retail investors; institutional players are also taking notice.

Increased Institutional Holdings of XRP

- Evidence of increased institutional buying activity: While concrete data may lag, various cryptocurrency exchanges and financial news outlets have reported a rise in institutional-level buying of XRP.

- Reasons behind the institutional interest: Institutions may be viewing XRP as a hedging strategy against market volatility, a diversification tool within their crypto portfolios, or a long-term bet on the growth of cross-border payment solutions.

- Comparison to other cryptocurrencies’ institutional adoption rates: The rate of XRP's institutional adoption, while significant, needs to be compared against other major cryptocurrencies to understand its relative position in the market.

Implications for XRP's Market Capitalization and Price

The increased interest has significant implications.

- Analysis of XRP's market capitalization trends following the Trump endorsement: Market capitalization has seen a corresponding increase, reflecting the growing demand for XRP.

- Prediction of future price movements based on current market dynamics: Predicting future price movements is inherently difficult, but current trends suggest potential for further growth, although volatility remains a key risk.

- Potential risks and challenges associated with the increased institutional interest: Increased institutional involvement can lead to increased price manipulation or potential for market crashes if there is a sudden sell-off.

Analyzing the Long-Term Prospects of XRP Investment

The long-term success of XRP hinges on several factors.

Factors Contributing to XRP's Potential for Growth

- Ripple's technological advancements and partnerships: Ongoing improvements to RippleNet and strategic partnerships enhance its functionality and reach.

- Global adoption of RippleNet and its potential for widespread use: Wider adoption of RippleNet for cross-border transactions could significantly increase demand for XRP.

- Growing interest in cross-border payments and XRP's role in facilitating them: The increasing need for efficient and cost-effective cross-border payment solutions positions XRP favorably.

Risks Associated with Investing in XRP

Despite the potential, significant risks remain.

- Regulatory uncertainty surrounding cryptocurrencies in general, and XRP specifically: Regulatory clarity remains a significant challenge for the entire cryptocurrency market, and XRP is no exception.

- Volatility of the cryptocurrency market and the potential for significant price swings: The crypto market is notoriously volatile, and XRP is no exception; significant price fluctuations are expected.

- Competition from other cryptocurrencies in the same space: XRP faces competition from other cryptocurrencies aiming to facilitate cross-border payments.

Conclusion

The unexpected surge in XRP investment following the perceived endorsement from Donald Trump has significantly impacted the cryptocurrency market. This influx of investment, driven by both speculation and a growing belief in XRP's long-term potential, particularly among institutional investors, is a noteworthy development. While significant opportunities exist, investors should carefully weigh the potential risks involved before investing in XRP. Conduct thorough research and understand the complexities of the cryptocurrency market, specifically the regulatory landscape and technological developments around XRP and RippleNet before making any investment decisions. Ultimately, the future of XRP remains tied to its ability to deliver on its promises within the evolving world of digital assets. Learn more about navigating the exciting world of XRP investment and making informed decisions.

Featured Posts

-

Stunning Defensive Play Mariners Outfielders Catch Of The Year Candidate

May 07, 2025

Stunning Defensive Play Mariners Outfielders Catch Of The Year Candidate

May 07, 2025 -

Hegseths Signal Chat Use Exclusive Details On Over A Dozen Pentagon Communications

May 07, 2025

Hegseths Signal Chat Use Exclusive Details On Over A Dozen Pentagon Communications

May 07, 2025 -

Ssc Chsl 2025 Final Result Announced Check Your Status Online

May 07, 2025

Ssc Chsl 2025 Final Result Announced Check Your Status Online

May 07, 2025 -

Rihannas Post Fenty Beauty Event A Sweet Fan Moment In Paris

May 07, 2025

Rihannas Post Fenty Beauty Event A Sweet Fan Moment In Paris

May 07, 2025 -

Shifting Sands Mideasts Diminished Role In The Global Ai Race

May 07, 2025

Shifting Sands Mideasts Diminished Role In The Global Ai Race

May 07, 2025

Latest Posts

-

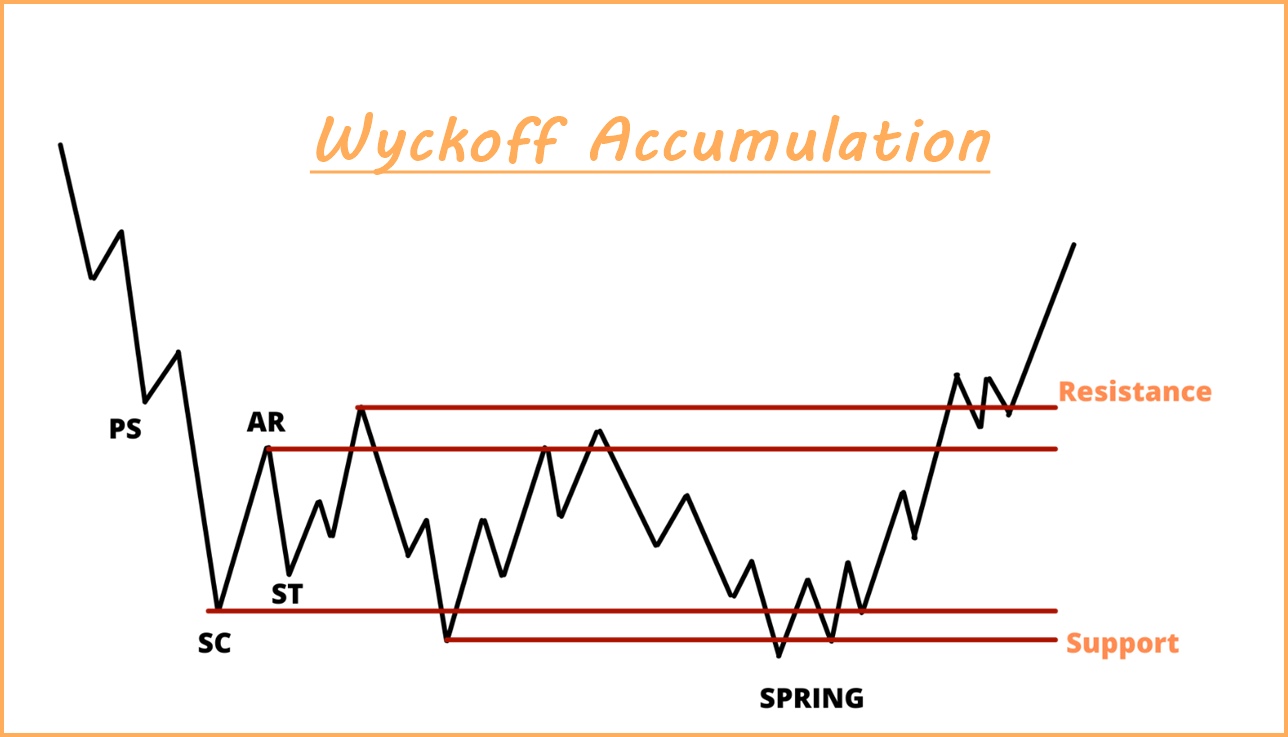

Ethereum Price Forecast Is 2 700 The Next Target After Accumulation

May 08, 2025

Ethereum Price Forecast Is 2 700 The Next Target After Accumulation

May 08, 2025 -

Will Ethereum Hit 2 700 Wyckoff Accumulation Signals

May 08, 2025

Will Ethereum Hit 2 700 Wyckoff Accumulation Signals

May 08, 2025 -

Ethereum Nears 2 700 Wyckoff Accumulation Analysis

May 08, 2025

Ethereum Nears 2 700 Wyckoff Accumulation Analysis

May 08, 2025 -

Ethereum Price Prediction 2 700 Target As Wyckoff Accumulation Concludes

May 08, 2025

Ethereum Price Prediction 2 700 Target As Wyckoff Accumulation Concludes

May 08, 2025 -

Ethereum Price Forecast Comprehensive Analysis Of Market Trends And Predictions

May 08, 2025

Ethereum Price Forecast Comprehensive Analysis Of Market Trends And Predictions

May 08, 2025